Page 43 - SHBe20.vp

P. 43

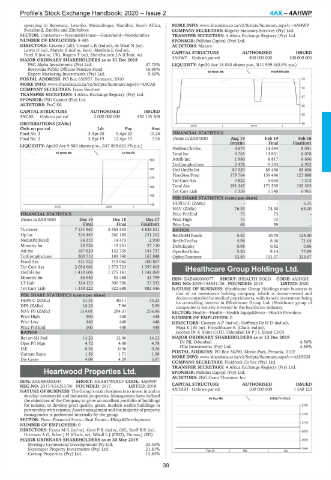

Profile’s Stock Exchange Handbook: 2020 – Issue 2 4AX – 4AHWP

operating in Botswana, Lesotho, Mozambique, Namibia, South Africa, MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=4AHWP

Swaziland, Zambia and Zimbabwe. COMPANY SECRETARY: Kilgetty Statutory Services (Pty) Ltd.

SECTOR: Consumer—Personal&House—Household—Nondurables TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

NUMBER OF EMPLOYEES: 8 485 SPONSOR: Pallidus Capital (Pty) Ltd.

DIRECTORS: Craven J (alt), CronjéLR(ind ne), de Waal N (ne), AUDITORS: Mazars

Lewis D (ne), Marole B (ind ne, Bots), Masilela E (ind ne),

Patel B (ind ne, UK), Rogers T (ne), Holtzhausen J A (Chair, ne) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018 4AHWP Ords no par val 400 000 000 100 000 005

PSG Alpha Investments (Pty) Ltd. 47.70% LIQUIDITY: Apr20 Ave 18 040 shares p.w., R11 999.4(0.9% p.a.)

Botswana Public Officers Pension Fund 16.90%

Export Marketing Investments (Pty) Ltd. 9.40% 40 Week MA HEARTWOOD

POSTAL ADDRESS: PO Box 650957, Benmore, 2010 73

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=4ACAS

COMPANY SECRETARY: Frans Reichert 70

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

67

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: PwC SA 65

CAPITAL STRUCTURE AUTHORISED ISSUED

62

4ACAS Ords no par val 2 000 000 000 452 135 508

DISTRIBUTIONS [ZARc] 59

2018 | 2019 |

Ords no par val Ldt Pay Amt

Final No 3 3 Apr 20 9 Apr 20 10.26 FINANCIAL STATISTICS

Final No 2 5 Apr 19 12 Apr 19 7.96 (Amts in ZAR’000) Aug 19 Feb 19 Feb 18

Interim Final Final(rst)

LIQUIDITY: Apr20 Ave 9 580 shares p.w., R47 899.6(0.1% p.a.)

NetRent/InvInc 4 674 14 584 8 041

40 Week MA CA SALES Total Inc 4 765 14 851 8 078

500 Attrib Inc 1 980 8 817 6 696

TotCompIncLoss 2 476 9 293 6 952

490 Ord UntHs Int 87 929 85 450 65 696

FixedAss/Prop 179 764 159 496 123 888

479

Tot Curr Ass 3 822 5 655 7 372

469 Total Ass 191 345 171 595 135 305

Tot Curr Liab 7 358 5 540 6 965

458

PER SHARE STATISTICS (cents per share)

448 HEPLU-C (ZARc) - - 6.35

2018 | 2019 |

NAV (ZARc) 76.35 74.30 65.00

FINANCIAL STATISTICS Price Prd End 73 73 -

(Amts in ZAR’000) Dec 19 Dec 18 Dec 17 Price High 73 73 -

Final Final Final(rst) Price Low 66 59 -

Turnover 7 131 967 5 555 533 4 838 511 RATIOS

Op Inc 336 449 260 185 231 262 RetOnSH Funds 5.52 10.70 125.30

NetIntPd(Rcvd) 34 315 14 473 2 910 RetOnTotAss 4.98 8.66 71.64

Minority Int 20 526 19 251 27 110 Debt:Equity 0.98 0.82 0.86

Att Inc 187 820 152 755 144 737 OperRetOnInv 5.20 9.14 77.89

TotCompIncLoss 200 710 189 740 167 848 OpInc:Turnover 53.89 103.37 224.67

Fixed Ass 511 522 419 062 100 807

Tot Curr Ass 2 054 661 1 573 723 1 397 805 iHealthcare Group Holdings Ltd.

Ord SH Int 1 410 606 1 275 181 1 142 069

4AIHGH

Minority Int 56 950 52 468 41 799 ISIN: ZAE400000077 SHORT: IHEALTH HOLD CODE: 4AIHGH

LT Liab 324 133 306 596 27 532 REG NO: 2019/155531/06 FOUNDED: 2019 LISTED: 2020

Tot Curr Liab 1 319 222 922 688 882 546 NATURE OF BUSINESS: iHealthcare Group Holdings main business is

that of an investment holding company, which is doctor-owned and

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 51.31 40.11 33.23 doctor-controlled by medical practitioners, with its sole investment being

its controlling interest in iHealthcare Group Ltd. iHealthcare group of

DPS (ZARc) 10.26 7.96 5.99

companies is entirely invested in the healthcare industry.

NAV PS (ZARc) 314.01 284.31 256.86 SECTOR: Health—Health—Health Equip&Srvcs—Health Providers

Price High 500 448 448 NUMBER OF EMPLOYEES: 0

Price Low 448 448 448 DIRECTORS: CoetzeeAP(ind ne), Hoffman DrHD(ind ne),

Price Prd End 500 448 448 MojaKJM(ne), Fleischhauer K (Chair, ind ne),

RATIOS Jacobsz Dr A (Joint CEO), Odendaal DrPJL (Joint CEO)

Ret on SH Fnd 14.20 12.96 14.52 MAJOR ORDINARY SHAREHOLDERS as at 13 Dec 2019

Oper Pft Mgn 4.72 4.68 4.78 Dr PJL Odendaal 4.56%

D:E 0.36 0.36 0.26 Olia Investments (Pty) Ltd. 4.55%

Current Ratio 1.56 1.71 1.58 POSTAL ADDRESS: PO Box 36290, Menlo Park, Pretoria, 0102

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=4AIHGH

Div Cover 4.08 4.29 5.87

COMPANY SECRETARY: Fluidrock Co Sec (Pty) Ltd.

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

Heartwood Properties Ltd. SPONSOR: Pallidus Capital (Pty) Ltd.

4AHWP AUDITORS: SNG Grant Thornton Inc.

ISIN: ZAE400000044 SHORT: HEARTWOOD CODE: 4AHWP

REG NO: 2017/654253/06 FOUNDED: 2017 LISTED: 2018 CAPITAL STRUCTURE AUTHORISED ISSUED

NATURE OF BUSINESS: The Group’s main business is to invest in and to 4AIHGH Ords no par val 500 000 000 1 540 120

develop commercial and industrial properties. Management have defined

the objectives of the Company to grow an excellent portfolio of buildings 80 Day MA IHEALTH HOLD

for tenants, to develop great quality, green, modern usable buildings in 2799

partnership with tenants. Asset management and the majority of property

management is performed internally by the group. 2759

SECTOR: Fins—Financial Srvcs—Real Estate—Hldgs&Development

2719

NUMBER OF EMPLOYEES: 0

DIRECTORS: EvansMR(ind ne), GentPR(ind ne, UK), SeeffBR(ne),

2679

Utterson A G, Scher J H (Chair, ne), Whall L J (CEO), Dumas J (FD)

MAJOR ORDINARY SHAREHOLDERS as at 30 May 2019 2639

Montagu Commercial Developments Pty Ltd. 23.30%

Skyscraper Property Investments (Pty) Ltd. 21.81% Feb 20 | Mar | Apr 2599

Cornop Properties (Pty) Ltd. 15.84%

39