Page 108 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 108

CHAPTER 6

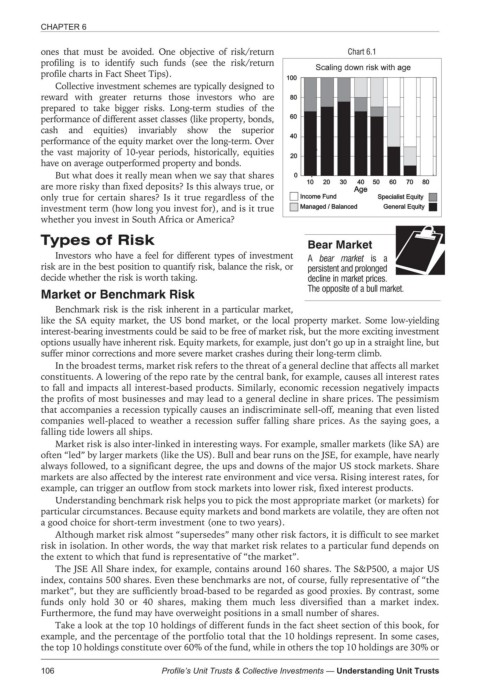

ones that must be avoided. One objective of risk/return Chart 6.1

profiling is to identify such funds (see the risk/return

profile charts in Fact Sheet Tips).

Collective investment schemes are typically designed to

reward with greater returns those investors who are

prepared to take bigger risks. Long-term studies of the

performance of different asset classes (like property, bonds,

cash and equities) invariably show the superior

performance of the equity market over the long-term. Over

the vast majority of 10-year periods, historically, equities

have on average outperformed property and bonds.

But what does it really mean when we say that shares

are more risky than fixed deposits? Is this always true, or

only true for certain shares? Is it true regardless of the

investment term (how long you invest for), and is it true

whether you invest in South Africa or America?

Types of Risk Bear Market

Investors who have a feel for different types of investment A bear market is a

risk are in the best position to quantify risk, balance the risk, or persistent and prolonged

decide whether the risk is worth taking. decline in market prices.

The opposite of a bull market.

Market or Benchmark Risk

Benchmark risk is the risk inherent in a particular market,

like the SA equity market, the US bond market, or the local property market. Some low-yielding

interest-bearing investments could be said to be free of market risk, but the more exciting investment

options usually have inherent risk. Equity markets, for example, just don’t go up in a straight line, but

suffer minor corrections and more severe market crashes during their long-term climb.

In the broadest terms, market risk refers to the threat of a general decline that affects all market

constituents. A lowering of the repo rate by the central bank, for example, causes all interest rates

to fall and impacts all interest-based products. Similarly, economic recession negatively impacts

the profits of most businesses and may lead to a general decline in share prices. The pessimism

that accompanies a recession typically causes an indiscriminate sell-off, meaning that even listed

companies well-placed to weather a recession suffer falling share prices. As the saying goes, a

falling tide lowers all ships.

Market risk is also inter-linked in interesting ways. For example, smaller markets (like SA) are

often “led” by larger markets (like the US). Bull and bear runs on the JSE, for example, have nearly

always followed, to a significant degree, the ups and downs of the major US stock markets. Share

markets are also affected by the interest rate environment and vice versa. Rising interest rates, for

example, can trigger an outflow from stock markets into lower risk, fixed interest products.

Understanding benchmark risk helps you to pick the most appropriate market (or markets) for

particular circumstances. Because equity markets and bond markets are volatile, they are often not

a good choice for short-term investment (one to two years).

Although market risk almost “supersedes” many other risk factors, it is difficult to see market

risk in isolation. In other words, the way that market risk relates to a particular fund depends on

the extent to which that fund is representative of “the market”.

The JSE All Share index, for example, contains around 160 shares. The S&P500, a major US

index, contains 500 shares. Even these benchmarks are not, of course, fully representative of “the

market”, but they are sufficiently broad-based to be regarded as good proxies. By contrast, some

funds only hold 30 or 40 shares, making them much less diversified than a market index.

Furthermore, the fund may have overweight positions in a small number of shares.

Take a look at the top 10 holdings of different funds in the fact sheet section of this book, for

example, and the percentage of the portfolio total that the 10 holdings represent. In some cases,

the top 10 holdings constitute over 60% of the fund, while in others the top 10 holdings are 30% or

106 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts