Page 117 - SHBe20.vp

P. 117

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – CON

A. Lange & Söhne, Jaeger-LeCoultre, Vacheron Constantin, Officine DIRECTORS: ChouLCH(ne), MaizeyAJ(ne), Siyotula N (ind ne),

Panerai, IWC Schaffhausen, Baume & Mercier, Roger Dubuis, Yoox Thorndike Jr.WN(ld ind ne), XabaNR(ind ne), Napier R

Net-A-Porter (‘YNAP’), Watchfinder, Montblanc, Alfred Dunhill, Chloé, S (Chair, ind ne), Riskowitz S M (CEO), Louw L E (CFO)

Peter Millar, Azzedine Alaïa, Serapian and Purdey. MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019

SECTOR: Consumer—Personal&House—Personal—Clothing&Accessories Pershing LLC 34.49%

NUMBER OF EMPLOYEES: 35 640 Chou Leo Chih Hao Mr 9.57%

DIRECTORS: Guieysse S (HR), Arora N (ne, Indian), Bos N (Fr), Snowball Wealth (Pty) Ltd. 5.36%

Brendish C (ld ind ne, UK), Eckert J (ne, Swiss), Jin Dr K (ne, China), POSTAL ADDRESS: PO Box 97, Melrose Arch, 2076

Magnoni R (ne, It), Moss J (ne, USA), Nevistic Dr V (ne, Swiss), Pictet G MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CND

(ne, Swiss), Quasha A (ne, USA), Ramos M (ne), Rupert J (ne), COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

Rupert A (ne), Saage G (ne, USA), Vigneron C (Fr), Rupert TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

J P (Chair, ne), Malherbe J (Dep Chair, ne), Lambert J (CEO, Fr), SPONSOR: Merchantec Capital

Grund B (CFO, German) AUDITORS: BDO South Africa Inc.

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Compagnie Financiere Rupert 9.10% CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CFR CND Ords no par value 1 500 000 000 764 443 900

COMPANY SECRETARY: Swen Grundmann DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par value Ldt Pay Amt

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Final No 3 11 Dec 14 22 Dec 14 5.00

AUDITORS: PwC SA Share Premium No 2 2 Dec 11 12 Dec 11 10.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Apr20 Ave 337 539 shares p.w., R478 116.3(2.3% p.a.)

CFR Dep Receipts - 5 220 000 000

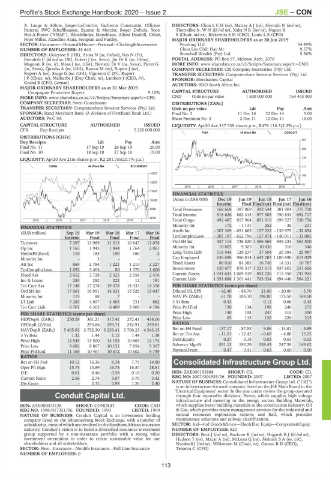

FINA 40 Week MA CONDUIT

DISTRIBUTIONS [CHFc]

361

Dep Receipts Ldt Pay Amt

Final No 11 17 Sep 19 26 Sep 19 20.00

298

Final No 10 18 Sep 18 27 Sep 18 19.00

LIQUIDITY: Apr20 Ave 21m shares p.w., R2 281.7m(20.7% p.a.) 235

CONG 40 Week MA RICHEMONT 171

14027

108

12837

45

2015 | 2016 | 2017 | 2018 | 2019 |

11647

FINANCIAL STATISTICS

10458 (Amts in ZAR’000) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

Interim Final Final(rst) Final(rst) Final(rst)

9268 Total Premiums 168 668 387 869 392 544 381 904 375 708

Total Income 518 626 882 415 977 303 750 833 692 717

8078

2015 | 2016 | 2017 | 2018 | 2019 | Total Outgo 492 487 857 964 851 916 699 527 520 756

Minority Int 172 - 1 131 252 - 36 - 231

FINANCIAL STATISTICS

Attrib Inc - 307 369 - 651 665 127 222 - 139 975 - 32 854

(EUR million) Sep 19 Mar 19 Mar 18 Mar 17 Mar 16

Interim Final Final Final Final TotCompIncLoss - 307 197 - 652 796 127 474 - 140 011 - 33 085

Turnover 7 397 13 989 11 013 10 647 11 076 Ord SH Int 437 114 736 520 1 396 565 945 233 561 800

Op Inc 1 165 1 943 1 844 1 764 2 061 Minority Int 10 805 9 305 10 436 310 346

NetIntPd(Rcvd) 110 183 150 160 - 2 Long-Term Liab 116 944 129 237 37 504 29 384 25 987

Cap Employed 636 698 986 814 1 642 283 1 100 690 615 029

Minority Int - 3 - - -

Att Inc 869 2 784 1 221 1 210 2 227 Fixed Assets 86 010 84 385 16 746 14 331 10 787

TotCompIncLoss 1 092 3 404 80 1 370 1 600 Investments 620 677 876 317 1 221 613 837 602 251 626

Fixed Ass 2 652 2 728 2 325 2 558 2 476 Current Assets 1 041 633 1 069 419 892 726 715 450 741 905

Inv & Loans 283 282 222 12 191 Current Liab 1 351 888 1 301 441 763 034 694 446 564 221

Tot Curr Ass 17 148 17 278 19 678 14 433 14 358 PER SHARE STATISTICS (cents per share)

Ord SH Int 17 061 16 951 14 631 15 529 15 047 Diluted HL EPS - 42.40 - 88.70 21.00 - 20.80 - 5.70

Minority Int 115 88 7 - - NAV PS (ZARc) 61.70 105.10 198.00 175.50 169.50

LT Liab 7 285 4 697 4 605 731 882 3 Yr Beta 0.43 - 0.12 0.66 0.45

Tot Curr Liab 6 701 6 303 6 409 3 900 4 196 Price Prd End 130 134 198 240 275

PER SHARE STATISTICS (cents per share) Price High 140 198 247 315 390

HEPDepR (ZARc) 250.29 361.21 317.41 272.41 438.06 Price Low 65 115 130 220 215

DPDepR (ZARc) - 295.86 293.71 242.91 249.81 RATIOS

NAVDepR (ZARc) 5 405.92 3 752.30 3 239.41 3 706.23 4 543.15 Ret on SH Fund - 137.17 - 87.53 9.06 - 14.81 - 5.89

3 Yr Beta 1.32 1.44 1.12 1.44 1.38 Ret on Tot Ass - 11.01 - 12.42 - 0.68 - 4.88 13.25

Price High 12 545 13 500 13 153 10 663 12 174 Debt:Equity 0.27 0.18 0.03 0.03 0.05

Price Low 9 682 8 867 10 151 7 854 9 367 Solvency Mgn% 531.13 192.29 358.43 247.59 149.62

Price Prd End 11 168 10 467 10 672 10 602 9 749 Payouts:Prem 0.47 0.41 0.63 0.60 0.50

RATIOS

Ret on SH Fnd 10.12 16.36 8.34 7.79 14.80 Consolidated Infrastructure Group Ltd.

Oper Pft Mgn 15.75 13.89 16.74 16.57 18.61 CON

D:E 0.61 0.46 0.58 0.16 0.20 ISIN: ZAE000153888 SHORT: CIL CODE: CIL

REG NO: 2007/004935/06 FOUNDED: 2007 LISTED: 2007

Current Ratio 2.56 2.74 3.07 3.70 3.42

Div Cover - 2.32 0.99 1.26 2.40 NATURE OF BUSINESS: Consolidated Infrastructure Group Ltd. (”CIG”)

is an infrastructure-focused company listed on the JSE Main Board in the

‘Electrical Equipment’ sector. In the year under review the group operated

Conduit Capital Ltd. through four reportable divisions: Power, which supplies high voltage

infrastructure and metering to the energy sector; Building Materials,

CON

ISIN: ZAE000073128 SHORT: CONDUIT CODE: CND which supplies heavy building materials to the construction industry; Oil

REG NO: 1998/017351/06 FOUNDED: 1993 LISTED: 1999 & Gas, which provides waste management services for the industrial and

NATURE OF BUSINESS: Conduit Capital is an investment holding natural resources exploration sectors; and Rail, which provides

company listed on the Johannesburg Stock Exchange, with a number of maintenance solutions and railway electrification.

subsidiaries, most of which are involved in the Southern African insurance SECTOR: Ind—Ind Goods&Srvcs—Elec&Elec Equip—Componts&Equip

industry. Conduit’s vision is to build a diversified insurance investment NUMBER OF EMPLOYEES: 820

group supported by a non-insurance portfolio with a strong value DIRECTORS: Beck J (ind ne), Bucknor K (ind ne), HogarthRJ(ld ind ne),

investment orientation in order to create sustainable value for our Hudson T (ne), Mazar A (ne), McLean Q (ne), MelnickSA(ne, UK),

shareholders and all stakeholders. Nwokedi J (ind ne), Wilkerson M (Chair, ne), Gamsu R D (CEO),

SECTOR: Fins—Insurance—Nonlife Insurance—Full Line Insurance Teixeira C (CFO)

NUMBER OF EMPLOYEES: 0

113