Page 149 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 149

Classification of CISs

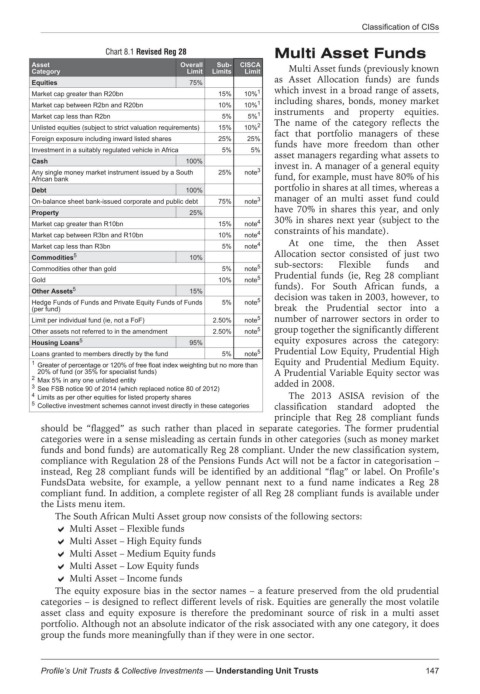

Chart 8.1 Revised Reg 28 Multi Asset Funds

Multi Asset funds (previously known

Asset Overall Sub- CISCA

Category Limit Limits Limit

as Asset Allocation funds) are funds

75%

Equities

Market cap greater than R20bn 15% 10% 1 which invest in a broad range of assets,

Market cap between R2bn and R20bn 10% 10% 1 including shares, bonds, money market

Market cap less than R2bn 5% 5% 1 instruments and property equities.

Unlisted equities (subject to strict valuation requirements) 15% 10% 2 The name of the category reflects the

fact that portfolio managers of these

Foreign exposure including inward listed shares 25% 25%

funds have more freedom than other

Investment in a suitably regulated vehicle in Africa 5% 5%

asset managers regarding what assets to

100%

Cash invest in. A manager of a general equity

Any single money market instrument issued by a South 25% note 3

African bank fund, for example, must have 80% of his

portfolio in shares at all times, whereas a

100%

Debt

On-balance sheet bank-issued corporate and public debt 75% note 3 manager of an multi asset fund could

have 70% in shares this year, and only

25%

Property

Market cap greater than R10bn 15% note 4 30% in shares next year (subject to the

constraints of his mandate).

Market cap between R3bn and R10bn 10% note 4

Market cap less than R3bn 5% note 4 At one time, the then Asset

5 Allocation sector consisted of just two

Commodities 10%

sub-sectors: Flexible funds and

Commodities other than gold 5% note 5

Prudential funds (ie, Reg 28 compliant

Gold 10% note 5

funds). For South African funds, a

5

Other Assets 15% decision was taken in 2003, however, to

Hedge Funds of Funds and Private Equity Funds of Funds 5% note 5

(per fund) break the Prudential sector into a

Limit per individual fund (ie, not a FoF) 2.50% note 5 number of narrower sectors in order to

Other assets not referred to in the amendment 2.50% note 5 group together the significantly different

5 95% equity exposures across the category:

Housing Loans

Loans granted to members directly by the fund 5% note 5 Prudential Low Equity, Prudential High

1 Greater of percentage or 120% of free float index weighting but no more than Equity and Prudential Medium Equity.

20% of fund (or 35% for specialist funds) A Prudential Variable Equity sector was

2

Max 5% in any one unlisted entity

3 See FSB notice 90 of 2014 (which replaced notice 80 of 2012) added in 2008.

4 The 2013 ASISA revision of the

Limits as per other equities for listed property shares

5

Collective investment schemes cannot invest directly in these categories classification standard adopted the

principle that Reg 28 compliant funds

should be “flagged” as such rather than placed in separate categories. The former prudential

categories were in a sense misleading as certain funds in other categories (such as money market

funds and bond funds) are automatically Reg 28 compliant. Under the new classification system,

compliance with Regulation 28 of the Pensions Funds Act will not be a factor in categorisation –

instead, Reg 28 compliant funds will be identified by an additional “flag” or label. On Profile’s

FundsData website, for example, a yellow pennant next to a fund name indicates a Reg 28

compliant fund. In addition, a complete register of all Reg 28 compliant funds is available under

the Lists menu item.

The South African Multi Asset group now consists of the following sectors:

Multi Asset – Flexible funds

Multi Asset – High Equity funds

Multi Asset – Medium Equity funds

Multi Asset – Low Equity funds

Multi Asset – Income funds

The equity exposure bias in the sector names – a feature preserved from the old prudential

categories – is designed to reflect different levels of risk. Equities are generally the most volatile

asset class and equity exposure is therefore the predominant source of risk in a multi asset

portfolio. Although not an absolute indicator of the risk associated with any one category, it does

group the funds more meaningfully than if they were in one sector.

147

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts