Page 73 - Stock Exchange Handbook 2020 - Issue 3

P. 73

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – ADA

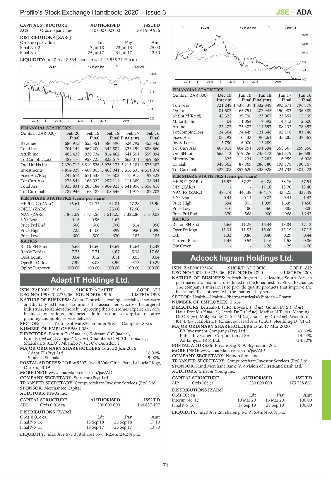

SCOM 40 Week MA ADAPTIT

CAPITAL STRUCTURE AUTHORISED ISSUED

ACS Ords no par value 10 000 000 000 394 959 976

1650

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 1349

Final No 2 17 Jul 18 23 Jul 18 25.00

Final No 1 25 Jul 17 31 Jul 17 12.50 1048

LIQUIDITY: Jul20 Ave 2 534 shares p.w., R16 535.2(-% p.a.)

748

ALSH 40 Week MA ACSION

447

1372

146

2015 | 2016 | 2017 | 2018 | 2019 |

1142

913 FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

684 Interim Final Final(rst) Final Final

Turnover 721 249 1 438 138 1 332 849 993 671 796 178

454

Op Inc 81 602 165 751 207 945 150 983 136 389

NetIntPd(Rcvd) 42 325 39 796 23 067 22 851 15 139

225

2015 | 2016 | 2017 | 2018 | 2019 | Minority Int - 104 1 054 7 592 4 413 2 600

Att Inc 22 207 75 307 114 557 88 133 78 357

FINANCIAL STATISTICS

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16 TotCompIncLoss 24 364 74 449 121 648 92 108 81 746

Fixed Ass 106 192 110 433 96 261 35 285 37 367

Final Final Final Final(rst) Final

Revenue 686 973 653 351 586 490 524 792 453 343 Inv & Loans 5 750 6 000 15 289 - -

Total Inc 701 144 667 200 342 584 323 299 888 660 Tot Curr Ass 467 818 464 251 391 594 355 667 259 556

Attrib Inc 485 423 920 734 814 462 641 551 559 094 Ord SH Int 665 413 679 256 745 173 661 579 466 680

TotCompIncLoss 489 476 958 725 823 617 663 071 569 558 Minority Int - 325 - 221 2 283 6 959 6 008

Ord UntHs Int 7 320 712 6 819 526 5 976 173 5 215 181 4 575 387 LT Liab 848 562 87 869 286 780 193 178 190 767

Investments 7 854 029 7 409 903 6 468 041 5 316 335 4 311 974 Tot Curr Liab 322 208 852 620 338 928 224 733 301 422

FixedAss/Prop 747 674 671 533 76 503 75 915 92 322

PER SHARE STATISTICS (cents per share)

Tot Curr Ass 278 844 168 022 297 114 111 389 38 641 HEPS-C (ZARc) 15.93 57.27 62.08 58.76 57.54

Total Ass 9 923 831 9 283 184 7 964 923 6 641 956 5 656 418 DPS (ZARc) - - 17.10 13.70 13.40

Tot Curr Liab 787 946 163 487 108 546 111 977 87 702 NAV PS (ZARc) 483.74 445.38 464.17 435.25 337.49

3 Yr Beta 0.44 0.14 - 0.03 0.44 1.43

PER SHARE STATISTICS (cents per share)

HEPLU-C (ZARc) 65.61 71.73 61.81 47.28 45.90 Price High 694 905 1 099 1 699 1 450

DPLU (ZARc) - - 25.00 12.50 - Price Low 310 480 560 885 800

NAV (ZARc) 1 861.09 1 733.56 1 518.25 1 322.86 1 160.08 Price Prd End 370 568 900 968 1 242

3 Yr Beta - 0.16 - 0.96 - 1.63 - - RATIOS

Price Prd End 600 600 700 814 950 Ret on SH Fnd 6.65 11.25 16.34 13.84 17.13

Price High 725 1 100 899 950 1 090 Oper Pft Mgn 11.31 11.53 15.60 15.19 17.13

Price Low 600 500 670 185 185 D:E 1.33 0.86 0.40 0.29 0.44

Current Ratio 1.45 0.54 1.16 1.58 0.86

RATIOS

RetOnSH Funds 6.65 13.60 13.69 12.64 12.42 Div Cover - - 4.26 4.29 4.00

RetOnTotAss 7.73 7.71 4.67 5.38 17.66

Debt:Equity 0.04 0.12 0.11 0.05 0.04 Adcock Ingram Holdings Ltd.

OperRetOnInv 7.99 8.08 8.96 9.73 10.29

ADC

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 ISIN: ZAE000123436 SHORT: ADCOCK CODE: AIP

REG NO: 2007/016236/06 FOUNDED: 1890 LISTED: 2008

Adapt IT Holdings Ltd. NATURE OF BUSINESS: Adcock Ingram is a leading South African

pharmaceutical manufacturer listed on the Johannesburg Stock Exchange.

ADA The company’s mission is to provide quality products that improve the

ISIN: ZAE000113163 SHORT: ADAPTIT CODE: ADI health and lives of people in the markets they serve.

REG NO: 1998/017276/06 FOUNDED: 1996 LISTED: 1998 SECTOR: Health—Health—Pharmaceuticals&Biotech—Pharm

NATURE OF BUSINESS: Adapt IT provides leading, specialised software

and digitally-led business solutions that assist clients, across the targeted NUMBER OF EMPLOYEES: 2 614

industries, to Achieve more by improving their customer experience, core DIRECTORS: Letsoalo B (HR), Boyce L (ind ne), Gumbi Dr S (ind ne),

business operations, business administration, enterprise resource Haus Prof M (ld ind ne), Lesoli Dr T (ind ne), MadisaNT(ne), Manning

planning and public service delivery. DrCE(ne), Mokgokong DrATM(ne), Ransaby D (ind ne), Wakeford

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs KPE(ne), Ralphs L P (Chair, ne), Hall A G (CEO), Neethling D (CFO)

NUMBER OF EMPLOYEES: 1 088 MAJOR ORDINARY SHAREHOLDERS as at 17 Mar 2020 43.60%

BB Investment Company (Pty) Ltd.

DIRECTORS: Fortuin O (ld ind ne), KoffmanCC(ind ne), Public Investment Corporation of SA 14.94%

Ntuli B (ind ne), Nyanga Z (ind ne), Chambers C M (Chair, ind ne), Ad-Izinyosi (RF) Ltd. 14.70%

Shabalala S (CEO), Mbambo N (CFO), Dunsdon T

POSTAL ADDRESS: Private Bag X69, Bryanston, 2021

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 MORE INFO: www.sharedata.co.za/sdo/jse/AIP

Adapt IT (Pty) Ltd. 10.00%

Sibusiso Shabalala 9.00% COMPANY SECRETARY: Ntando Simelane

POSTAL ADDRESS: PO Box 5207, Rydall Vale Office Park, La Lucia Ridge, TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Durban, 4019 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

MORE INFO: www.sharedata.co.za/sdo/jse/ADI AUDITORS: Ernst & Young Inc.

COMPANY SECRETARY: Statucor (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AIP Ords 10c ea 250 000 000 175 758 861

SPONSOR: Merchantec Capital

AUDITORS: KPMG Inc. DISTRIBUTIONS [ZARc]

Ords 10c ea Ldt Pay Amt

Interim No 17 10 Mar 20 16 Mar 20 100.00

CAPITAL STRUCTURE AUTHORISED ISSUED

ADI Ords 0.01c ea 200 000 000 144 887 497 Final No 16 17 Sep 19 23 Sep 19 100.00

LIQUIDITY: Jul20 Ave 2m shares p.w., R85.4m(45.6% p.a.)

DISTRIBUTIONS [ZARc]

Ords 0.01c ea Ldt Pay Amt

Final No 16 18 Sep 18 25 Sep 18 17.10

Final No 15 19 Sep 17 26 Sep 17 13.70

LIQUIDITY: Jul20 Ave 673 388 shares p.w., R2.4m(24.2% p.a.)

71