Page 108 - SHBe20.vp

P. 108

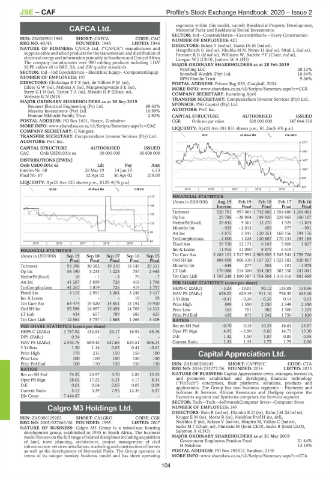

JSE – CAF Profile’s Stock Exchange Handbook: 2020 – Issue 2

segments within this model, namely Residential Property Development,

CAFCA Ltd. Memorial Parks and Residential Rental Investments.

CAF SECTOR: Ind—Constn&Matrls—Constn&Matrls—Heavy Construction

ISIN: ZW0009011942 SHORT: CAFCA CODE: CAC NUMBER OF EMPLOYEES: 421

REG NO: 40/45 FOUNDED: 1945 LISTED: 1946 DIRECTORS: Baloyi T (ind ne), Gama Dr M (ind ne),

NATURE OF BUSINESS: CAFCA Ltd. (“CAFCA”) manufactures and Hauptfleisch G (ind ne), Nkuhlu M N, Ntene H (ind ne), Ntuli L (ind ne),

supplies cable and allied products for the transmission and distribution of PatmoreRB(ld ind ne), Williams W, Radebe P F (Chair, ind ne),

electrical energy and information primarily in Southern and Central Africa. Lategan W J (CEO), Joubert W A (FD)

The company manufactures over 900 cabling products including 11kV MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

XLPE cables all to BRT, SA, and ZW quality standards. Pershing LLC 28.13%

SECTOR: Ind—Ind Goods&Srvcs—Elec&Elec Equip—Componts&Equip Snowball Wealth (Pty) Ltd. 10.64%

NUMBER OF EMPLOYEES: 197 BPM Familie Trust 9.36%

DIRECTORS: ChidzongaETZ(ne), de VilliersPW(ne), POSTAL ADDRESS: Private Bag X33, Craighall, 2024

EddeyGW(ne), Mabena A (ne), MangwengwendeSE(ne), MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CGR

SteynGJH(ne), TaylorTA(ne), Mkushi H P (Chair, ne), COMPANY SECRETARY: Itumeleng April

Webster R N (MD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Reunert Electrical Engineering (Py) Ltd. 69.63% SPONSOR: PSG Capital (Pty) Ltd.

Messina Investments (Pty) Ltd. 10.99% AUDITORS: PwC Inc.

Honour Mkhushi Family Trust 2.92% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 1651, Harare, Zimbabwe CGR Ords no par value 500 000 000 147 044 518

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CAC LIQUIDITY: Apr20 Ave 181 831 shares p.w., R1.2m(6.4% p.a.)

COMPANY SECRETARY: C Kangara

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. INDI 40 Week MA CALGRO

AUDITORS: PwC Inc. 2277

CAPITAL STRUCTURE AUTHORISED ISSUED

CAC Ords USD0.001c ea 50 000 000 30 600 000 1867

DISTRIBUTIONS [ZWDc] 1457

Ords USD0.001c ea Ldt Pay Amt

Interim No 68 28 May 19 14 Jun 19 6.13 1047

Final No 67 12 Apr 02 30 Apr 02 218.00

637

LIQUIDITY: Apr20 Ave 125 shares p.w., R129.4(-% p.a.)

227

ELEE 40 Week MA CAFCA 2015 | 2016 | 2017 | 2018 | 2019 |

215 FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 Feb 19 Feb 18 Feb 17 Feb 16

185 Interim Final Final Final Final

Turnover 520 781 997 065 1 742 602 1 554 680 1 204 063

155

Op Inc 25 786 - 28 904 149 926 228 965 160 167

125 NetIntPd(Rcvd) 29 842 9 361 - 12 270 1 925 - 11 874

Minority Int - 925 - 2 013 456 977 - 991

94

Att Inc - 1 875 3 241 120 351 169 156 194 176

TotCompIncLoss - 2 800 1 228 120 807 170 133 193 185

64

2015 | 2016 | 2017 | 2018 | 2019 | Fixed Ass 29 550 12 173 6 163 5 806 3 827

FINANCIAL STATISTICS Inv & Loans 11 915 11 090 8 879 6 519 -

(Amts in USD’000) Sep 19 Sep 18 Sep 17 Sep 16 Sep 15 Tot Curr Ass 2 263 101 2 517 953 2 985 855 2 545 543 1 759 766

Final Final Final Final Final Ord SH Int 804 808 806 310 1 167 327 1 023 182 820 867

Turnover 93 396 30 382 19 310 18 149 29 311 Minority Int - 648 277 355 - 101 - 1 078

Op Inc 54 190 5 233 1 223 757 2 445 LT Liab 178 088 214 300 354 283 302 358 241 041

NetIntPd(Rcvd) 10 - 1 - 3 79 - 7 Tot Curr Liab 1 707 248 1 890 387 1 704 504 1 419 316 881 669

Att Inc 41 267 3 859 726 419 1 796 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 41 267 3 859 726 419 1 797 HEPS-C (ZARc) - 3.24 - 19.01 90.12 133.08 138.96

Fixed Ass 4 119 2 991 3 264 3 246 3 417 NAV PS (ZARc) 628.02 629.19 911.18 798.35 645.00

Inv & Loans - - - 19 19 3 Yr Beta - 0.41 - 0.26 - 0.36 0.14 0.03

Tot Curr Ass 64 474 19 520 14 851 13 191 14 910 Price High 899 1 550 2 050 2 349 2 350

Ord SH Int 55 598 16 097 15 458 14 709 14 312 Price Low 363 701 982 1 500 1 225

LT Liab 434 657 789 682 625 Price Prd End 435 875 1 242 1 750 1 820

Tot Curr Liab 12 561 5 757 1 868 1 065 3 409 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd - 0.70 0.15 10.35 16.63 23.57

HEPS-C (ZARc) 1 787.92 152.53 29.17 18.92 65.76 Oper Pft Mgn 4.95 - 2.90 8.60 14.73 13.30

DPS (ZARc) 0.24 - - - - D:E 1.42 1.50 1.07 0.85 0.95

NAV PS (ZARc) 2 543.76 689.45 637.66 624.51 606.14 Current Ratio 1.33 1.33 1.75 1.79 2.00

3 Yr Beta 1.20 1.14 0.05 0.41 - 0.61

Price High 170 215 150 150 180 Capital Appreciation Ltd.

Price Low 100 100 150 150 130

CAP

Price Prd End 100 170 150 150 150 ISIN: ZAE000208245 SHORT: CAPPREC CODE: CTA

RATIOS REG NO: 2014/253277/06 FOUNDED: 2014 LISTED: 2015

Ret on SH Fnd 74.22 23.97 4.70 2.85 12.55 NATURE OF BUSINESS: Capital Appreciation owns, manages, invests in,

Oper Pft Mgn 58.02 17.22 6.33 4.17 8.34 and promotes established and developing financial technology

(“FinTech”) enterprises, their platforms, solutions, products and

D:E 0.01 0.04 0.05 0.05 0.09 applications. The Group has two business segments – Payments and

Current Ratio 5.13 3.39 7.95 12.39 4.37 Software & Services. African Resonance and Dashpay comprise the

Div Cover 7 444.67 - - - - Payments segment and Synthesis comprises the Services segment.

SECTOR: Tech—Tech—Software&Computer Srvcs—Computer Srvcs

Calgro M3 Holdings Ltd. NUMBER OF EMPLOYEES: 249

DIRECTORS: Bulo B (ind ne), DlaminiKD(ne), KahnJM(ld ind ne),

CAL

ISIN: ZAE000109203 SHORT: CALGRO CODE: CGR KrugerEM(ne), Morar R (ne), Neishlos Prof H (ne, Isrl),

REG NO: 2005/027663/06 FOUNDED: 1995 LISTED: 2007 Neishlos E (ne), Sekese V (ind ne), Shapiro M, Valkin C (ind ne),

NATURE OF BUSINESS: Calgro M3 Group is a mixed-use housing Sacks M ( (Chair, ne), Pimstein M (Joint CEO), Sacks B (Joint CEO),

development group, established in 1995 in South Africa. The business Salomon A (CFO)

model focuses on the full range of related disciplines including acquisition MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

of land, town planning, architecture, project management of civil Government Employees Pension Fund 21.44%

infrastructure, services installation, marketing and construction of homes H Neishlos 13.15%

as well as the development of Memorial Parks. The Group operates in POSTAL ADDRESS: PO Box 785812, Sandton, 2146

terms of its unique turnkey business model and has three operating MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=CTA

104