Page 59 - SHB 2020 Issue 1

P. 59

Profile’s Stock Exchange Handbook: 2020 – Issue 1 ZARX – ZXTIP

Price Low 1 080 650 1 030 1 040 -

Price Prd End 1 145 1 100 1 100 1 040 - TWK Investments Ltd.

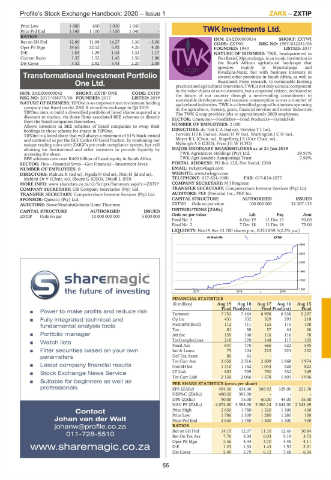

RATIOS ZXTWI ISIN: ZAEZ00000034 SHORT: ZXTWI

Ret on SH Fnd 12.89 11.98 14.27 3.30 - 5.00 CODE: ZXTWI REG NO: 1997/012251/06

Oper Pft Mgn 19.65 22.52 6.92 4.20 4.20 FOUNDED: 1940 LISTED: 2017

D:E 1.03 1.29 1.43 1.32 1.17 NATURE OF BUSINESS: TWK, headquartered in

Current Ratio 1.55 1.52 1.45 1.50 1.80 Piet Retief, Mpumalanga, is an iconic institution in

Div Cover 3.32 2.82 3.43 2.20 2.00 the South African agricultural landscape that

operates mainly in Mpumalanga and

KwaZulu-Natal, but with business interests in

Transformational Investment Portfolio several other provinces in South Africa, as well as

Swaziland. From research, to sustainable farming

One Ltd. practices and agricultural innovation, TWK is not only a crucial component

in the value chains of our customers, but a corporate citizen, dedicated to

ZXTIP

ISIN: ZAEZ00000042 SHORT: ZXTIP ONE CODE: ZXTIP the future of our country through a never-ending commitment to

REG NO: 2017/458073/06 FOUNDED: 2017 LISTED: 2019 sustainable development and resource consumption across a number of

NATURE OF BUSINESS: TIPOne is an empowerment investment holding agri-related industries. TWK is a diversified group of businesses operating

company that listed on the ZAR X securities exchange in Q4 2019. in the agriculture, forestry, grain, financial services and motor industries.

TIPOne aims to build a diversified portfolio of listed shares acquired at a The TWK Group provides jobs to approximately 2000 employees.

discount to market, via those firms associated BEE schemes or directly SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

from the listed companies themselves.

Allows investors in BEE schemes of listed companies to swap their NUMBER OF EMPLOYEES: 2 000

holdings in those scheme for shares in TIPOne. DIRECTORS: du Toit C A (ind ne), Ferreira T I (ne),

TIPOne is a listed share that will always a minimum of 51% black owned Ferreira H J K (ind ne), Kusel H W (ne), Wartington J C N (ne),

and controlled as per the BEE Codes Of Good Practice, by combining our Meyer R L (Chair, ne), Stapelberg J S (Vice Chair, ne),

unique trading rules with ZARX’s pre-trade compliance system, but still Myburgh A S (CEO), Fivaz J E W (CFO)

allowing for Institutional and other investors to provide liquidity by MAJOR ORDINARY SHAREHOLDERS as at 24 Jun 2019

accessing the share. TWK Agriculture Holdings (Pty) Ltd. 59.97%

BEE schemes own over R400 billion of listed equity in South Africa TWK Agri Aandele Aansporings Trust 7.96%

SECTOR: Fins—Financial Srvcs—Gen Financial—Investment Srvcs POSTAL ADDRESS: PO Box 128, Piet Retief, 2380

NUMBER OF EMPLOYEES: 0 EMAIL: twk@twkagri.com

DIRECTORS: Mahura K (ind ne), Ngada N (ind ne), Ntoi H (ld ind ne), WEBSITE: www.twkagri.com

Mahlati Dr V (Chair, ne), Blount G (CEO), Ditodi L (FD) TELE PHONE: 017-824-1000 FAX: 017-824-1077

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ZXTIP COMPANY SECRETARY: M J Potgieter

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: PKF (Pretoria) Inc., PKF Inc.

SPONSOR: Questco (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: SizweNtsalubaGobodo Grant Thornton ZXTWI Ords no par value 100 000 000 32 307 135

CAPITAL STRUCTURE AUTHORISED ISSUED DISTRIBUTIONS [ZARc]

ZXTIP Ords no par 10 000 000 000 5 000 000 Ords no par value Ldt Pay Amt

Final No 3 6 Dec 19 11 Dec 19 90.00

Final No 2 7 Dec 18 11 Dec 18 75.00

LIQUIDITY: Nov19 Ave 13 700 shares p.w., R323 859.5(2.2% p.a.)

40 Week MA ZXTWI

2950

2620

2290

sharemagic 1960

TM

1630

the future of investing 2017 | 2018 | 2019 1300

FINANCIAL STATISTICS

(R million) Aug 19 Aug 18 Aug 17 Aug 16 Aug 15

Final Final(rst) Final Final(rst) Final

+ Power to make profits and reduce risk

Turnover 7 753 7 464 6 998 6 538 5 297

+ Fully integrated technical and Op Inc 431 332 329 293 218

fundamental analysis tools NetIntPd(Rcvd) 112 111 125 110 108

Tax 81 58 57 44 26

+ Portfolio manager Att Inc 159 140 116 116 78

+ Watch lists TotCompIncLoss 218 170 148 117 105

Fixed Ass 847 770 666 622 595

+ Filter securities based on your own Inv & Loans 75 104 225 223 232

parameters Def Tax Asset 80 63 - - -

Tot Curr Ass 2 650 2 516 2 609 1 868 1 974

+ Latest company financial results Ord SH Int 1 310 1 162 1 043 928 823

+ Stock Exchange News Service LT Liab 803 769 790 332 349

Tot Curr Liab 2 150 2 066 1 578 1 801 1 936

+ Suitable for beginners as well as PER SHARE STATISTICS (cents per share)

professionals EPS (ZARc) 494.30 434.46 366.92 329.00 221.76

HEPS-C (ZARc) 480.20 391.00 - - -

DPS (ZARc) 90.00 75.00 60.00 44.00 35.00

NAV PS (ZARc) 4 074.00 3 598.00 3 306.24 2 642.00 2 343.49

Contact Price High 2 650 1 780 1 320 1 300 430

Price Low 1 780 1 300 1 280 1 280 100

Johan van der Walt Price Prd End 2 650 1 780 1 300 1 300 430

johanw@profile.co.za RATIOS

Ret on SH Fnd 14.19 12.07 11.10 12.46 10.84

011-728-5510 Ret On Tot Ass 7.76 5.35 6.03 5.19 3.73

Oper Pft Mgn 5.56 4.44 4.70 4.48 4.11

www.sharemagic.co.za D:E 1.23 1.33 1.43 1.53 2.01

Div Cover 5.49 5.79 6.12 7.48 6.34

55