Page 138 - SHBe20.vp

P. 138

JSE – GOL Profile’s Stock Exchange Handbook: 2020 – Issue 2

POSTAL ADDRESS: Postnet Suite 252, Private

Gold Fields Ltd. Bag X30500, Houghton, 2041

GOL EMAIL: investors@goldfields.com

ISIN: ZAE000018123 WEBSITE: www.goldfields.com

SHORT: GFIELDS TELEPHONE: 011-562-9700 FAX: 011-562-9829

CODE: GFI COMPANY SECRETARY:TarynHarmse(acting)

REG NO: 1968/004880/06

FOUNDED: 1998 TRANSFER SECRETARY: Computershare

LISTED: 1998 Investor Services (Pty) Ltd.

SPONSOR: JP Morgan Equities South Africa Ltd.

Scan the QR code to AUDITORS: KPMG Inc.

NATURE OF BUSINESS: visit our website BANKERS: Standard Bank of SA Ltd.

Gold Fields Limited is a

globally diversified gold CALENDAR Expected Status

producer with nine Annual General Meeting May 2020 Unconfirmed

operating mines (including our Asanko Joint Venture) and Next Interim Results Aug 2020 Unconfirmed

two projects in Australia, Chile, Ghana, Peru and South

Next Final Results Feb 2021 Unconfirmed

Africa, with total attributable annual gold-equivalent produc-

tion of approximately 2Moz. It has attributable gold Mineral CAPITAL STRUCTURE AUTHORISED ISSUED

Reserves of around 48.1Moz and gold Mineral Resources of GFI Ords 50c ea 1 000 000 000 828 632 707

around 96.6Moz. Attributable copper Mineral Reserves total DISTRIBUTIONS [ZARc]

691 million pounds and Mineral Resources 4,816 million Ords 50c ea Ldt Pay Amt

pounds. Gold Fields has a primary listing on the Johannesburg Final No 91 10 Mar 20 16 Mar 20 100.00

Stock Exchange (JSE) Limited, with secondary listings on the Interim No 90 3 Sep 19 9 Sep 19 60.00

New York Stock Exchange (NYSE). Final No 89 12 Mar 19 18 Mar 19 20.00

Interim No 88 4 Sep 18 10 Sep 18 20.00

SECTOR: Basic Materials—Basic Resrcs—Mining—Gold Mining LIQUIDITY: Mar20 Ave 14m shares p.w., R1 106.7m(89.0% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 27 Dec 2019

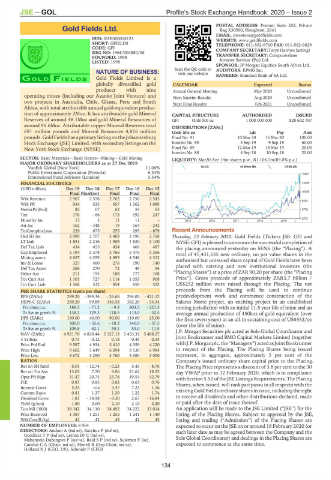

VanEck Global (New York) 11.06% GLDX 40 Week MA GFIELDS

Public Investment Corporation (Pretoria) 6.34%

15801

Dimensional Fund Advisors (London) 5.54%

FINANCIAL STATISTICS 13295

(USD million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

10789

Final Final(rst) Final Final Final

Wrk Revenue 2 967 2 578 2 762 2 750 2 545

8283

Wrk Pft 934 535 657 1 362 1 089

NetIntPd(Rcd) 82 67 62 59 65 5778

Tax 176 - 66 173 192 247

3272

Minority Int 13 3 11 11 - 2015 | 2016 | 2017 | 2018 | 2019 |

Att Inc 162 - 348 - 19 163 - 242

TotCompIncLoss 229 675 255 295 - 879 Recent Announcements

Ord SH Int 2 909 2 707 3 403 3 190 2 768 Thursday, 13 February 2020: Gold Fields (Tickers JSE: GFI and

LT Liab 1 851 2 216 1 909 1 820 2 100 NYSE: GFI) is pleased to announcethe successful completion of

Def Tax Liab 434 455 454 466 487 the placing announced yesterday on SENS (the “Placing”). A

Cap Employed 5 194 5 378 5 766 5 475 5 356 total of 41,431,635 new ordinary, no par value shares in the

Mining assets 4 657 4 259 4 893 4 548 4 312 authorised but unissued share capital of Gold Fields have been

Inv & Loans 327 460 276 190 140

Def Tax Asset 266 270 72 49 54 placed with existing and new institutional investors (the

Other Ass 211 194 188 177 168 “Placing Shares”) at a price of ZAR 90.20 per share (the “Placing

Tot Curr Ass 1 101 727 1 114 1 053 908 Price”). Gross proceeds of approximately ZAR3.7 billion /

Tot Curr Liab 1 368 532 854 859 522 US$252 million were raised through the Placing. The net

PER SHARE STATISTICS (cents per share) proceeds from the Placing will be used to continue

EPS (ZARc) 289.20 - 599.34 - 26.66 294.00 - 421.12 predevelopment work and commence construction of the

HEPS-C (ZARc) 289.20 99.89 346.58 382.20 - 54.34 Salares Norte project, an exciting project in an established

Pct chng p.a. 189.5 - 71.2 - 9.3 803.3 - 221.5 mining jurisdiction with an initial 11.5 year life of mine and an

Tr 5yr av grwth % 138.2 129.3 118.5 113.0 - 32.5 average annual production of 450koz of gold equivalent (over

DPS (ZARc) 160.00 40.00 90.00 110.00 25.00 the first seven years) at an all-in sustaining cost of US$552/oz

Pct chng p.a. 300.0 - 55.6 - 18.2 340.0 - 37.5 (over the life of mine).

Tr 5yr av grwth % 105.8 62.1 55.1 53.0 - 11.5

NAV (ZARc) 4 921.70 4 820.44 5 127.13 5 453.32 5 488.27 J.P. Morgan Securities plc acted as Sole Global Coordinator and

Joint Bookrunner and BMO Capital Markets Limited (together

3 Yr Beta 0.73 0.12 0.18 - 0.49 0.34

Price Prd End 9 587 4 934 5 410 4 359 4 220 with J.P. Morganplc,the“Managers”)actedasJointBookrunner

Price High 9 602 5 649 6 094 9 130 6 984 in respect of the Placing. The Placing Shares being issued

Price Low 4 672 3 290 3 760 3 680 3 000 represent, in aggregate, approximately 5 per cent of the

RATIOS Company’s issued ordinary share capital prior to the Placing.

Ret on SH fund 6.01 - 12.74 - 0.23 5.45 - 8.76 The Placing Price represents a discount of 3.8 per cent to the 30

Ret on Tot Ass 13.03 7.70 9.06 21.62 18.25 day VWAP prior to 12 February 2020, which is in compliance

Oper Pft Mgn 31.47 20.75 23.78 49.54 42.79 with Section 5.52 of the JSE Listings Requirements. The Placing

D:E 0.87 0.85 0.62 0.63 0.76 Shares, when issued, will rank pari passu in all respects with the

Interest Cover 5.24 n/a 3.47 7.23 1.16

Current Ratio 0.81 1.37 1.30 1.22 1.74 existing Gold Fields ordinary shares in issue, including the right

Dividend Cover 1.81 - 14.98 - 0.30 2.67 - 16.84 to receive all dividends and other distributions declared, made

Yield (g/ton) 1.80 2.00 2.10 2.10 2.20 or paid after the date of issue thereof.

Ton Mll (‘000) 38 342 34 110 34 492 34 222 33 014 An application will be made to the JSE Limited (“JSE”) for the

Price Received 1 387 1 251 1 255 1 241 1 140 listing of the Placing Shares. Subject to approval by the JSE,

WrkCost(R/kg) 41 42 43 42 43 listing and trading (“Admission”) of the Placing Shares are

NUMBER OF EMPLOYEES: 8 964 expected to occur on the JSE on or around 18 February 2020 (or

DIRECTORS: Andani A (ind ne), Bacchus P (ind ne), such later date as may be agreed between the Company and the

GoodlaceTP(ind ne), Letton Dr C (ind ne),

Mahanyele-Dabengwa P (ind ne), ReidSP(ind ne), Suleman Y (ne), Sole Global Coordinator) and dealings in the Placing Shares are

Carolus C A (Chair, ind ne), Menell R (Dep Chair, ind ne), expected to commence at the same time.

Holland N J (CEO, UK), Schmidt P (CFO)

134