Page 142 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 142

CHAPTER 8

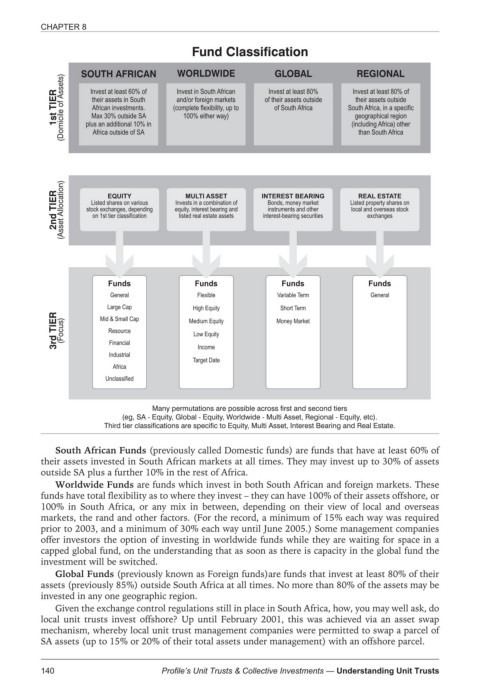

Fund Classification

WORLDWIDE

REGIONAL

GLOBAL

Assets) SOUTH AFRICAN Invest in South African Invest at least 80% Invest at least 80% of

TIER of their assets in South (complete flexibility, up to of their assets outside South Africa, in a specific

Invest at least 60% of

and/or foreign markets

their assets outside

African investments.

of South Africa

(Domicile plus an additional 10% in (including Africa) other

1st Max 30% outside SA 100% either way) geographical region

than South Africa

Africa outside of SA

TIER Allocation) stock exchanges, depending equity, interest bearing and INTEREST BEARING Listed property shares on

REAL ESTATE

EQUITY

MULTI ASSET

Invests in a combination of

Listed shares on various

Bonds, money market

local and overseas stock

instruments and other

2nd (Asset on 1st tier classification listed real estate assets interest-bearing securities exchanges

Funds Funds Funds Funds

General Flexible Variable Term General

Large Cap High Equity Short Term

TIER (Focus) Mid & Small Cap Medium Equity Money Market

Resource

3rd Financial Low Equity

Income

Industrial

Target Date

Africa

Unclassified

Many permutations are possible across first and second tiers

(eg, SA - Equity, Global - Equity, Worldwide - Multi Asset, Regional - Equity, etc).

Third tier classifications are specific to Equity, Multi Asset, Interest Bearing and Real Estate.

South African Funds (previously called Domestic funds) are funds that have at least 60% of

their assets invested in South African markets at all times. They may invest up to 30% of assets

outside SA plus a further 10% in the rest of Africa.

Worldwide Funds are funds which invest in both South African and foreign markets. These

funds have total flexibility as to where they invest – they can have 100% of their assets offshore, or

100% in South Africa, or any mix in between, depending on their view of local and overseas

markets, the rand and other factors. (For the record, a minimum of 15% each way was required

prior to 2003, and a minimum of 30% each way until June 2005.) Some management companies

offer investors the option of investing in worldwide funds while they are waiting for space in a

capped global fund, on the understanding that as soon as there is capacity in the global fund the

investment will be switched.

Global Funds (previously known as Foreign funds)are funds that invest at least 80% of their

assets (previously 85%) outside South Africa at all times. No more than 80% of the assets may be

invested in any one geographic region.

Given the exchange control regulations still in place in South Africa, how, you may well ask, do

local unit trusts invest offshore? Up until February 2001, this was achieved via an asset swap

mechanism, whereby local unit trust management companies were permitted to swap a parcel of

SA assets (up to 15% or 20% of their total assets under management) with an offshore parcel.

140 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts