Page 165 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 165

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – MER

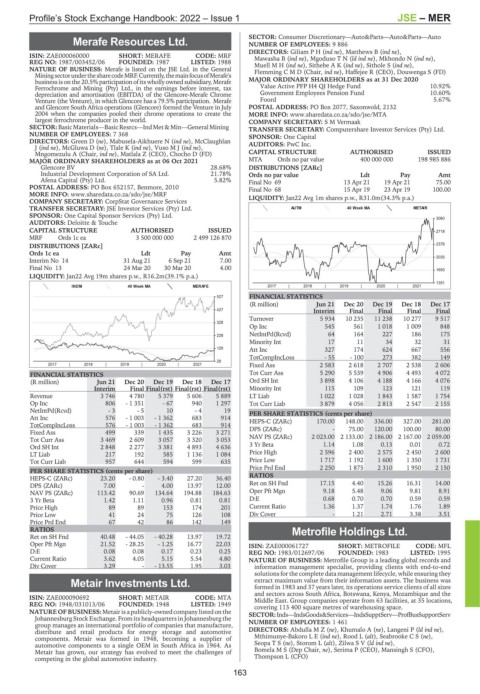

SECTOR: Consumer Discretionary—Auto&Parts—Auto&Parts—Auto

Merafe Resources Ltd. NUMBER OF EMPLOYEES: 9 886

MER DIRECTORS: GiliamPH(ind ne), Matthews B (ind ne),

ISIN: ZAE000060000 SHORT: MERAFE CODE: MRF Mawasha B (ind ne), MgodusoTN(ld ind ne), Mkhondo N (ind ne),

REG NO: 1987/003452/06 FOUNDED: 1987 LISTED: 1988 MuellMH(ind ne), SithebeAK(ind ne), Sithole S (ind ne),

NATURE OF BUSINESS: Merafe is listed on the JSE Ltd. in the General FlemmingCMD (Chair, ind ne), Haffejee R (CEO), Douwenga S (FD)

MiningsectorunderthesharecodeMRF.Currently,themainfocusofMerafe's

business is on the 20.5% participation of its wholly owned subsidiary, Merafe MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

Ferrochrome and Mining (Pty) Ltd., in the earnings before interest, tax Value Active PFP H4 QI Hedge Fund 10.92%

depreciation and amortisation (EBITDA) of the Glencore-Merafe Chrome Government Employees Pension Fund 10.60%

Venture (the Venture), in which Glencore has a 79.5% participation. Merafe Foord 5.67%

and Glencore South Africa operations (Glencore) formed the Venture in July POSTAL ADDRESS: PO Box 2077, Saxonwold, 2132

2004 when the companies pooled their chrome operations to create the MORE INFO: www.sharedata.co.za/sdo/jse/MTA

largest ferrochrome producer in the world. COMPANY SECRETARY: S M Vermaak

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 7 368 SPONSOR: One Capital

DIRECTORS: Green D (ne), Mabusela-Aikhuere N (ind ne), McClaughlan AUDITORS: PwC Inc.

J(ind ne), McGluwa D (ne), Tlale K (ind ne), VusoMJ(ind ne),

Mngomezulu A (Chair, ind ne), Matlala Z (CEO), Chocho D (FD) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 06 Oct 2021 MTA Ords no par value 400 000 000 198 985 886

Glencore BV 28.68% DISTRIBUTIONS [ZARc]

Industrial Development Corporation of SA Ltd. 21.78% Ords no par value Ldt Pay Amt

Afena Capital (Pty) Ltd. 5.82% Final No 69 13 Apr 21 19 Apr 21 75.00

POSTAL ADDRESS: PO Box 652157, Benmore, 2010 Final No 68 15 Apr 19 23 Apr 19 100.00

MORE INFO: www.sharedata.co.za/sdo/jse/MRF LIQUIDITY: Jan22 Avg 1m shares p.w., R31.0m(34.3% p.a.)

COMPANY SECRETARY: CorpStat Governance Services

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. AUTM 40 Week MA METAIR

SPONSOR: One Capital Sponsor Services (Pty) Ltd.

3060

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED 2718

MRF Ords 1c ea 3 500 000 000 2 499 126 870

DISTRIBUTIONS [ZARc] 2376

Ords 1c ea Ldt Pay Amt

2035

Interim No 14 31 Aug 21 6 Sep 21 7.00

Final No 13 24 Mar 20 30 Mar 20 4.00 1693

LIQUIDITY: Jan22 Avg 19m shares p.w., R16.2m(39.1% p.a.)

1351

INDM 40 Week MA MERAFE 2017 | 2018 | 2019 | 2020 | 2021

527 FINANCIAL STATISTICS

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

427 Interim Final Final Final Final

Turnover 5 934 10 235 11 238 10 277 9 517

328

Op Inc 545 561 1 018 1 009 848

228 NetIntPd(Rcvd) 64 164 227 186 175

Minority Int 17 11 34 32 31

129 Att Inc 327 174 624 667 556

TotCompIncLoss - 55 - 100 273 382 149

29

2017 | 2018 | 2019 | 2020 | 2021 Fixed Ass 2 583 2 618 2 707 2 538 2 606

FINANCIAL STATISTICS Tot Curr Ass 5 290 5 539 4 906 4 493 4 072

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Ord SH Int 3 898 4 106 4 188 4 166 4 076

Interim Final Final(rst) Final(rst) Final(rst) Minority Int 115 109 123 121 119

Revenue 3 746 4 780 5 379 5 606 5 889 LT Liab 1 022 1 028 1 843 1 587 1 754

Op Inc 806 - 1 351 - 67 940 1 297 Tot Curr Liab 3 879 4 056 2 813 2 547 2 155

NetIntPd(Rcvd) - 3 - 5 10 - 4 19 PER SHARE STATISTICS (cents per share)

Att Inc 576 - 1 003 - 1 362 683 914

TotCompIncLoss 576 - 1 003 - 1 362 683 914 HEPS-C (ZARc) 170.00 - 148.00 336.00 327.00 281.00

100.00

80.00

DPS (ZARc)

75.00

120.00

Fixed Ass 499 339 1 435 3 226 3 271

Tot Curr Ass 3 469 2 609 3 057 3 320 3 053 NAV PS (ZARc) 2 023.00 2 133.00 2 186.00 2 167.00 2 059.00

Ord SH Int 2 848 2 277 3 381 4 893 4 636 3 Yr Beta 1.14 1.08 0.13 0.01 0.72

LT Liab 217 192 585 1 136 1 084 Price High 2 596 2 400 2 575 2 450 2 600

Tot Curr Liab 957 644 594 599 635 Price Low 1 717 1 192 1 600 1 350 1 731

Price Prd End 2 250 1 875 2 310 1 950 2 150

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 23.20 - 0.80 - 3.40 27.20 36.40 RATIOS

DPS (ZARc) 7.00 - 4.00 13.97 12.00 Ret on SH Fnd 17.15 4.40 15.26 16.31 14.00

NAV PS (ZARc) 113.42 90.69 134.64 194.88 184.63 Oper Pft Mgn 9.18 5.48 9.06 9.81 8.91

3 Yr Beta 1.42 1.11 0.96 0.81 0.81 D:E 0.68 0.70 0.70 0.59 0.59

Price High 89 89 153 174 201 Current Ratio 1.36 1.37 1.74 1.76 1.89

Price Low 41 24 75 126 108 Div Cover - 1.21 2.71 3.38 3.51

Price Prd End 67 42 86 142 149

RATIOS Metrofile Holdings Ltd.

Ret on SH Fnd 40.48 - 44.05 - 40.28 13.97 19.72

MET

Oper Pft Mgn 21.52 - 28.25 - 1.25 16.77 22.03 ISIN: ZAE000061727 SHORT: METROFILE CODE: MFL

D:E 0.08 0.08 0.17 0.23 0.25 REG NO: 1983/012697/06 FOUNDED: 1983 LISTED: 1995

Current Ratio 3.62 4.05 5.15 5.54 4.80 NATURE OF BUSINESS: Metrofile Group is a leading global records and

Div Cover 3.29 - - 13.55 1.95 3.03 information management specialist, providing clients with end-to-end

solutions for the complete data management lifecycle, while ensuring they

Metair Investments Ltd. extract maximum value from their information assets. The business was

formed in 1983 and 37 years later, its operations service clients of all sizes

and sectors across South Africa, Botswana, Kenya, Mozambique and the

MET

ISIN: ZAE000090692 SHORT: METAIR CODE: MTA Middle East. Group companies operate from 63 facilities, at 35 locations,

REG NO: 1948/031013/06 FOUNDED: 1948 LISTED: 1949 covering 113 400 square metres of warehousing space.

NATURE OF BUSINESS:Metair is a publicly-owned company listed on the SECTOR:Inds—IndsGoods&Services—IndsSupptServ—ProfBusSupportServ

Johannesburg Stock Exchange. From its headquarters in Johannesburg the

group manages an international portfolio of companies that manufacture, NUMBER OF EMPLOYEES: 1 461

distribute and retail products for energy storage and automotive DIRECTORS: AbdullaMZ(ne), Khumalo A (ne), Langeni P (ld ind ne),

components. Metair was formed in 1948, becoming a supplier of Mthimunye-BakoroLE(ind ne), Rood L (alt), SeabrookeCS(ne),

automotive components to a single OEM in South Africa in 1964. As SeopaTS(ne), Storom L (alt), ZilwaSV(ld ind ne),

Metair has grown, our strategy has evolved to meet the challenges of Bomela M S (Dep Chair, ne), Serima P (CEO), Mansingh S (CFO),

competing in the global automotive industry. Thompson L (CFO)

163