Page 141 - SHBe20.vp

P. 141

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – GRI

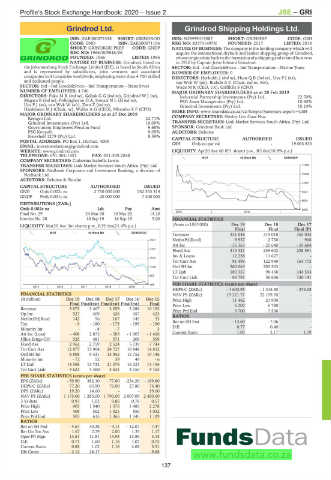

Grindrod Ltd. Grindrod Shipping Holdings Ltd.

GRI GRI

ISIN: ZAE000072328 SHORT: GRINDROD ISIN: SG9999019087 SHORT: GRINSHIP CODE: GSH

CODE: GND ISIN: ZAE000071106 REG NO: 201731497H FOUNDED: 2017 LISTED: 2018

SHORT: GRINDROD PREF CODE: GNDP NATURE OF BUSINESS: The company is the holding company which will

REG NO: 1966/009846/06 acquire the international drybulk and tanker shipping group of Grindrod,

FOUNDED: 1966 LISTED: 1986 whoseorigins dateback tothe formationofashipping andrelatedbusiness

NATURE OF BUSINESS: Grindrod, listed on in 1910 by Captain John Edward Grindrod.

the Johannesburg Stock Exchange Limited (JSE), is based in South Africa SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Marine Trans

and is represented by subsidiaries, joint ventures and associated NUMBER OF EMPLOYEES: 0

companies in 31countries worldwide, employing more than 4 700 skilled DIRECTORS: Herholdt J (ind ne), HuatQB(ind ne), UysPJ(ne),

and dedicated people. van Wyk W (alt), Brahde A C (Chair, ind ne, Nor),

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs Wade M R (CEO, UK), Griffiths S (CFO)

NUMBER OF EMPLOYEES: 4 746 MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

DIRECTORS: FakuMR(ind ne), GelinkGG(ind ne), GrindrodWJ(ne), Industrial Partnership Investments (Pty) Ltd. 22.70%

Magara B (ind ne), Polkinghorne D A, SowaziNL(ld ind ne), PSG Asset Management (Pty) Ltd. 10.60%

UysPJ(ne), van Wyk W (alt), Zatu Z (ind ne), Grindrod Investments (Pty) Ltd. 10.10%

Hankinson M J (Chair, ne), Waller A G (CEO), Mbambo X F (CFO) MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=GSH

MAJOR ORDINARY SHAREHOLDERS as at 27 Dec 2019

Remgro Ltd. 22.71% COMPANY SECRETARY: Shirley Lim Guat Hua

Grindrod Investments (Pty) Ltd. 10.09% TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Government Employees Pension Fund 9.68% SPONSOR: Grindrod Bank Ltd.

PSG Konsult 9.05% AUDITORS: Deloitte

Newshelf 1279 (Pty) Ltd. 8.39% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 1, Durban, 4000 GSH Ords no par val - 19 063 833

EMAIL: investorrelations@grindrod.com

WEBSITE: www.grindrod.com LIQUIDITY: Apr20 Ave 68 891 shares p.w., R5.6m(18.8% p.a.)

TELEPHONE: 031-304-1451 FAX: 031-305-2848

COMPANY SECRETARY: Catherina Isabella Lewis INDT 40 Week MA GRINSHIP

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. 17899

SPONSORS: Nedbank Corporate and Investment Banking, a division of

Nedbank Ltd. 15080

AUDITORS: Deloitte & Touche

12261

CAPITAL STRUCTURE AUTHORISED ISSUED

GND Ords 0.002c ea 2 750 000 000 762 553 314 9443

GNDP Prefs 0.031c ea 20 000 000 7 400 000

6624

DISTRIBUTIONS [ZARc]

Ords 0.002c ea Ldt Pay Amt 3805

Final No 29 24 Mar 20 30 Mar 20 14.20 2018 | 2019 |

Interim No 28 10 Sep 19 16 Sep 19 5.00 FINANCIAL STATISTICS

LIQUIDITY: Mar20 Ave 3m shares p.w., R19.1m(21.4% p.a.) (Amts in USD’000) Dec 19 Dec 18 Dec 17

Final Final Final (P)

INDT 40 Week MA GRINDROD

Turnover 331 046 319 018 355 035

NetIntPd(Rcvd) 9 937 2 730 906

2541

Att Inc - 35 363 - 20 640 - 59 684

2107

Fixed Ass 313 321 249 602 238 591

Inv & Loans 12 238 11 627 -

1672

Tot Curr Ass 91 499 122 949 154 775

1238 Ord SH Int 260 063 292 503 -

LT Liab 180 337 98 458 344 554

803

Tot Curr Liab 86 791 56 666 130 141

369 PER SHARE STATISTICS (cents per share)

2015 | 2016 | 2017 | 2018 | 2019 |

HEPS-C (ZARc) - 1 603.95 - 1 315.50 - 374.08

FINANCIAL STATISTICS NAV PS (ZARc) 19 221.71 22 109.70 -

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Price High 11 462 21 900 -

Final Final(rst) Final(rst) Final(rst) Final Price Low 6 202 6 780 -

Revenue 3 873 3 467 3 059 3 288 10 192 Price Prd End 9 700 7 536 -

Op Inc 527 409 426 457 423

NetInt(Pd)Rcvd 142 96 167 149 33 RATIOS - 13.60 - 7.06 -

Ret on SH Fnd

Tax - 9 - 180 - 173 - 195 - 190

Minority Int - - 8 - 7 - 3 D:E 0.77 0.40 -

Att Inc (Loss) - 408 2 873 - 583 - 1 907 - 1 426 Current Ratio 1.05 2.17 1.19

Hline Erngs-CO 525 481 571 209 559

Fixed Ass 2 962 2 759 2 524 5 739 7 744

Tot Curr Ass 12 877 13 964 24 727 16 848 14 612

Ord SH Int 8 808 9 431 13 955 15 752 19 146

Minority Int - 72 52 39 49 - 6

LT Liab 14 568 13 732 21 376 16 223 13 154

Tot Curr Liab 4 621 4 360 3 631 4 155 4 163

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 59.90 382.10 - 77.60 - 254.20 - 189.80

HEPS-C (ZARc) 77.20 63.90 76.00 27.80 74.40

DPS (ZARc) 19.20 14.60 - - 19.60

NAV PS (ZARc) 1 175.00 1 285.00 1 790.00 2 007.00 2 450.00

3 Yr Beta 0.93 1.02 0.86 0.78 0.57

Price High 905 1 540 1 575 1 485 2 278

Price Low 408 562 1 025 850 1 032

Price Prd End 503 615 1 365 1 345 1 129

RATIOS

Ret on SH Fnd - 4.67 30.38 - 4.11 - 12.07 - 7.47

Ret On Tot Ass 1.67 2.79 2.00 1.33 1.17

Oper Pft Mgn 13.61 11.81 13.93 13.89 4.15

D:E 0.71 1.60 1.18 1.07 0.75

Current Ratio 0.88 1.02 1.16 4.06 3.51

Div Cover - 3.12 26.17 - - - 9.68

137