Page 45 - SHB 2021 Issue 4

P. 45

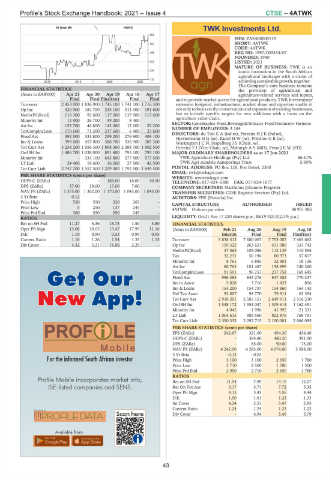

Profile’s Stock Exchange Handbook: 2021 – Issue 4 CTSE – 4ATWK

TWK Investments Ltd.

40 Week MA NWKH

550 4ATWK

ISIN: ZAE400000119

467 SHORT: 4ATWK

CODE: 4ATWK

385 REG NO: 1997/003334/07

FOUNDED: 1940

302 LISTED: 2021

NATURE OF BUSINESS: TWK is an

220

iconic institution in the South African

agricultural landscape with a vision of

137 achieving sustainablegrowth,together.

2018 | 2019 | 2020 | 2021

The Company’s core business remains

FINANCIAL STATISTICS the provision of agricultural and

(Amts in ZAR'000) Apr 21 Apr 20 Apr 19 Apr 18 Apr 17 agriculture-related services and inputs,

Final Final Final(rst) Final Final and to provide market access for agricultural products. TWK Investments’

Turnover 2 453 000 1 836 900 1 745 100 1 741 100 1 716 300 extensive footprint, infrastructure, market share and expertise enable it

Op Inc 320 900 184 700 235 100 313 300 191 600 not only to focus on the conservation and expansion of existing businesses,

NetIntPd(Rcvd) 116 300 92 600 117 600 137 900 117 600 but to include specific targets for new additions with a focus on the

agriculture value chain.

Minority Int 13 900 26 700 99 200 8 400 - SECTOR:ConsStaples–Food,Beverage&Tobacco–FoodProducers–Farmers

Att Inc 153 700 46 800 143 000 12 200 52 200

TotCompIncLoss 170 600 71 200 237 600 6 400 23 600 NUMBER OF EMPLOYEES: 3 184

DIRECTORS: du ToitCA(ind ne), FerreiraHJK(ind ne),

Fixed Ass 392 500 333 800 299 200 276 900 409 100 HiestermannHG(ne), KuselHW(ne), PrinslooGB(ne),

Inv & Loans 399 600 457 000 388 700 336 900 385 300 WartingtonJCN, Stapelberg J S (Chair, ne),

Tot Curr Ass 3 234 200 1 956 300 1 898 300 2 388 700 1 902 500 Ferreira T I (Vice Chair, ne), Myburgh A S (MD), FivazJEW (FD)

Ord SH Int 1 486 700 1 038 000 891 400 795 100 795 100 MAJOR ORDINARY SHAREHOLDERS as at 17 Jun 2021

Minority Int - 334 100 643 800 577 500 577 500 TWK Agriculture Holdings (Pty) Ltd. 66.41%

LT Liab 24 400 19 600 16 200 27 500 42 500 TWK Agri Aandele Aansporings Trust 5.95%

Tot Curr Liab 2 747 700 1 557 500 1 229 300 1 792 500 1 649 500 POSTAL ADDRESS: PO Box 128, Piet Retief, 2380

EMAIL: twk@twkagri.com

PER SHARE STATISTICS (cents per share)

WEBSITE: www.twkagri.com

HEPS-C (ZARc) - - 188.00 16.00 40.50 TELEPHONE: 017-824-1000 FAX: 017-824-1077

DPS (ZARc) 37.00 19.00 17.00 7.00 - COMPANY SECRETARY: Marthinus Johannes Potgieter

NAV PS (ZARc) 1 375.00 1 362.00 1 170.00 1 043.00 1 043.00 TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd.

3 Yr Beta 0.12 - - - - AUDITORS: PFK (Pretoria) Inc.

Price High 550 550 320 265 - CAPITAL STRUCTURE AUTHORISED ISSUED

Price Low 5 250 137 245 - 4ATWK Ords no par value - 38 951 986

Price Prd End 360 550 290 245 -

RATIOS LIQUIDITY: Oct21 Ave 17 220 shares p.w., R619 920.0(2.3% p.a.)

Ret on SH Fnd 11.27 5.36 15.78 1.50 3.80 FINANCIAL STATISTICS

Oper Pft Mgn 13.08 10.05 13.47 17.99 11.16 (Amts in ZAR'000) Feb 21 Aug 20 Aug 19 Aug 18

D:E 1.10 0.90 0.53 0.99 0.95 Interim Final Final Final(rst)

Current Ratio 1.18 1.26 1.54 1.33 1.15 Turnover 3 838 512 7 680 067 7 753 007 7 463 662

Div Cover 4.32 3.21 11.06 2.29 - Op Inc 159 322 263 621 431 080 331 743

NetIntPd(Rcvd) 37 565 105 086 112 139 110 554

Tax 32 231 50 196 80 973 57 817

Minority Int 8 761 6 885 32 901 18 136

Att Inc 80 765 101 487 158 899 140 360

TotCompIncLoss 91 591 96 757 217 758 169 645

Fixed Ass 996 385 845 276 847 382 770 237

Inv in Assoc 5 828 3 716 1 433 856

Inv & Loans 154 200 154 737 154 860 164 143

Def Tax Asset 92 807 98 770 79 911 63 354

Tot Curr Ass 2 918 201 2 585 151 2 649 911 2 516 230

Ord SH Int 1 548 172 1 354 047 1 309 614 1 162 451

Minority Int 4 045 1 996 41 995 21 331

LT Liab 1 004 615 989 560 802 876 768 791

Tot Curr Liab 2 350 332 2 092 715 2 150 081 2 066 095

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 242.67 321.00 494.30 434.46

HEPS-C (ZARc) - 384.80 480.20 391.00

DPS (ZARc) - 65.00 90.00 75.00

NAV PS (ZARc) 4 242.00 4 283.00 4 074.00 3 598.00

3 Yr Beta - 0.13 - 0.03 - -

Price High 3 100 3 100 2 650 1 780

Price Low 2 710 2 500 1 780 1 300

Price Prd End 2 950 2 710 2 650 1 780

RATIOS

Ret on SH Fnd 11.54 7.99 14.19 12.07

Ret On Tot Ass 5.17 3.71 7.72 5.35

Oper Pft Mgn 4.15 3.43 5.56 4.44

D:E 1.50 1.61 1.23 1.33

Int Cover 4.24 2.51 3.47 2.95

Current Ratio 1.24 1.24 1.23 1.22

Div Cover - 4.94 5.49 5.79

43