Page 131 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 131

Profile’s Stock Exchange Handbook: 2020 – Issue 4 JSE – GAI

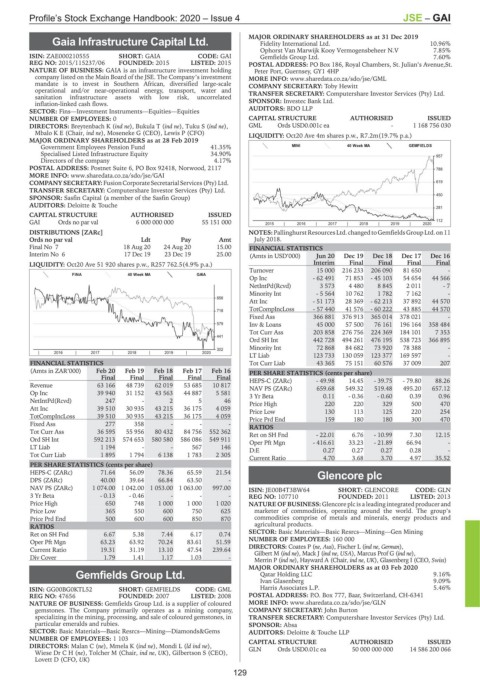

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

Gaia Infrastructure Capital Ltd. Fidelity International Ltd. 10.96%

Ophorst Van Marwijk Kooy Vermogensbeheer N.V 7.85%

GAI

ISIN: ZAE000210555 SHORT: GAIA CODE: GAI Gemfields Group Ltd. 7.60%

REG NO: 2015/115237/06 FOUNDED: 2015 LISTED: 2015 POSTAL ADDRESS: PO Box 186, Royal Chambers, St. Julian’s Avenue,St.

NATURE OF BUSINESS: GAIA is an infrastructure investment holding Peter Port, Guernsey, GY1 4HP

company listed on the Main Board of the JSE. The Company’s investment MORE INFO: www.sharedata.co.za/sdo/jse/GML

mandate is to invest in Southern African, diversified large-scale COMPANY SECRETARY: Toby Hewitt

operational and/or near-operational energy, transport, water and TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

sanitation infrastructure assets with low risk, uncorrelated

inflation-linked cash flows. SPONSOR: Investec Bank Ltd.

SECTOR: Fins—Investment Instruments—Equities—Equities AUDITORS: BDO LLP

NUMBER OF EMPLOYEES: 0 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Breytenbach K (ind ne), Bukula T (ind ne), Tuku S (ind ne), GML Ords USD0.001c ea - 1 168 756 030

Mbalo K E (Chair, ind ne), Moseneke G (CEO), Lewis P (CFO) LIQUIDITY: Oct20 Ave 4m shares p.w., R7.2m(19.7% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

Government Employees Pension Fund 41.35% MINI 40 Week MA GEMFIELDS

Specialised Listed Infrastructure Equity 34.90% 957

Directors of the company 4.17%

POSTAL ADDRESS: Postnet Suite 6, PO Box 92418, Norwood, 2117 788

MORE INFO: www.sharedata.co.za/sdo/jse/GAI

COMPANY SECRETARY: FusionCorporateSecretarialServices(Pty)Ltd. 619

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

450

SPONSOR: Sasfin Capital (a member of the Sasfin Group)

AUDITORS: Deloitte & Touche

281

CAPITAL STRUCTURE AUTHORISED ISSUED

GAI Ords no par val 6 000 000 000 55 151 000 2015 | 2016 | 2017 | 2018 | 2019 | 2020 112

DISTRIBUTIONS [ZARc] NOTES:PallinghurstResourcesLtd.changed toGemfieldsGroupLtd.on11

Ords no par val Ldt Pay Amt July 2018.

Final No 7 18 Aug 20 24 Aug 20 15.00 FINANCIAL STATISTICS

Interim No 6 17 Dec 19 23 Dec 19 25.00 (Amts in USD’000) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16

LIQUIDITY: Oct20 Ave 51 920 shares p.w., R257 762.5(4.9% p.a.) Interim Final Final Final Final

Turnover 15 000 216 233 206 090 81 650 -

FINA 40 Week MA GAIA

Op Inc - 62 491 71 853 - 45 103 54 654 44 566

NetIntPd(Rcvd) 3 573 4 480 8 845 2 011 - 7

Minority Int - 5 564 10 762 1 782 7 162 -

856

Att Inc - 51 173 28 369 - 62 213 37 892 44 570

TotCompIncLoss - 57 440 41 576 - 60 222 43 885 44 570

718

Fixed Ass 366 881 376 913 365 014 378 021 -

579 Inv & Loans 45 000 57 500 76 161 196 164 358 484

Tot Curr Ass 203 858 276 756 224 369 184 101 7 353

441

Ord SH Int 442 728 494 261 476 195 538 723 366 895

Minority Int 72 868 84 682 73 920 78 388 -

302

| 2016 | 2017 | 2018 | 2019 | 2020

LT Liab 123 733 130 059 123 377 169 597 -

FINANCIAL STATISTICS Tot Curr Liab 43 365 75 151 60 576 37 009 207

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16 PER SHARE STATISTICS (cents per share)

Final Final Final Final Final HEPS-C (ZARc) - 49.98 14.45 - 39.75 - 79.80 88.26

Revenue 63 166 48 739 62 019 53 685 10 817 NAV PS (ZARc) 659.68 549.32 519.48 495.20 657.12

Op Inc 39 940 31 152 43 563 44 887 5 581 3 Yr Beta 0.11 - 0.36 - 0.60 0.39 0.96

NetIntPd(Rcvd) 247 - 2 5 46 Price High 220 220 329 500 470

Att Inc 39 510 30 935 43 215 36 175 4 059 Price Low 130 113 125 220 254

TotCompIncLoss 39 510 30 935 43 215 36 175 4 059 Price Prd End 159 180 180 300 470

Fixed Ass 277 358 - - - RATIOS

Tot Curr Ass 36 595 55 956 80 432 84 756 552 362 Ret on SH Fnd - 22.01 6.76 - 10.99 7.30 12.15

Ord SH Int 592 213 574 653 580 580 586 086 549 911 Oper Pft Mgn - 416.61 33.23 - 21.89 66.94 -

LT Liab 1 194 - - 567 146

D:E 0.27 0.27 0.27 0.28 -

Tot Curr Liab 1 895 1 794 6 138 1 783 2 305

Current Ratio 4.70 3.68 3.70 4.97 35.52

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 71.64 56.09 78.36 65.59 21.54 Glencore plc

DPS (ZARc) 40.00 39.64 66.84 63.50 -

GLE

NAV PS (ZARc) 1 074.00 1 042.00 1 053.00 1 063.00 997.00 ISIN: JE00B4T3BW64 SHORT: GLENCORE CODE: GLN

3 Yr Beta - 0.13 - 0.46 - - - REG NO: 107710 FOUNDED: 2011 LISTED: 2013

Price High 650 748 1 000 1 000 1 020 NATURE OF BUSINESS: Glencore plc is a leading integrated producer and

Price Low 365 550 600 750 625 marketer of commodities, operating around the world. The group’s

Price Prd End 500 600 600 850 870 commodities comprise of metals and minerals, energy products and

RATIOS agricultural products.

Ret on SH Fnd 6.67 5.38 7.44 6.17 0.74 SECTOR: Basic Materials—Basic Resrcs—Mining—Gen Mining

Oper Pft Mgn 63.23 63.92 70.24 83.61 51.59 NUMBER OF EMPLOYEES: 160 000

Current Ratio 19.31 31.19 13.10 47.54 239.64 DIRECTORS: Coates P (ne, Aus), Fischer L (ind ne, German),

Gilbert M (ind ne), Mack J (ind ne, USA), Marcus Prof G (ind ne),

Div Cover 1.79 1.41 1.17 1.03 - Merrin P (ind ne), Hayward A (Chair, ind ne, UK), Glasenberg I (CEO, Swiss)

MAJOR ORDINARY SHAREHOLDERS as at 03 Feb 2020

Gemfields Group Ltd. Qatar Holding LLC 9.16%

Ivan Glasenberg 9.09%

GEM

ISIN: GG00BG0KTL52 SHORT: GEMFIELDS CODE: GML Harris Associates L.P. 5.46%

REG NO: 47656 FOUNDED: 2007 LISTED: 2008 POSTAL ADDRESS: P.O. Box 777, Baar, Switzerland, CH-6341

NATURE OF BUSINESS: Gemfields Group Ltd. is a supplier of coloured MORE INFO: www.sharedata.co.za/sdo/jse/GLN

gemstones. The Company primarily operates as a mining company, COMPANY SECRETARY: John Burton

specializing in the mining, processing, and sale of coloured gemstones, in TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

particular emeralds and rubies. SPONSOR: Absa

SECTOR: Basic Materials—Basic Resrcs—Mining—Diamonds&Gems AUDITORS: Deloitte & Touche LLP

NUMBER OF EMPLOYEES: 1 103 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Malan C (ne), Mmela K (ind ne), Mondi L (ld ind ne), GLN Ords USD0.01c ea 50 000 000 000 14 586 200 066

Wiese DrCH(ne), Tolcher M (Chair, ind ne, UK), Gilbertson S (CEO),

Lovett D (CFO, UK)

129