Page 36 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 36

CHAPTER 1

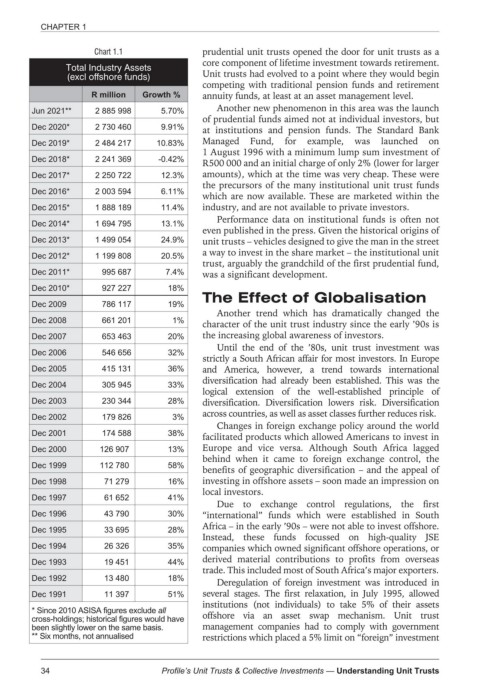

Chart 1.1 prudential unit trusts opened the door for unit trusts as a

core component of lifetime investment towards retirement.

Total Industry Assets

(excl offshore funds) Unit trusts had evolved to a point where they would begin

competing with traditional pension funds and retirement

annuity funds, at least at an asset management level.

R million Growth %

Jun 2021** 2 885 998 5.70% Another new phenomenon in this area was the launch

of prudential funds aimed not at individual investors, but

Dec 2020* 2 730 460 9.91% at institutions and pension funds. The Standard Bank

Dec 2019* 2 484 217 10.83% Managed Fund, for example, was launched on

1 August 1996 with a minimum lump sum investment of

Dec 2018* 2 241 369 -0.42%

R500 000 and an initial charge of only 2% (lower for larger

Dec 2017* 2 250 722 12.3% amounts), which at the time was very cheap. These were

the precursors of the many institutional unit trust funds

Dec 2016* 2 003 594 6.11%

which are now available. These are marketed within the

Dec 2015* 1 888 189 11.4% industry, and are not available to private investors.

Performance data on institutional funds is often not

Dec 2014* 1 694 795 13.1%

even published in the press. Given the historical origins of

Dec 2013* 1 499 054 24.9% unit trusts – vehicles designed to give the man in the street

a way to invest in the share market – the institutional unit

Dec 2012* 1 199 808 20.5%

trust, arguably the grandchild of the first prudential fund,

Dec 2011* 995 687 7.4% was a significant development.

Dec 2010* 927 227 18%

The Effect of Globalisation

Dec 2009 786 117 19%

Another trend which has dramatically changed the

Dec 2008 661 201 1%

character of the unit trust industry since the early ’90s is

Dec 2007 653 463 20% the increasing global awareness of investors.

Until the end of the ’80s, unit trust investment was

Dec 2006 546 656 32%

strictly a South African affair for most investors. In Europe

Dec 2005 415 131 36% and America, however, a trend towards international

diversification had already been established. This was the

Dec 2004 305 945 33%

logical extension of the well-established principle of

Dec 2003 230 344 28% diversification. Diversification lowers risk. Diversification

across countries, as well as asset classes further reduces risk.

Dec 2002 179 826 3%

Changes in foreign exchange policy around the world

Dec 2001 174 588 38%

facilitated products which allowed Americans to invest in

Dec 2000 126 907 13% Europe and vice versa. Although South Africa lagged

behind when it came to foreign exchange control, the

Dec 1999 112 780 58%

benefits of geographic diversification – and the appeal of

Dec 1998 71 279 16% investing in offshore assets – soon made an impression on

local investors.

Dec 1997 61 652 41%

Due to exchange control regulations, the first

Dec 1996 43 790 30% “international” funds which were established in South

Africa – in the early ’90s – were not able to invest offshore.

Dec 1995 33 695 28%

Instead, these funds focussed on high-quality JSE

Dec 1994 26 326 35% companies which owned significant offshore operations, or

derived material contributions to profits from overseas

Dec 1993 19 451 44%

trade. This included most of South Africa’s major exporters.

Dec 1992 13 480 18%

Deregulation of foreign investment was introduced in

Dec 1991 11 397 51% several stages. The first relaxation, in July 1995, allowed

institutions (not individuals) to take 5% of their assets

* Since 2010 ASISA figures exclude all

cross-holdings; historical figures would have offshore via an asset swap mechanism. Unit trust

been slightly lower on the same basis. management companies had to comply with government

** Six months, not annualised restrictions which placed a 5% limit on “foreign” investment

34 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts