Page 6 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 6

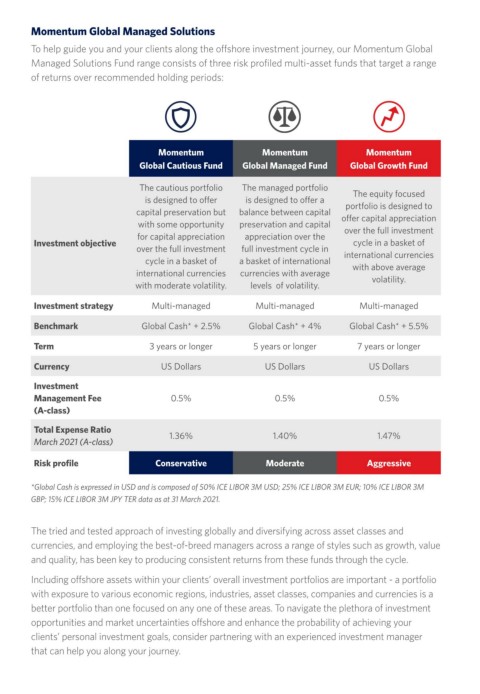

Momentum Global Managed Solutions

To help guide you and your clients along the offshore investment journey, our Momentum Global

Managed Solutions Fund range consists of three risk profiled multi-asset funds that target a range

of returns over recommended holding periods:

Momentum Momentum Momentum

Global Cautious Fund Global Managed Fund Global Growth Fund

The cautious portfolio The managed portfolio The equity focused

is designed to offer is designed to offer a

portfolio is designed to

capital preservation but balance between capital offer capital appreciation

with some opportunity preservation and capital

for capital appreciation appreciation over the over the full investment

Investment objective cycle in a basket of

over the full investment full investment cycle in international currencies

cycle in a basket of a basket of international

international currencies currencies with average with above average

volatility.

with moderate volatility. levels of volatility.

Investment strategy Multi-managed Multi-managed Multi-managed

Benchmark Global Cash* + 2.5% Global Cash* + 4% Global Cash* + 5.5%

Term 3 years or longer 5 years or longer 7 years or longer

Currency US Dollars US Dollars US Dollars

Investment

Management Fee 0.5% 0.5% 0.5%

(A-class)

Total Expense Ratio

March 2021 (A-class) 1.36% 1.40% 1.47%

Risk profile Conservative Moderate Aggressive

*Global Cash is expressed in USD and is composed of 50% ICE LIBOR 3M USD; 25% ICE LIBOR 3M EUR; 10% ICE LIBOR 3M

GBP; 15% ICE LIBOR 3M JPY TER data as at 31 March 2021.

The tried and tested approach of investing globally and diversifying across asset classes and

currencies, and employing the best-of-breed managers across a range of styles such as growth, value

and quality, has been key to producing consistent returns from these funds through the cycle.

Including offshore assets within your clients’ overall investment portfolios are important - a portfolio

with exposure to various economic regions, industries, asset classes, companies and currencies is a

better portfolio than one focused on any one of these areas. To navigate the plethora of investment

opportunities and market uncertainties offshore and enhance the probability of achieving your

clients’ personal investment goals, consider partnering with an experienced investment manager

that can help you along your journey.