Page 132 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 132

JSE – GLO Profile’s Stock Exchange Handbook: 2020 – Issue 4

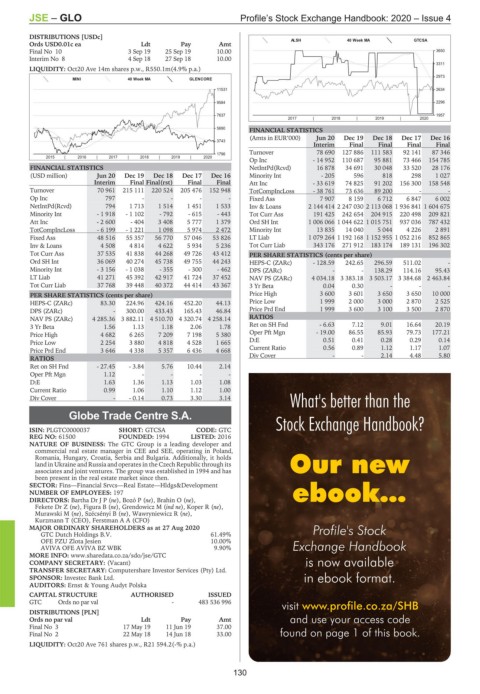

DISTRIBUTIONS [USDc]

Ords USD0.01c ea Ldt Pay Amt ALSH 40 Week MA GTCSA

Final No 10 3 Sep 19 25 Sep 19 10.00 3650

Interim No 8 4 Sep 18 27 Sep 18 10.00

3311

LIQUIDITY: Oct20 Ave 14m shares p.w., R550.1m(4.9% p.a.)

2973

MINI 40 Week MA GLENCORE

11531 2634

9584 2296

7637 1957

2017 | 2018 | 2019 | 2020

5690 FINANCIAL STATISTICS

(Amts in EUR’000) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

3743

Interim Final Final Final Final

1796 Turnover 78 690 127 886 111 583 92 141 87 346

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Op Inc - 14 952 110 687 95 881 73 466 154 785

FINANCIAL STATISTICS NetIntPd(Rcvd) 16 878 34 691 30 048 33 520 28 176

(USD million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 Minority Int - 205 596 818 298 1 027

Interim Final Final(rst) Final Final Att Inc - 33 619 74 825 91 202 156 300 158 548

Turnover 70 961 215 111 220 524 205 476 152 948 TotCompIncLoss - 38 761 73 636 89 200 - -

Op Inc 797 - - - - Fixed Ass 7 907 8 159 6 712 6 847 6 002

NetIntPd(Rcvd) 794 1 713 1 514 1 451 1 533 Inv & Loans 2 144 414 2 247 030 2 113 068 1 936 841 1 604 675

Minority Int - 1 918 - 1 102 - 792 - 615 - 443 Tot Curr Ass 191 425 242 654 204 915 220 498 209 821

Att Inc - 2 600 - 404 3 408 5 777 1 379 Ord SH Int 1 006 066 1 044 622 1 015 751 937 036 787 432

TotCompIncLoss - 6 199 - 1 221 1 098 5 974 2 472 Minority Int 13 835 14 040 5 044 4 226 2 891

Fixed Ass 48 516 55 357 56 770 57 046 53 826 LT Liab 1 079 264 1 192 168 1 152 955 1 052 216 852 865

Inv & Loans 4 508 4 814 4 622 5 934 5 236 Tot Curr Liab 343 176 271 912 183 174 189 131 196 302

Tot Curr Ass 37 535 41 838 44 268 49 726 43 412 PER SHARE STATISTICS (cents per share)

Ord SH Int 36 069 40 274 45 738 49 755 44 243 HEPS-C (ZARc) - 128.59 242.65 296.59 511.02 -

Minority Int - 3 156 - 1 038 - 355 - 300 - 462 DPS (ZARc) - - 138.29 114.16 95.43

LT Liab 41 271 45 392 42 917 41 724 37 452 NAV PS (ZARc) 4 034.18 3 383.18 3 503.17 3 384.68 2 463.84

Tot Curr Liab 37 768 39 448 40 372 44 414 43 367 3 Yr Beta 0.04 0.30 - - -

PER SHARE STATISTICS (cents per share) Price High 3 600 3 601 3 650 3 650 10 000

HEPS-C (ZARc) 83.30 224.96 424.16 452.20 44.13 Price Low 1 999 2 000 3 000 2 870 2 525

DPS (ZARc) - 300.00 433.43 165.43 46.84 Price Prd End 1 999 3 600 3 100 3 500 2 870

NAV PS (ZARc) 4 285.36 3 882.11 4 510.70 4 320.74 4 258.14 RATIOS

3 Yr Beta 1.56 1.13 1.18 2.06 1.78 Ret on SH Fnd - 6.63 7.12 9.01 16.64 20.19

Oper Pft Mgn - 19.00 86.55 85.93 79.73 177.21

Price High 4 682 6 265 7 209 7 198 5 380

Price Low 2 254 3 880 4 818 4 528 1 665 D:E 0.51 0.41 0.28 0.29 0.14

Price Prd End 3 646 4 338 5 357 6 436 4 668 Current Ratio 0.56 0.89 1.12 1.17 1.07

RATIOS Div Cover - - 2.14 4.48 5.80

Ret on SH Fnd - 27.45 - 3.84 5.76 10.44 2.14

Oper Pft Mgn 1.12 - - - -

D:E 1.63 1.36 1.13 1.03 1.08

Current Ratio 0.99 1.06 1.10 1.12 1.00

What's better than the

Div Cover - - 0.14 0.73 3.30 3.14

Globe Trade Centre S.A.

GLO Stock Exchange Handbook?

ISIN: PLGTC0000037 SHORT: GTCSA CODE: GTC

REG NO: 61500 FOUNDED: 1994 LISTED: 2016

NATURE OF BUSINESS: The GTC Group is a leading developer and

commercial real estate manager in CEE and SEE, operating in Poland,

Romania, Hungary, Croatia, Serbia and Bulgaria. Additionally, it holds

land in Ukraine and Russia and operates in the Czech Republic through its Our new

associates and joint ventures. The group was established in 1994 and has

been present in the real estate market since then.

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

NUMBER OF EMPLOYEES: 197 ebook…

DIRECTORS: Bartha DrJP(ne), Bozó P (ne), Brahin O (ne),

Fekete Dr Z (ne), Figura B (ne), Grendowicz M (ind ne), Koper R (ne),

Murawski M (ne), Szécsényi B (ne), Wawryniewicz R (ne),

Kurzmann T (CEO), Ferstman A A (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 27 Aug 2020 Profile's Stock

GTC Dutch Holdings B.V. 61.49%

OFE PZU Zlota Jesien 10.00%

AVIVA OFE AVIVA BZ WBK 9.90% Exchange Handbook

MORE INFO: www.sharedata.co.za/sdo/jse/GTC

COMPANY SECRETARY: (Vacant) is now available

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. in ebook format.

AUDITORS: Ernst & Young Audyt Polska

CAPITAL STRUCTURE AUTHORISED ISSUED

GTC Ords no par val - 483 536 996

visit www.profile.co.za/SHB

DISTRIBUTIONS [PLN]

Ords no par val Ldt Pay Amt and use your access code

Final No 3 17 May 19 11 Jun 19 37.00

Final No 2 22 May 18 14 Jun 18 33.00 found on page 1 of this book.

LIQUIDITY: Oct20 Ave 761 shares p.w., R21 594.2(-% p.a.)

130