Page 68 - SHBe20.vp

P. 68

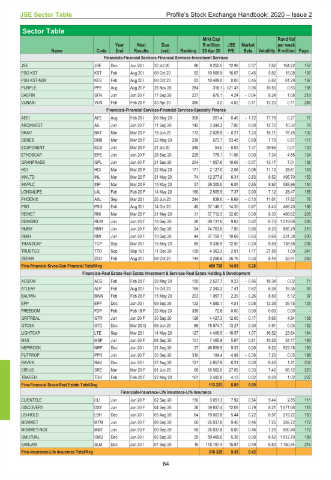

JSE Sector Table Profile’s Stock Exchange Handbook: 2020 – Issue 2

Sector Table

Mrkt Cap Rand Val

Year Next Due R million JSE Market per week

Name Code End Results (est) Ranking 29 Apr 20 P/E Beta Volatility R million Page

Financials-Financial Services-Financial Services-Investment Services

JSE JSE Dec Jun 20 I 30 Jul 20 86 9 252.5 12.98 0.37 7.62 104.22 157

PSG KST KST Feb Aug 20 I 08 Oct 20 82 10 568.9 16.07 0.45 5.82 18.08 197

PSG KST-NSX KFS Feb Aug 20 I 08 Oct 20 83 10 489.0 0.00 0.45 5.82 61.29 197

PURPLE PPE Aug Aug 20 F 26 Nov 20 284 318.1 - 121.43 0.06 10.50 0.53 198

SASFIN SFN Jun Jun 20 F 17 Sep 20 237 676.1 4.24 - 0.04 8.24 1.08 219

VUNANI VUN Feb Feb 20 F 30 Apr 20 380 3.2 4.02 - 0.41 12.20 0.11 246

Financials-Financial Services-Financial Services-Specialty Finance

AEEI AEE Aug Feb 20 I 08 May 20 308 201.4 0.45 - 1.72 17.76 0.27 77

ARCINVEST AIL Jun Jun 20 F 11 Sep 20 142 3 344.2 7.80 0.00 12.72 10.32 79

BRAIT BAT Mar Mar 20 F 18 Jun 20 172 2 028.8 - 0.21 1.23 15.71 78.75 102

DENEB DNB Mar Mar 20 F 22 May 20 238 673.7 53.45 0.69 7.78 0.67 117

ECSPONENT ECS Jun Mar 20 F 21 Jul 20 345 54.0 - 0.03 1.37 39.66 0.07 120

ETHOSCAP EPE Jun Jun 20 F 28 Sep 20 225 778.1 11.86 0.00 7.34 4.85 124

GRANPRADE GPL Jun Jun 20 F 21 Sep 20 204 1 057.6 10.09 - 0.07 13.17 7.01 136

HCI HCI Mar Mar 20 F 22 May 20 171 2 127.0 2.06 - 0.06 11.10 28.61 143

INVLTD INL Mar Mar 20 F 21 May 20 74 12 277.8 6.31 0.83 8.52 495.70 153

INVPLC INP Mar Mar 20 F 15 May 20 57 26 305.0 6.05 0.85 8.92 588.96 154

LONG4LIFE L4L Feb Feb 20 F 14 May 20 160 2 505.5 7.37 0.00 7.12 28.47 165

PHOENIX AXL Sep Mar 20 I 26 Jun 20 244 639.0 - 6.69 - 0.13 11.61 17.82 78

PSG PSG Feb Aug 20 I 14 Oct 20 45 37 146.1 14.20 0.87 8.43 468.20 196

REINET RNI Mar Mar 20 F 21 May 20 31 57 712.5 32.80 0.00 8.30 488.62 205

REMGRO REM Jun Jun 20 F 18 Sep 20 26 69 131.6 9.02 0.62 6.70 1 219.68 206

RMBH RMH Jun Jun 20 F 06 Sep 20 24 74 763.8 7.85 0.66 8.20 885.29 210

RMIH RMI Jun Jun 20 F 10 Sep 20 44 37 759.1 10.69 0.63 5.69 231.38 200

TRANSCAP TCP Sep Mar 20 I 15 May 20 85 9 336.9 12.92 - 0.20 8.59 138.58 238

TRUSTCO TTO Sep Sep 19 I 11 Dec 20 129 4 363.3 2.01 1.17 27.58 1.09 241

ZEDER ZED Feb Aug 20 I 08 Oct 20 144 3 258.8 26.76 0.33 8.46 32.91 250

Fins-Financial Srvcs-Gen Financial Total/Avg 489 708 14.03 0.28

Financials-Real Estate-Real Estate Investment & Services-Real Estate Holding & Development

ACSION ACS Feb Feb 20 F 29 May 20 159 2 527.7 9.23 - 0.96 18.34 0.02 71

ATLEAF ALP Feb Aug 20 I 15 Oct 20 165 2 343.3 7.41 0.62 6.36 16.35 93

BALWIN BWN Feb Feb 20 F 15 May 20 203 1 057.7 2.29 - 0.26 8.89 6.12 97

EPP EPP Dec Jun 20 I 09 Sep 20 123 4 585.1 4.51 - 0.08 12.38 39.15 125

FREEDOM FDP Feb Feb 18 F 29 May 20 339 72.5 0.00 0.00 0.00 0.00 -

GRITREAL GTR Jun Jun 20 F 30 Sep 20 126 4 427.3 12.00 - 0.17 5.66 4.84 138

GTCSA GTC Dec Mar 20 Q 09 Jun 20 69 15 574.7 13.27 0.30 4.91 0.03 132

LIGHTCAP LTE Sep Mar 20 I 14 May 20 127 4 406.5 - 18.57 1.07 16.52 23.64 164

MAS MSP Jun Jun 20 F 04 Sep 20 101 7 465.9 5.67 0.81 10.26 54.17 166

NEPIROCK NRP Dec Jun 20 I 21 Aug 20 37 46 655.5 9.33 0.00 9.22 523.18 180

PUTPROP PPR Jun Jun 20 F 30 Sep 20 310 184.4 4.99 - 0.36 7.20 0.05 198

RAVEN RAV Dec Jun 20 I 27 Aug 20 121 4 857.8 6.31 0.00 6.46 1.41 202

SIRIUS SRE Mar Mar 20 F 01 Jun 20 68 16 562.0 27.09 0.33 7.42 68.12 223

TRADEH TDH Feb Feb 20 F 22 May 20 161 2 482.8 4.13 0.02 8.28 1.02 237

Fins-Financial Srvcs-Real Estate Total/Avg 113 203 8.85 0.09

Financials-Insurance-Life Insurance-Life Insurance

CLIENTELE CLI Jun Jun 20 F 02 Sep 20 150 3 051.3 7.92 0.54 5.44 2.85 111

DISCOVERY DSY Jun Jun 20 F 04 Sep 20 28 59 937.4 12.09 0.79 8.21 1 071.68 118

LIB-HOLD LBH Dec Jun 20 I 05 Aug 20 64 19 003.8 5.44 0.22 6.57 219.22 163

MOMMET MTM Jun Jun 20 F 09 Sep 20 60 25 037.8 9.40 0.46 7.25 269.72 172

MOMMET-NSX MMT Jun Jun 20 F 09 Sep 20 59 25 037.8 0.00 0.46 7.25 500.40 172

OMUTUAL OMU Dec Jun 20 I 02 Sep 20 29 59 469.0 5.35 0.00 8.52 1 512.70 189

SANLAM SLM Dec Jun 20 I 07 Sep 20 16 118 787.4 15.87 0.49 6.80 1 760.54 216

Fins-Insurance-Life Insurance Total/Avg 310 325 9.35 0.42

64