Page 136 - Stock Exchange Handbook 2020 - Issue 3

P. 136

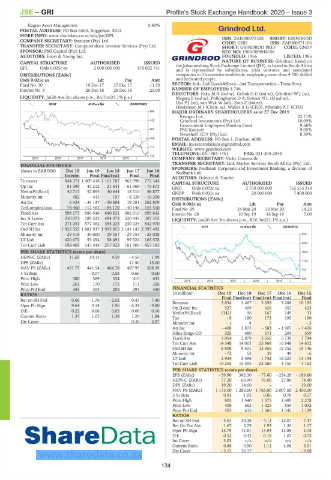

JSE – GRI Profile’s Stock Exchange Handbook: 2020 – Issue 3

Kagiso Asset Management 5.80%

POSTAL ADDRESS: PO Box 6563, Roggebaai, 8012 Grindrod Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/GPL GRI

COMPANY SECRETARY: Statucor (Pty) Ltd. ISIN: ZAE000072328 SHORT: GRINDROD

ISIN: ZAE000071106

CODE: GND

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SHORT: GRINDROD PREF CODE: GNDP

SPONSOR: PSG Capital (Pty) Ltd. REG NO: 1966/009846/06

AUDITORS: Ernst & Young Inc. FOUNDED: 1966 LISTED: 1986

NATURE OF BUSINESS: Grindrod, listed on

the Johannesburg Stock Exchange Limited (JSE), is based in South Africa

CAPITAL STRUCTURE AUTHORISED ISSUED

GPL Ords 0.025c ea 2 000 000 000 470 022 741

and is represented by subsidiaries, joint ventures and associated

companies in 31countries worldwide, employing more than 4 700 skilled

DISTRIBUTIONS [ZARc]

and dedicated people.

Ords 0.025c ea Ldt Pay Amt

Final No 10 19 Dec 17 27 Dec 17 11.50 SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs

Interim No 9 20 Dec 16 28 Dec 16 25.00 NUMBER OF EMPLOYEES: 4 746

DIRECTORS: FakuMR(ind ne), GelinkGG(ind ne), GrindrodWJ(ne),

LIQUIDITY: Jul20 Ave 2m shares p.w., R6.7m(23.1% p.a.) Magara B (ind ne), Polkinghorne D A, SowaziNL(ld ind ne),

UysPJ(ne), van Wyk W (alt), Zatu Z (ind ne),

GENF 40 Week MA GRANPRADE

Hankinson M J (Chair, ne), Waller A G (CEO), Mbambo X F (CFO)

884

MAJOR ORDINARY SHAREHOLDERS as at 27 Dec 2019

Remgro Ltd. 22.71%

742 Grindrod Investments (Pty) Ltd. 10.09%

Government Employees Pension Fund 9.68%

600 PSG Konsult 9.05%

Newshelf 1279 (Pty) Ltd. 8.39%

458 POSTAL ADDRESS: PO Box 1, Durban, 4000

EMAIL: investorrelations@grindrod.com

317

WEBSITE: www.grindrod.com

TELEPHONE: 031-304-1451 FAX: 031-305-2848

175

2015 | 2016 | 2017 | 2018 | 2019 | COMPANY SECRETARY: Vicky Commaille

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SPONSORS: Nedbank Corporate and Investment Banking, a division of

FINANCIAL STATISTICS

(Amts in ZAR’000)

Nedbank Ltd.

Jun 18

Jun 17

Jun 16

Jun 19

Dec 19

Interim Final Final(rst) Final Final AUDITORS: Deloitte & Touche

Turnover 844 371 1 409 418 1 101 707 962 998 772 344

ISSUED

Op Inc 81 399 44 212 21 641 - 61 068 - 75 673 CAPITAL STRUCTURE AUTHORISED 762 553 314

GND

2 750 000 000

Ords 0.002c ea

NetIntPd(Rcvd) 40 713 52 895 40 644 18 510 48 877 GNDP Prefs 0.031c ea 20 000 000 7 400 000

Minority Int 482 - 443 197 - 8 328 - 10 290

Att Inc 6 424 - 36 137 - 50 064 19 281 202 809 DISTRIBUTIONS [ZARc]

Ords 0.002c ea Ldt Pay Amt

TotCompIncLoss 78 460 - 112 462 - 85 170 - 40 146 155 510 Final No 29 24 Mar 20 30 Mar 20 14.20

Fixed Ass 598 177 586 546 640 631 582 610 695 843 Interim No 28 10 Sep 19 16 Sep 19 5.00

Inv & Loans 230 073 189 523 494 273 520 435 307 355

LIQUIDITY: Jun20 Ave 3m shares p.w., R16.3m(21.1% p.a.)

Tot Curr Ass 271 251 577 462 355 223 230 023 842 970

INDT 40 Week MA GRINDROD

Ord SH Int 1 925 555 1 881 937 1 995 855 2 141 147 2 397 492

Minority Int - 29 518 - 30 000 - 29 557 - 29 754 - 28 038 2541

LT Liab 420 672 59 454 58 491 99 522 165 578

2092

Tot Curr Liab 198 403 547 444 257 023 181 909 457 183

1642

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 11.69 19.13 4.59 - 4.59 1.99

1193

DPS (ZARc) - - - 11.50 15.00

NAV PS (ZARc) 451.77 441.54 464.78 497.95 508.39 743

3 Yr Beta - - 0.07 0.58 0.66 0.60

Price High 380 369 334 410 633 294

2015 | 2016 | 2017 | 2018 | 2019 |

Price Low 261 170 175 111 326

Price Prd End 355 305 205 291 350 FINANCIAL STATISTICS

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

RATIOS

Ret on SH Fnd 0.66 - 1.76 - 2.02 0.47 7.40 Final Final(rst) Final(rst) Final(rst) Final

Oper Pft Mgn 9.64 3.14 1.96 - 6.34 - 9.80 Revenue 3 834 3 467 3 059 3 288 10 192

426

409

Op (Loss) Inc

457

423

527

D:E 0.22 0.06 0.05 0.06 0.16 NetIntPd(Rcvd) (142) 96 167 149 33

Current Ratio 1.37 1.05 1.38 1.26 1.84 Tax - 9 180 173 195 190

Div Cover - - - 0.38 2.87 Minority Int - 1 8 7 - - 3

Att Inc - 408 2 873 - 583 - 1 907 - 1 426

Hline Erngs-CO 525 480 571 209 559

Fixed Ass 3 054 2 879 2 650 5 739 7 744

Tot Curr Ass 14 348 14 003 25 868 16 848 14 612

Ord SH Int 8 808 9 431 13 955 15 752 19 146

Minority Int - 72 52 39 49 - 6

LT Liab 2 934 2 496 1 742 16 223 13 154

Tot Curr Liab 16 255 15 595 23 266 4 155 4 163

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 59.90 382.10 - 77.60 - 254.20 - 189.80

HEPS-C (ZARc) 77.20 63.90 76.00 27.80 74.40

DPS (ZARc) 19.20 14.60 - - 19.60

NAV PS (ZARc) 1 175.00 1 285.00 1 763.00 2 007.00 2 450.00

3 Yr Beta 0.93 1.02 0.86 0.78 0.57

Price High 905 1 540 1 575 1 485 2 278

Price Low 408 562 1 025 850 1 032

Price Prd End 503 615 1 365 1 345 1 129

RATIOS

Ret on SH Fnd - 4.67 30.38 - 4.11 - 12.07 - 7.47

Ret On Tot Ass 1.67 2.79 1.93 1.33 1.17

Oper Pft Mgn 13.75 11.81 13.93 13.89 4.15

D:E 0.52 0.42 0.18 1.07 0.75

Int Cover 3.03 n/a n/a n/a n/a

Current Ratio 0.88 0.90 1.11 4.06 3.51

Div Cover - 3.12 26.17 - - - 9.68

134