Page 63 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 63

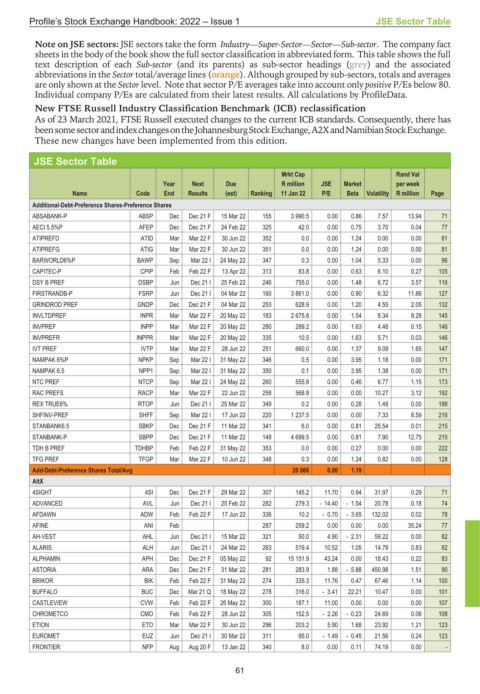

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE Sector Table

JSE Sector Table

Note on JSE sectors: JSE sectors take the form Industry—Super-Sector—Sector—Sub-sector. The company fact

sheets in the body of the book show the full sector classification in abbreviated form. This table shows the full

text description of each Sub-sector (and its parents) as sub-sector headings (grey) and the associated

abbreviations in the Sector total/average lines (orange). Although grouped by sub-sectors, totals and averages

are only shown at the Sector level. Note that sector P/E averages take into account only positive P/Es below 80.

Individual company P/Es are calculated from their latest results. All calculations by ProfileData.

New FTSE Russell Industry Classification Benchmark (ICB) reclassification

As of 23 March 2021, FTSE Russell executed changes to the current ICB standards. Consequently, there has

beensomesectorandindexchangesontheJohannesburgStockExchange,A2XandNamibianStockExchange.

These new changes have been implemented from this edition.

JSE Sector Table

Mrkt Cap Rand Val

Year Next Due R million JSE Market per week

Name Code End Results (est) Ranking 11 Jan 22 P/E Beta Volatility R million Page

Additional-Debt-Preference Shares-Preference Shares

ABSABANK-P ABSP Dec Dec 21 F 15 Mar 22 155 3 990.5 0.00 0.86 7.57 13.94 71

AECI 5.5%P AFEP Dec Dec 21 F 24 Feb 22 325 42.0 0.00 0.75 3.70 0.04 77

ATIPREFD ATID Mar Mar 22 F 30 Jun 22 352 0.0 0.00 1.24 0.00 0.00 81

ATIPREFG ATIG Mar Mar 22 F 30 Jun 22 351 0.0 0.00 1.24 0.00 0.00 81

BARWORLD6%P BAWP Sep Mar 22 I 24 May 22 347 0.3 0.00 1.04 5.33 0.00 96

CAPITEC-P CPIP Feb Feb 22 F 13 Apr 22 313 83.8 0.00 0.63 6.10 0.27 105

DSY B PREF DSBP Jun Dec 21 I 25 Feb 22 246 755.0 0.00 1.48 6.72 3.57 116

FIRSTRANDB-P FSRP Jun Dec 21 I 04 Mar 22 160 3 861.0 0.00 0.90 6.32 11.86 127

GRINDROD PREF GNDP Dec Dec 21 F 04 Mar 22 253 628.9 0.00 1.20 4.55 2.05 132

INVLTDPREF INPR Mar Mar 22 F 20 May 22 183 2 675.8 0.00 1.54 8.34 8.28 145

INVPREF INPP Mar Mar 22 F 20 May 22 280 289.2 0.00 1.63 4.48 0.15 146

INVPREFR INPPR Mar Mar 22 F 20 May 22 335 10.5 0.00 1.63 5.71 0.03 146

IVT PREF IVTP Mar Mar 22 F 28 Jun 22 251 660.0 0.00 1.37 9.09 1.65 147

NAMPAK 6%P NPKP Sep Mar 22 I 31 May 22 346 0.5 0.00 3.95 1.18 0.00 171

NAMPAK 6.5 NPP1 Sep Mar 22 I 31 May 22 350 0.1 0.00 3.95 1.38 0.00 171

NTC PREF NTCP Sep Mar 22 I 24 May 22 260 555.8 0.00 0.46 6.77 1.15 173

RAC PREFS RACP Mar Mar 22 F 22 Jun 22 258 568.8 0.00 0.00 10.27 3.12 192

REX TRUE6% RTOP Jun Dec 21 I 25 Mar 22 349 0.2 0.00 0.28 1.48 0.00 198

SHFINV-PREF SHFF Sep Mar 22 I 17 Jun 22 220 1 237.5 0.00 0.00 7.33 8.59 216

STANBANK6.5 SBKP Dec Dec 21 F 11 Mar 22 341 6.0 0.00 0.81 25.54 0.01 215

STANBANK-P SBPP Dec Dec 21 F 11 Mar 22 148 4 699.5 0.00 0.81 7.90 12.75 215

TDH B PREF TDHBP Feb Feb 22 F 31 May 22 353 0.0 0.00 0.27 0.00 0.00 222

TFG PREF TFGP Mar Mar 22 F 10 Jun 22 348 0.3 0.00 1.24 0.82 0.00 128

Add-Debt-Preference Shares Total/Avg 20 066 0.00 1.19

AltX

4SIGHT 4SI Dec Dec 21 F 29 Mar 22 307 145.2 11.70 0.94 31.97 0.29 71

ADVANCED AVL Jun Dec 21 I 25 Feb 22 282 279.3 - 14.40 - 1.54 20.78 0.18 74

AFDAWN ADW Feb Feb 22 F 17 Jun 22 336 10.2 - 0.70 - 3.65 132.02 0.02 78

AFINE ANI Feb 287 259.2 0.00 0.00 0.00 35.24 77

AH-VEST AHL Jun Dec 21 I 15 Mar 22 321 50.0 4.90 - 2.31 59.22 0.00 82

ALARIS ALH Jun Dec 21 I 24 Mar 22 263 519.4 10.52 1.05 14.79 0.83 82

ALPHAMIN APH Dec Dec 21 F 05 May 22 92 15 151.9 43.24 0.00 18.43 0.22 83

ASTORIA ARA Dec Dec 21 F 31 Mar 22 281 283.9 1.88 - 5.88 450.98 1.51 90

BRIKOR BIK Feb Feb 22 F 31 May 22 274 335.3 11.76 0.47 67.46 1.14 100

BUFFALO BUC Dec Mar 21 Q 18 May 22 278 316.0 - 3.41 22.21 10.47 0.00 101

CASTLEVIEW CVW Feb Feb 22 F 26 May 22 300 187.1 11.00 0.00 0.00 0.00 107

CHROMETCO CMO Feb Feb 22 F 28 Jun 22 305 152.5 - 2.26 - 0.23 24.69 0.06 108

ETION ETO Mar Mar 22 F 30 Jun 22 296 203.2 5.90 1.68 23.92 1.21 123

EUROMET EUZ Jun Dec 21 I 30 Mar 22 311 95.0 - 1.49 - 0.45 21.56 0.24 123

FRONTIER NFP Aug Aug 20 F 13 Jan 22 340 8.0 0.00 0.11 74.19 0.00 -

61