Page 335 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 335

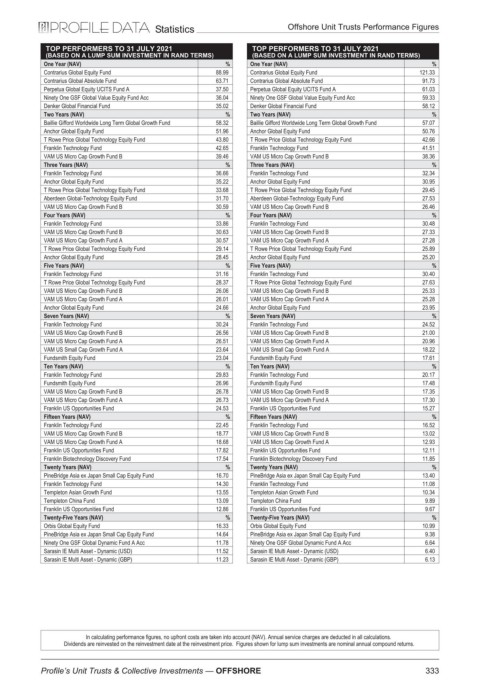

Statistics Offshore Unit Trusts Performance Figures

TOP PERFORMERS TO 31 JULY 2021 TOP PERFORMERS TO 31 JULY 2021

(BASED ON A LUMP SUM INVESTMENT IN RAND TERMS) (BASED ON A LUMP SUM INVESTMENT IN RAND TERMS)

One Year (NAV) % One Year (NAV) %

Contrarius Global Equity Fund 88.99 Contrarius Global Equity Fund 121.33

Contrarius Global Absolute Fund 63.71 Contrarius Global Absolute Fund 91.73

Perpetua Global Equity UCITS Fund A 37.50 Perpetua Global Equity UCITS Fund A 61.03

Ninety One GSF Global Value Equity Fund Acc 36.04 Ninety One GSF Global Value Equity Fund Acc 59.33

Denker Global Financial Fund 35.02 Denker Global Financial Fund 58.12

Two Years (NAV) % Two Years (NAV) %

Baillie Gifford Worldwide Long Term Global Growth Fund 58.32 Baillie Gifford Worldwide Long Term Global Growth Fund 57.07

Anchor Global Equity Fund 51.96 Anchor Global Equity Fund 50.76

T Rowe Price Global Technology Equity Fund 43.80 T Rowe Price Global Technology Equity Fund 42.66

Franklin Technology Fund 42.65 Franklin Technology Fund 41.51

VAM US Micro Cap Growth Fund B 39.46 VAM US Micro Cap Growth Fund B 38.36

Three Years (NAV) % Three Years (NAV) %

Franklin Technology Fund 36.66 Franklin Technology Fund 32.34

Anchor Global Equity Fund 35.22 Anchor Global Equity Fund 30.95

T Rowe Price Global Technology Equity Fund 33.68 T Rowe Price Global Technology Equity Fund 29.45

Aberdeen Global-Technology Equity Fund 31.70 Aberdeen Global-Technology Equity Fund 27.53

VAM US Micro Cap Growth Fund B 30.59 VAM US Micro Cap Growth Fund B 26.46

Four Years (NAV) % Four Years (NAV) %

Franklin Technology Fund 33.86 Franklin Technology Fund 30.48

VAM US Micro Cap Growth Fund B 30.63 VAM US Micro Cap Growth Fund B 27.33

VAM US Micro Cap Growth Fund A 30.57 VAM US Micro Cap Growth Fund A 27.28

T Rowe Price Global Technology Equity Fund 29.14 T Rowe Price Global Technology Equity Fund 25.89

Anchor Global Equity Fund 28.45 Anchor Global Equity Fund 25.20

Five Years (NAV) % Five Years (NAV) %

Franklin Technology Fund 31.16 Franklin Technology Fund 30.40

T Rowe Price Global Technology Equity Fund 28.37 T Rowe Price Global Technology Equity Fund 27.63

VAM US Micro Cap Growth Fund B 26.06 VAM US Micro Cap Growth Fund B 25.33

VAM US Micro Cap Growth Fund A 26.01 VAM US Micro Cap Growth Fund A 25.28

Anchor Global Equity Fund 24.66 Anchor Global Equity Fund 23.95

Seven Years (NAV) % Seven Years (NAV) %

Franklin Technology Fund 30.24 Franklin Technology Fund 24.52

VAM US Micro Cap Growth Fund B 26.56 VAM US Micro Cap Growth Fund B 21.00

VAM US Micro Cap Growth Fund A 26.51 VAM US Micro Cap Growth Fund A 20.96

VAM US Small Cap Growth Fund A 23.64 VAM US Small Cap Growth Fund A 18.22

Fundsmith Equity Fund 23.04 Fundsmith Equity Fund 17.61

Ten Years (NAV) % Ten Years (NAV) %

Franklin Technology Fund 29.83 Franklin Technology Fund 20.17

Fundsmith Equity Fund 26.96 Fundsmith Equity Fund 17.48

VAM US Micro Cap Growth Fund B 26.78 VAM US Micro Cap Growth Fund B 17.35

VAM US Micro Cap Growth Fund A 26.73 VAM US Micro Cap Growth Fund A 17.30

Franklin US Opportunities Fund 24.53 Franklin US Opportunities Fund 15.27

Fifteen Years (NAV) % Fifteen Years (NAV) %

Franklin Technology Fund 22.45 Franklin Technology Fund 16.52

VAM US Micro Cap Growth Fund B 18.77 VAM US Micro Cap Growth Fund B 13.02

VAM US Micro Cap Growth Fund A 18.68 VAM US Micro Cap Growth Fund A 12.93

Franklin US Opportunities Fund 17.82 Franklin US Opportunities Fund 12.11

Franklin Biotechnology Discovery Fund 17.54 Franklin Biotechnology Discovery Fund 11.85

Twenty Years (NAV) % Twenty Years (NAV) %

PineBridge Asia ex Japan Small Cap Equity Fund 16.70 PineBridge Asia ex Japan Small Cap Equity Fund 13.40

Franklin Technology Fund 14.30 Franklin Technology Fund 11.08

Templeton Asian Growth Fund 13.55 Templeton Asian Growth Fund 10.34

Templeton China Fund 13.09 Templeton China Fund 9.89

Franklin US Opportunities Fund 12.86 Franklin US Opportunities Fund 9.67

Twenty-Five Years (NAV) % Twenty-Five Years (NAV) %

Orbis Global Equity Fund 16.33 Orbis Global Equity Fund 10.99

PineBridge Asia ex Japan Small Cap Equity Fund 14.64 PineBridge Asia ex Japan Small Cap Equity Fund 9.38

Ninety One GSF Global Dynamic Fund A Acc 11.78 Ninety One GSF Global Dynamic Fund A Acc 6.64

Sarasin IE Multi Asset - Dynamic (USD) 11.52 Sarasin IE Multi Asset - Dynamic (USD) 6.40

Sarasin IE Multi Asset - Dynamic (GBP) 11.23 Sarasin IE Multi Asset - Dynamic (GBP) 6.13

In calculating performance figures, no upfront costs are taken into account (NAV). Annual service charges are deducted in all calculations.

Dividends are reinvested on the reinvestment date at the reinvestment price. Figures shown for lump sum investments are nominal annual compound returns.

333

Profile’s Unit Trusts & Collective Investments — OFFSHORE