Page 139 - Stock Exchange Handbook 2020 - Issue 3

P. 139

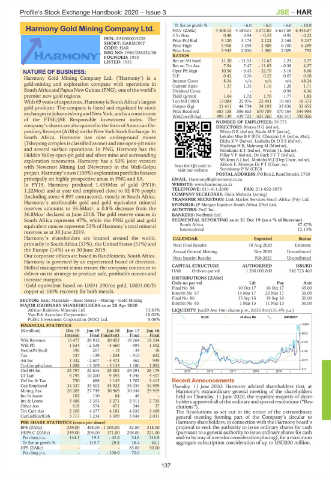

Profile’s Stock Exchange Handbook: 2020 – Issue 3 JSE – HAR

Tr 5yr av grwth % - - 6.0 - 6.0 - 6.0 - 10.0

Harmony Gold Mining Company Ltd. NAV (ZARc) 4 408.15 4 189.01 5 073.85 6 657.69 6 443.87

HAR 3 Yr Beta 0.48 0.94 - 0.33 0.92 - 0.22

ISIN: ZAE000015228 Price Prd End 5 120 3 174 2 122 2 168 5 247

SHORT: HARMONY Price High 5 906 3 298 2 908 6 700 6 289

CODE: HAR

REG NO: 1950/038232/06 Price Low 2 945 2 036 1 900 2 009 792

FOUNDED: 1950 RATIOS

LISTED: 1951 Ret on SH fund 11.20 - 11.53 - 17.62 1.24 3.37

Ret on Tot Ass 7.94 7.47 - 11.83 - 0.38 4.27

NATURE OF BUSINESS: Oper Pft Mgn 10.56 - 9.43 - 22.79 - 5.16 8.68

0.08

Harmony Gold Mining Company Ltd. (‘Harmony’) is a D:E 0.42 0.26 0.22 0.07 48.24

n/a

Interest Cover

n/a

n/a

8.34

gold-mining and exploration company with operations in Current Ratio 1.37 1.35 1.16 1.28 1.71

SouthAfricaandPapuaNew Guinea(PNG), oneoftheworld’s Dividend Cover - - - 0.98 4.36

premier new gold regions. Yield (g/ton) 1.64 1.72 1.76 1.77 1.83

With 69years ofexperience, Harmonyis SouthAfrica’s largest Ton Mll (‘000) 13 084 25 976 22 441 19 401 18 373

gold producer. The company is listed and regulated by stock Output (kg) 21 411 44 734 38 193 33 836 33 655

exchangesinJohannesburgandNewYork,andisaconstituent Price Received 683 158 586 653 570 709 570 164 544 984

392 026

436 917

499 139

421 260

WrkCost(R/kg)

439 722

of the FTSE/JSE Responsible Investment index. The NUMBER OF EMPLOYEES: 39 773

company’s shares are also quoted in the form of American De- DIRECTORS: Motau H G (ind ne),

positaryReceipts(ADRs)ontheNew YorkStockExchange.In Sibiya G R (ind ne), Sisulu M V (ind ne),

South Africa, Harmony has nine underground mines Lekubo Miss B P (FD), Chissano J A (ind ne, Moz),

(Tshepongcomplexis classifiedasone)andoneopen-pit mine Dicks K V (ind ne), LushabaDrDSS(ind ne),

Mashego H E, Msimang M (ld ind ne),

and several surface operations. In PNG, Harmony has the Nondumo K T (ind ne), Wetton J L (ind ne),

Hidden Valley open-pit gold and silver mine and surrounding Pillay V P (ind ne), De Buck FFT(ind ne),

exploration tenements. Harmony has a 50% joint venture Wilkens A J (ne), Motloba M J (Dep Chair, ind ne),

with Newcrest Mining Ltd (Newcrest) in the Wafi-Golpu Scan the QR code to Abbott F, Motsepe Dr P T (Chair, ne),

Steenkamp P W (CEO)

visit our website

project. Harmony’s own(100%) explorationportfoliofocuses POSTAL ADDRESS:POBox2,Randfontein,1760

principally on highly prospective areas in PNG and SA. EMAIL: HarmonyIR@harmony.co.za

In FY19, Harmony produced 1.438Moz of gold (FY18: WEBSITE: www.harmony.co.za

1.22Moz) and at year end employed close to 32 876 people TELEPHONE: 011-411-2000 FAX: 011-692-3879

COMPANY SECRETARY: Shela Mohatla (acting)

(including some 6 897 contractors), mostly in South Africa. TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Harmony’s attributable gold and gold equivalent mineral SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

reserves amounts to 36.5Moz¹, a 0.8% decrease from the AUDITORS: PwC Inc.

36.8Moz¹ declared at June 2018. The gold reserve ounces in BANKERS: Nedbank Ltd.

South Africa represent 47%, while the PNG gold and gold SEGMENTAL REPORTING as at 31 Dec 19 (asa%of Revenue)

equivalent ounces represent 53% of Harmony’s total mineral South Africa 87.87%

12.13%

International

reserves as at 30 June 2019.

Harmony’s shareholders are located around the world, CALENDAR Expected Status

primarily in South Africa (33%), the United States (51%) and Next Final Results 18 Aug 2020 Estimate

the Europe (14%) as at 30 June 2019.

Annual General Meeting Nov 2020 Unconfirmed

Our corporate offices are based in Randfontein, South Africa. Next Interim Results Feb 2021 Unconfirmed

Harmony is governed by an experienced board of directors.

Skilled management teams ensure the company continues to CAPITAL STRUCTURE AUTHORISED 542 725 460

ISSUED

Ords no par val

HAR

1 200 000 000

deliver on its strategy to produce safe, profitable ounces and

increase margins. DISTRIBUTIONS [ZARc]

¹Gold equivalent based on USD1 290/oz gold, USD3.00/lb Ords no par val 10 Oct 17 16 Oct 17 35.00

Amt

Ldt

Pay

Final No 88

copper at 100% recovery for both metals. Interim No 87 14 Mar 17 20 Mar 17 50.00

Final No 86 13 Sep 16 19 Sep 16 50.00

SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining

Interim No 85 1 Mar 13 11 Mar 13 50.00

MAJOR ORDINARY SHAREHOLDERS as at 28 Apr 2020

African Rainbow Minerals Ltd. 13.83% LIQUIDITY: Jun20 Ave 14m shares p.w., R631.9m(131.4% p.a.)

Van Eck Associate Corporation 10.02%

Public Investment Corporation (SOC) Ltd. 5.06% GLDX 40 Week MA HARMONY

10584

FINANCIAL STATISTICS

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

8642

Interim Final Final(rst) Final Final

Wrk Revenue 15 477 26 912 20 452 19 264 18 334

6700

Wrk Pft 1 634 - 2 538 - 4 660 - 994 1 592

NetIntPd(Rcd) 196 267 - 13 - 34 18 4758

Tax 157 - 139 - 234 - 510 632

Att Inc 1 332 - 2 607 - 4 473 362 949 2815

TotCompIncLoss 1 088 - 3 309 - 5 133 1 180 1 092

Ord SH Int 23 797 22 614 25 382 29 291 28 179 2015 | 2016 | 2017 | 2018 | 2019 | 873

LT Liab 9 795 10 200 9 395 4 046 4 407

Def Inc & Tax 750 688 1 145 1 702 2 413 Recent Announcements

Cap Employed 34 337 33 502 35 922 35 039 34 999 Thursday, 11 June 2020: Harmony advised shareholders that, at

Mining Ass 28 209 27 749 30 969 30 044 29 919 Harmony’s extraordinary general meeting of the shareholders

Inv In Assoc 102 110 84 46 - held on Thursday, 11 June 2020, the requisite majority of share-

Inv & Loans 3 486 3 393 3 271 2 911 2 735 holders approved all of the ordinary and special resolutions (“Res-

Other Ass 618 574 471 344 37 olutions”).

Tot Curr Ass 5 105 4 377 4 181 4 935 3 469 The Resolutions as set out in the notice of the extraordinary

CurLiabExclCsh 3 717 3 234 3 599 3 844 2 031 general meeting forming part of the Company’s circular to

Harmony shareholders, in connection with the Harmony board’s

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 249.00 - 498.00 - 1 003.00 82.00 218.00 proposal to seek the authority to issue ordinary shares for cash

HEPS-C (ZARc) 249.00 204.00 171.00 298.00 221.00 (pursuant to a general authority to issue ordinary shares for cash

Pct chng p.a. 144.1 19.3 - 42.6 34.8 216.9 and/or by way of a vendor consideration placing), for a maximum

Tr 5yr av grwth % - - 119.7 29.8 18.4 40.1 aggregate subscription consideration of up to USD200 million.

DPS (ZARc) - - - 85.00 50.00

Pct chng p.a. - - - 100.0 70.0 -

137