Page 107 - SHBe20.vp

P. 107

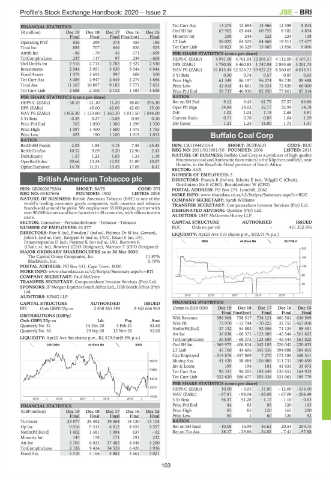

Profile’s Stock Exchange Handbook: 2020 – Issue 2 JSE – BRI

FINANCIAL STATISTICS Tot Curr Ass 13 274 12 655 13 966 12 359 9 814

(R million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Ord SH Int 63 902 65 444 60 759 8 182 4 894

Final Final Final Final(rst) Final Minority Int 258 244 222 224 138

Operating Prof 656 389 374 459 186 LT Liab 58 022 64 325 64 468 19 511 17 477

Total Inc 885 707 646 826 525 Tot Curr Liab 18 823 16 329 15 605 11 856 9 006

Attrib Inc - 86 - 79 46 171 - 699 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 237 117 97 239 - 668 HEPS-C (ZARc) 4 941.08 4 761.04 12 001.57 4 112.00 4 107.01

Ord UntHs Int 2 516 2 713 2 782 2 427 2 530 DPS (ZARc) 3 790.58 3 460.83 1 747.04 2 895.68 3 201.75

Investments 2 044 3 051 3 630 3 044 4 044 NAV PS (ZARc) 51 815.44 52 524.72 49 827.23 8 560.65 6 014.91

Fixed Assets 1 979 1 693 997 608 500 3 Yr Beta 0.50 0.74 0.57 0.87 0.93

Tot Curr Ass 3 089 2 947 2 649 2 274 1 656 Price High 61 349 86 197 96 074 98 739 89 488

Total Ass 11 267 10 897 9 185 7 771 7 653 Price Low 42 018 44 801 76 334 72 820 60 000

Tot Curr Liab 2 688 2 368 2 132 1 583 1 638 Price Prd End 59 737 46 930 82 950 77 861 87 314

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) - 58.10 - 21.10 11.20 48.00 - 295.30 Ret on SH Fnd 9.12 9.45 61.75 57.57 89.86

DPS (ZARc) - 45.00 42.00 42.00 35.00 Oper Pft Mgn 34.84 38.02 32.77 32.94 34.78

NAV PS (ZARc) 1 066.30 1 123.80 1 160.30 1 011.50 1 044.00 D:E 1.02 1.04 1.15 2.68 3.91

3 Yr Beta - 0.25 0.27 - 0.09 0.55 0.10 Current Ratio 0.71 0.78 0.89 1.04 1.09

Price Prd End 765 1 050 1 300 1 299 1 350 Div Cover 1.21 1.35 18.00 1.73 1.41

Price High 1 097 1 400 1 600 1 475 1 765

Price Low 625 190 1 100 1 015 1 013 Buffalo Coal Corp

RATIOS

BUF

RetOnSH Funds 2.05 1.84 4.13 7.58 - 25.43 ISIN: CA1194421014 SHORT: BUFFALO CODE: BUC

RetOnTotAss 10.52 9.09 8.20 12.90 2.43 REG NO: 2011/011661/10 FOUNDED: 2006 LISTED: 2011

Debt:Equity 1.57 1.23 1.05 1.33 1.19 NATURE OF BUSINESS: Buffalo Coal Corp is a producer of high quality

OperRetOnInv 20.66 13.24 12.92 21.89 10.87 bituminous coal and Anthracite from mines in the Klipriver coalfield, near

Dundee, in the KwaZulu-Natal province of South Africa.

OpInc:Turnover 14.78 11.51 13.45 17.09 8.41

SECTOR: AltX

NUMBER OF EMPLOYEES: 2

British American Tobacco plc DIRECTORS: Francis B (ind ne), Scholtz E (ne), Wiggill C (Chair),

Oosthuizen Ms E (CEO), Bezuidenhout W (CFO)

BRI

ISIN: GB0002875804 SHORT: BATS CODE: BTI POSTAL ADDRESS: PO Box 274, Lonehill, 2062

REG NO: 03407696 FOUNDED: 1902 LISTED: 2008 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=BUC

NATURE OF BUSINESS: British American Tobacco (BAT) is one of the COMPANY SECRETARY: Sarah Williams

world’s leading consumer goods companies, with nicotine and tobacco TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

brands sold around the globe. We employ over 55 000 people, partner with

over 90 000 farmers and have factories in 48 countries, with offices in even DESIGNATED ADVISOR: Questco (Pty) Ltd.

more. AUDITORS: UHY McGovern Hurley LLP

SECTOR: Consumer—Personal&House—Tobacco—Tobacco CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 63 877 BUC Ords no par val - 421 352 596

DIRECTORS: Farr S (ne), Fowden J (ind ne), Helmes Dr M (ne, German), LIQUIDITY: Apr20 Ave 110 shares p.w., R92.9(-% p.a.)

Jobin L (ind ne, Can), Koeppel H (ind ne, USA), Kwan S (ne, UK),

Panayotopoulos D (ne), Poynter K (snr ind ne, UK), Burrows R MINI 40 Week MA BUFFALO

(Chair, ne, Ire), Bowles J (CEO Designate), Marroco T (CFO Designate) 243

MAJOR ORDINARY SHAREHOLDERS as at 30 Mar 2020

The Capital Group Companies, Inc 11.97% 194

BlackRock, Inc. 5.79%

POSTAL ADDRESS: PO Box 631, Cape Town, 8000 146

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=BTI

COMPANY SECRETARY: Paul McCrory 98

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

49

SPONSORS: JP Morgan Equities South Africa Ltd., UBS South Africa (Pty)

Ltd. 1

AUDITORS: KPMG LLP 2015 | 2016 | 2017 | 2018 | 2019 |

CAPITAL STRUCTURE AUTHORISED ISSUED FINANCIAL STATISTICS

BTI Ords GBP0.25p ea 2 858 265 349 2 462 666 963 (Amts in ZAR’000) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15

Final Final(rst) Final Final Final

DISTRIBUTIONS [GBPp] Wrk Revenue 398 968 758 517 738 121 660 582 630 999

Ords GBP0.25p ea Ldt Pay Amt

Quarterly No 31 14 Dec 20 3 Feb 21 52.60 Wrk Pft 73 970 - 13 744 - 70 225 33 755 - 457 018

Quarterly No 30 29 Sep 20 12 Nov 20 52.60 NetIntPd(Rcd) 37 132 54 582 52 356 71 124 89 451

Att Inc 36 838 - 68 375 - 123 689 - 45 544 - 561 825

LIQUIDITY: Apr20 Ave 5m shares p.w., R2 579.9m(9.5% p.a.) TotCompIncLoss 36 839 - 68 375 - 123 689 - 45 544 - 561 825

JSE-TABA 40 Week MA BATS Ord SH Int - 369 975 - 406 814 - 342 105 - 226 042 - 220 633

LT Liab 45 760 44 606 345 036 394 888 584 805

Cap Employed - 319 876 - 357 869 7 270 173 185 368 511

85475 Mining Ass 41 420 58 484 106 886 311 731 340 650

Inv & Loans 199 194 181 41 633 35 675

74894

Tot Curr Ass 92 331 96 205 183 649 135 651 164 923

Tot Curr Liab 522 620 586 677 353 038 331 063 189 779

64312

PER SHARE STATISTICS (cents per share)

53731 HEPS-C (ZARc) 10.00 - 0.05 - 31.00 - 12.00 - 534.00

NAV (ZARc) - 87.81 - 98.04 - 85.08 - 67.09 - 208.49

43150

2015 | 2016 | 2017 | 2018 | 2019 | 3 Yr Beta 46.37 51.28 - 1.17 - 1.10 - 0.63

FINANCIAL STATISTICS Price Prd End 84 85 85 120 165

(GBP million) Dec 19 Dec 18 Dec 17 Dec 16 Dec 15 Price High 85 85 120 165 200

Final Final Final Final Final Price Low 84 1 60 120 92

Turnover 25 877 24 492 19 564 14 130 13 104 RATIOS

Op Inc 9 016 9 313 6 412 4 655 4 557 Ret on SH fund - 10.08 16.99 36.62 20.54 259.75

NetIntPd(Rcvd) 1 602 1 381 1 094 637 - 62 Ret on Tot Ass 18.17 - 29.86 - 34.02 - 7.41 - 97.88

Minority Int 145 178 171 191 232

Att Inc 5 704 6 032 37 485 4 648 4 290

TotCompIncLoss 2 126 9 424 34 528 6 426 3 936

Fixed Ass 5 518 5 166 4 882 3 661 3 021

103