Page 41 - SHBe20.vp

P. 41

Profile’s Stock Exchange Handbook: 2020 – Issue 2 SILP

PER SHARE STATISTICS (cents per share) COMPANY SECRETARY: Safyr Utilis Ltd.

HEPS-C (ZARc) 122.00 110.00 TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

DPS (ZARc) 27.00 48.00 SPONSOR: PSG Wealth Management Namibia (Pty) Ltd.

NAV PS (ZARc) 793.91 658.23 AUDITORS: Lancasters Chartered Accountants

Price Prd End 920 - CAPITAL STRUCTURE AUTHORISED ISSUED

Price High 920 - TAD Ords no par - 51 544 995

Price Low 900 -

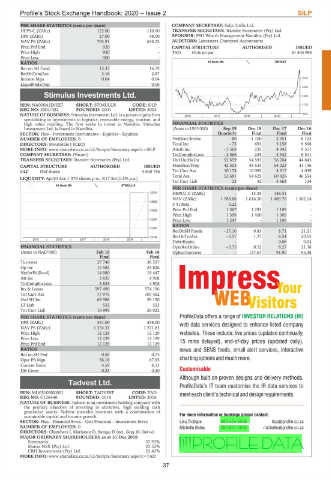

RATIOS 40 Week MA TADVEST

Ret on SH Fund 15.37 16.79

RetOnTotalAss 3.16 2.87

Interest Mgn 0.04 0.04 1573

LiquidFnds:Dep - 0.06

1440

Stimulus Investments Ltd. 1308

SILP

ISIN: NA000A1JN0Z7 SHORT: STIMULUS CODE: SILP 1175

REG NO: 2004/482 FOUNDED: 2004 LISTED: 2004

NATURE OF BUSINESS: Stimulus Investment Ltd. is a private equity firm 2016 | 2017 | 2018 | 2019 | 1043

specializing in investments in logistics, renewable energy, tourism, and

high value retailing. The firm seeks to invest in Namibia. Stimulus FINANCIAL STATISTICS

Investment Ltd. is based in Namibia. (Amts in USD’000) Sep 19 Dec 18 Dec 17 Dec 16

SECTOR: Fins—Investment Instruments—Equities—Equities Quarterly Final Final Final

NUMBER OF EMPLOYEES: 0 NetRent/InvInc - 80 - 1 100 2 951 8 103

DIRECTORS: Mwatotele J (CEO) Total Inc - 75 693 5 158 9 568

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=SILP Attrib Inc - 3 568 235 4 942 9 511

COMPANY SECRETARY: (Vacant) TotCompIncLoss - 3 568 235 4 942 9 511

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. Ord UntHs Int 52 659 54 593 56 764 44 845

CAPITAL STRUCTURE AUTHORISED ISSUED FixedAss/Prop 42 503 44 533 54 023 41 146

SILP Pref shares - 4 650 786 Tot Curr Ass 10 178 10 092 4 917 4 039

Total Ass 52 681 54 625 60 426 46 554

LIQUIDITY: Apr20 Ave 1 379 shares p.w., R17.5m(1.5% p.a.)

Tot Curr Liab 22 32 3 662 124

40 Week MA STIMULUS

PER SHARE STATISTICS (cents per share)

12791 HEPLU-C (ZARc) - 13.25 146.31 -

NAV (ZARc) 1 788.88 1 616.50 1 489.76 1 502.14

12659

3 Yr Beta 0.22 - - -

Price Prd End 1 367 1 293 1 109 -

12526

Price High 1 399 1 400 1 305 -

12394 Price Low 1 247 - 1 106 -

RATIOS

12261

RetOnSH Funds - 27.10 0.43 8.71 21.21

RetOnTotAss - 0.57 1.27 8.54 20.55

12129

2015 | 2016 | 2017 | 2018 | 2019 |

Debt:Equity - - 0.06 0.04

FINANCIAL STATISTICS OperRetOnInv - 0.75 0.52 8.27 21.38

(Amts in NAD’000) Feb 19 Feb 18 OpInc:Turnover - 137.67 91.90 95.48

Final Final

Turnover 27 740 36 537

Op Inc 15 585 24 826

NetIntPd(Rcvd) 14 980 19 447

Att Inc 3 835 4 908

TotCompIncLoss 3 835 4 908

Inv & Loans 597 490 574 196

Tot Curr Ass 77 975 107 462

Ord SH Int 62 986 59 150

LT Liab 532 532

Tot Curr Liab 16 995 26 022

PER SHARE STATISTICS (cents per share) ProfileData offers a range of INVESTOR RELATIONS (IR)

DPS (ZARc) 351.00 538.00 web data services designed to enhance listed company

NAV PS (ZARc) 1 354.31 1 271.83

Price High 12 129 12 129 websites. These include: live prices (updated continually,

Price Low 12 129 12 129

Price Prd End 12 129 12 129 15 mins delayed), end-of-day prices (updated daily),

RATIOS news and SENS feeds, email alert services, interactive

Ret on SH Fnd 0.58 0.75

Oper Pft Mgn 56.18 67.95 chartingoptionsandmuchmore.

Current Ratio 4.59 4.13

Div Cover 0.23 0.20 Customisable

Although built on proven designs and delivery methods,

Tadvest Ltd.

ProfileData’s IT team customise the IR data services to

TAD

ISIN: MU0510N00001 SHORT: TADVEST CODE: TAD meeteachclient’stechnicalanddesignrequirements.

REG NO: C126446 FOUNDED: 2016 LISTED: 2016

NATURE OF BUSINESS: Tadvest is an investment holding company with

the primary objective of investing in attractive, high yielding cash

generative assets. Tadvest provides investors with a combination of

sustainable capital and income growth. For more information or bookings please contact:

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs Lisa Trollope 082-454-9539 lisa@profile.co.za

NUMBER OF EMPLOYEES: 0 Michelle Botes 082-601-4020 michelle@profile.co.za

DIRECTORS: Chambers I, Marianen D, Savage D (ne), Gray M (ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

Semmatrix 37.97%

Matrix NSX (Pty) Ltd. 25.52%

CRH Investments (Pty) Ltd. 22.42%

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=TAD

37