Page 58 - SHB 2020 Issue 1

P. 58

ZARX – ZXDCG Profile’s Stock Exchange Handbook: 2020 – Issue 1

Minority Int 1 545 1 243 1 163 1 099 1 078

Dale Capital Group Ltd. LT Liab 1 455 1 371 1 291 1 206 1 206

ZXDCG Tot Curr Liab 2 655 2 562 2 896 2 300 1 789

ISIN: MU0227N00002 SHORT: DALE CODE: ZXDCG

REG NO: BVI.1443428 FOUNDED: 2000 LISTED: 2019 PER SHARE STATISTICS (cents per share)

NATURE OF BUSINESS: The founders of Dale have functioned as HEPS-C (ZARc) 79.80 80.90 105.20 83.30 64.50

successful private equity investors since 1994. Collectively, the board and DPS (ZARc) 21.00 42.00 38.00 29.00 29.00

executive team have managed, founded, advised, invested in, acquired, and NAV PS (ZARc) 1 484.00 1 406.00 1 316.00 1 192.00 1 120.00

successfully sold many companies, across numerous sectors and economic Price High 550 580 595 600 -

cycles. The more notable of these companies are detailed below:

*Dale International Trust Company Ltd.; Price Low 370 380 495 550 -

*Synergy Computing (Pty) Ltd.; Price Prd End 370 550 580 595 -

*AfrAsia Bank Limited; and RATIOS

*Queensgate Group Ltd. Ret on SH Fnd 11.02 9.68 11.14 6.52 6.47

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance Oper Pft Mgn 19.75 22.33 6.79 4.14 4.02

NUMBER OF EMPLOYEES: 0 D:E 0.92 1.14 1.26 1.15 1.01

DIRECTORS: West A (ind ne), Foulds M (Chair, ne, UK), Current Ratio 1.53 1.50 1.43 1.51 1.74

Noland N T (Interim CEO), Robert F L (CEO Designate, Mau) Div Cover 4.86 3.21 2.61 2.62 2.48

POSTAL ADDRESS: 2 River Court, St. Denis Street, Port Louis, Mauritius

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ZXDCG

COMPANY SECRETARY: Rockmills Financials Ltd. Senwes Ltd.

AUDITORS: Nexia SAB&T Inc. ZXSWS

ISIN: ZAEZ00000018 SHORT: ZXSWS CODE: ZXSWS

CAPITAL STRUCTURE AUTHORISED ISSUED REG NO: 1997/005336/06 FOUNDED: 1909 LISTED: 2017

ZXDCG Ords no par val. - 202 040 920 NATURE OF BUSINESS: Senwes is one of South Africa’s largest integrated

agri-businesses and one of the world’s largest providers of white maize to

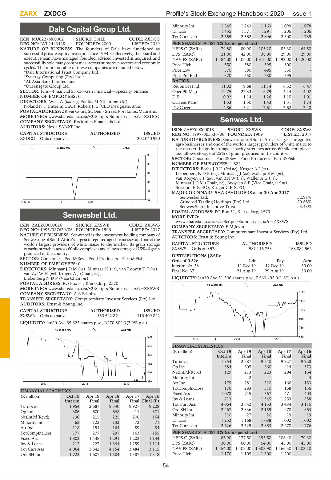

40 Day MA DALE the market. Its grain storage capacity stretches across 60 silo complexes

and allows storage of 25% of grain produced in the country.

90

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

88 NUMBER OF EMPLOYEES: 1 624

DIRECTORS: Botha J B H (ind ne), Kruger A J (ne),

86 Liebenberg N D P (ne), Minnaar J J (ne), Mohapi S M (ne),

van Rooyen T F (ne), van Zyl W (ne), Waller A G (ne),

84 Minnaar J D M (Chair, ne), Booysen S F (Vice Chair, ind ne),

Strydom F (CEO), Kruger C F (CFO)

82

MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2017

Senwesbel Ltd. 52.91%

80

Nov 19 | Dec | Grindrod Trading Holdings (Pty) Ltd. 20.68%

Senwes Share Incentive Trust 3.43%

POSTAL ADDRESS: PO Box 31, Klerksdorp, 2570

Senwesbel Ltd. MORE INFO:

ZXSWB www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ZXSWS

ISIN: ZAEZ00000026 SHORT: ZXSWB CODE: ZXSWB COMPANY SECRETARY: E M Joynt

REG NO: 1996/017629/06 FOUNDED: 1996 LISTED: 2017 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NATURE OF BUSINESS: Senwesbel is the investment holding company of AUDITORS: Ernst & Young Inc.

Senwes one of South Africa’s largest integrated agri-businesses and one of the

world’s largest providers of white maize to the market. Its grain storage CAPITAL STRUCTURE AUTHORISED ISSUED

capacity stretches across 60 silo complexes and allows storage of 25% of grain ZXSWS Ords of 0.52c 581 116 758 168 884 562

produced in the country. DISTRIBUTIONS [ZARc]

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish Ords of 0.52c Ldt Pay Amt

NUMBER OF EMPLOYEES: 0 Interim No 38 11 Dec 19 12 Dec 19 30.00

DIRECTORS: Minnaar J D M (ne), Minnaar J J (ne), van Rooyen T F (ne), Final No 37 21 Aug 19 29 Aug 19 30.00

van Zyl W H (ne), Kruger A J (Chair, ne),

Liebenberg N D P (Vice Chair, ne) LIQUIDITY: Jan20 Ave 51 306 shares p.w., R560 495.0(1.6% p.a.)

POSTAL ADDRESS: PO Box 31, Klerksdorp, 2570 40 Week MA ZXSWS

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=ZXSWB

COMPANY SECRETARY: A E Scholtz 1300

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

1170

AUDITORS: Ernst & Young Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 1040

ZXSWB Ords no par val 160 542 874 116 409 842

910

LIQUIDITY: Jan20 Ave 65 625 shares p.w., R270 802.3(2.9% p.a.)

780

40 Week MA ZXSWB

600 650

2017 | 2018 | 2019

554 FINANCIAL STATISTICS

(R million) Oct 19 Apr 19 Apr 18 Apr 17 Apr 16

508

Interim Final Final Final Final

Turnover 1 954 2 687 9 540 9 927 9 228

462

Op Inc 384 605 660 414 373

416 NetIntPd(Rcvd) 129 213 223 204 164

Minority Int - 2 1 1 3

370 Att Inc 179 281 310 166 153

2017 | 2018 | 2019

TotCompIncLoss 176 283 310 168 156

FINANCIAL STATISTICS Fixed Ass 1 078 715 567 471 403

(R million) Oct 19 Apr 19 Apr 18 Apr 17 Apr 16 Inv & Loans 213 - 1 345 1 259 888

Interim Final Final Final Final (P)

Turnover 1 954 2 687 9 540 9 927 9 228 Tot Curr Ass 4 064 3 842 4 153 3 484 3 115

Op Inc 386 600 648 411 371 Ord SH Int 2 467 2 336 2 159 1 970 1 863

NetIntPd(Rcvd) 130 215 225 206 164 Minority Int 310 27 20 19 19

Minority Int 62 122 133 73 71 LT Liab 1 252 1 168 1 088 1 002 1 002

Att Inc 118 154 164 89 84 Tot Curr Liab 2 626 2 529 2 863 2 270 1 776

TotCompIncLoss 177 277 297 163 155 PER SHARE STATISTICS (cents per share)

Fixed Ass 1 802 1 438 1 291 1 202 1 134 HEPS-C (ZARc) 86.90 177.50 195.50 108.40 79.30

Inv & Loans 212 227 1 344 1 259 1 114 DPS (ZARc) 30.00 60.00 54.00 45.00 45.00

Tot Curr Ass 4 064 3 842 4 154 3 484 3 115 NAV PS (ZARc) 1 454.00 1 405.00 1 303.90 1 166.50 1 103.10

Ord SH Int 1 723 1 607 1 504 1 387 1 318 Price High 1 170 1 105 1 300 1 200 -

54