Page 332 - Profile's Unit Trusts and Collective Investments 2021 issue 2

P. 332

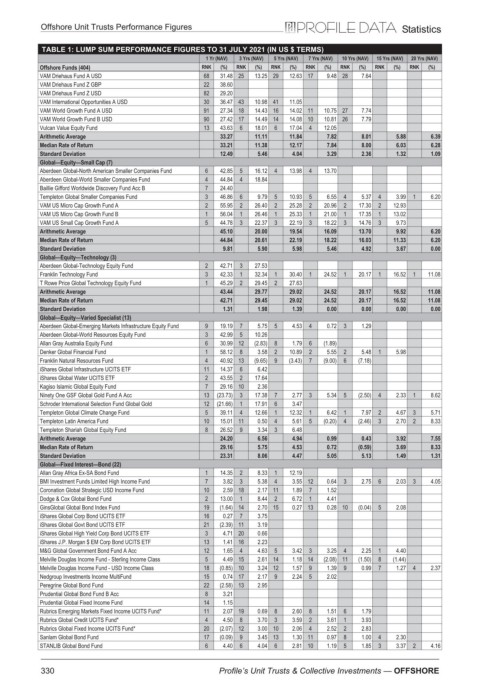

Offshore Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JULY 2021 (IN US $ TERMS)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (404) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

VAM Driehaus Fund A USD 68 31.48 25 13.25 29 12.63 17 9.48 28 7.64

VAM Driehaus Fund Z GBP 22 38.60

VAM Driehaus Fund Z USD 82 29.20

VAM International Opportunities A USD 30 36.47 43 10.98 41 11.05

VAM World Growth Fund A USD 91 27.34 18 14.43 16 14.02 11 10.75 27 7.74

VAM World Growth Fund B USD 90 27.42 17 14.49 14 14.08 10 10.81 26 7.79

Vulcan Value Equity Fund 13 43.63 6 18.01 6 17.04 4 12.05

Arithmetic Average 33.27 11.11 11.84 7.82 8.01 5.88 6.39

Median Rate of Return 33.21 11.38 12.17 7.84 8.00 6.03 6.28

Standard Deviation 12.49 5.46 4.04 3.29 2.36 1.32 1.09

Global—Equity—Small Cap (7)

Aberdeen Global-North American Smaller Companies Fund 6 42.85 5 16.12 4 13.98 4 13.70

Aberdeen Global-World Smaller Companies Fund 4 44.84 4 18.84

Baillie Gifford Worldwide Discovery Fund Acc B 7 24.40

Templeton Global Smaller Companies Fund 3 46.86 6 9.79 5 10.93 5 6.55 4 5.37 4 3.99 1 6.20

VAM US Micro Cap Growth Fund A 2 55.95 2 26.40 2 25.28 2 20.96 2 17.30 2 12.93

VAM US Micro Cap Growth Fund B 1 56.04 1 26.46 1 25.33 1 21.00 1 17.35 1 13.02

VAM US Small Cap Growth Fund A 5 44.78 3 22.37 3 22.19 3 18.22 3 14.76 3 9.73

Arithmetic Average 45.10 20.00 19.54 16.09 13.70 9.92 6.20

Median Rate of Return 44.84 20.61 22.19 18.22 16.03 11.33 6.20

Standard Deviation 9.81 5.90 5.98 5.46 4.92 3.67 0.00

Global—Equity—Technology (3)

Aberdeen Global-Technology Equity Fund 2 42.71 3 27.53

Franklin Technology Fund 3 42.33 1 32.34 1 30.40 1 24.52 1 20.17 1 16.52 1 11.08

T Rowe Price Global Technology Equity Fund 1 45.29 2 29.45 2 27.63

Arithmetic Average 43.44 29.77 29.02 24.52 20.17 16.52 11.08

Median Rate of Return 42.71 29.45 29.02 24.52 20.17 16.52 11.08

Standard Deviation 1.31 1.98 1.39 0.00 0.00 0.00 0.00

Global—Equity—Varied Specialist (13)

Aberdeen Global-Emerging Markets Infrastructure Equity Fund 9 19.19 7 5.75 5 4.53 4 0.72 3 1.29

Aberdeen Global-World Resources Equity Fund 3 42.99 5 10.26

Allan Gray Australia Equity Fund 6 30.99 12 (2.83) 8 1.79 6 (1.89)

Denker Global Financial Fund 1 58.12 8 3.58 2 10.89 2 5.55 2 5.48 1 5.98

Franklin Natural Resources Fund 4 40.92 13 (9.65) 9 (3.43) 7 (9.00) 6 (7.18)

iShares Global Infrastructure UCITS ETF 11 14.37 6 6.42

iShares Global Water UCITS ETF 2 43.55 2 17.64

Kagiso Islamic Global Equity Fund 7 29.16 10 2.36

Ninety One GSF Global Gold Fund A Acc 13 (23.73) 3 17.38 7 2.77 3 5.34 5 (2.50) 4 2.33 1 8.62

Schroder International Selection Fund Global Gold 12 (21.66) 1 17.91 6 3.47

Templeton Global Climate Change Fund 5 39.11 4 12.66 1 12.32 1 6.42 1 7.97 2 4.67 3 5.71

Templeton Latin America Fund 10 15.01 11 0.50 4 5.61 5 (0.20) 4 (2.46) 3 2.70 2 8.33

Templeton Shariah Global Equity Fund 8 26.52 9 3.34 3 6.48

Arithmetic Average 24.20 6.56 4.94 0.99 0.43 3.92 7.55

Median Rate of Return 29.16 5.75 4.53 0.72 (0.59) 3.69 8.33

Standard Deviation 23.31 8.06 4.47 5.05 5.13 1.49 1.31

Global—Fixed Interest—Bond (22)

Allan Gray Africa Ex-SA Bond Fund 1 14.35 2 8.33 1 12.19

BMI Investment Funds Limited High Income Fund 7 3.82 3 5.38 4 3.55 12 0.64 3 2.75 6 2.03 3 4.05

Coronation Global Strategic USD Income Fund 10 2.59 18 2.17 11 1.89 7 1.52

Dodge & Cox Global Bond Fund 2 13.00 1 8.44 2 6.72 1 4.41

GinsGlobal Global Bond Index Fund 19 (1.64) 14 2.70 15 0.27 13 0.28 10 (0.04) 5 2.08

iShares Global Corp Bond UCITS ETF 16 0.27 7 3.75

iShares Global Govt Bond UCITS ETF 21 (2.39) 11 3.19

iShares Global High Yield Corp Bond UCITS ETF 3 4.71 20 0.66

iShares J.P. Morgan $ EM Corp Bond UCITS ETF 13 1.41 16 2.23

M&G Global Government Bond Fund A Acc 12 1.65 4 4.63 5 3.42 3 3.25 4 2.25 1 4.40

Melville Douglas Income Fund - Sterling Income Class 5 4.49 15 2.61 14 1.18 14 (2.08) 11 (1.50) 8 (1.44)

Melville Douglas Income Fund - USD Income Class 18 (0.85) 10 3.24 12 1.57 9 1.39 9 0.99 7 1.27 4 2.37

Nedgroup Investments Income MultiFund 15 0.74 17 2.17 9 2.24 5 2.02

Peregrine Global Bond Fund 22 (2.58) 13 2.95

Prudential Global Bond Fund B Acc 8 3.21

Prudential Global Fixed Income Fund 14 1.15

Rubrics Emerging Markets Fixed Income UCITS Fund* 11 2.07 19 0.69 8 2.60 8 1.51 6 1.79

Rubrics Global Credit UCITS Fund* 4 4.50 8 3.70 3 3.59 2 3.61 1 3.93

Rubrics Global Fixed Income UCITS Fund* 20 (2.07) 12 3.00 10 2.06 4 2.52 2 2.83

Sanlam Global Bond Fund 17 (0.09) 9 3.45 13 1.30 11 0.97 8 1.00 4 2.30

STANLIB Global Bond Fund 6 4.40 6 4.04 6 2.81 10 1.19 5 1.85 3 3.37 2 4.16

330 Profile’s Unit Trusts & Collective Investments — OFFSHORE