Page 184 - SHB 2021 Issue 4

P. 184

JSE – PIC Profile’s Stock Exchange Handbook: 2021 – Issue 4

POSTAL ADDRESS: PO Box 23087, Claremont, Cape Town, 7735

Pick n Pay Stores Ltd. EMAIL: demuller@pnp.co.za

WEBSITE: www.picknpayinvestor.co.za

PIC

TELEPHONE: 021-658-1000 FAX: 021-797-0314

COMPANY SECRETARY: Debra Muller

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: Ernst & Young Inc.

BANKERS: Absa Bank Ltd., First National Bank of SA Ltd.

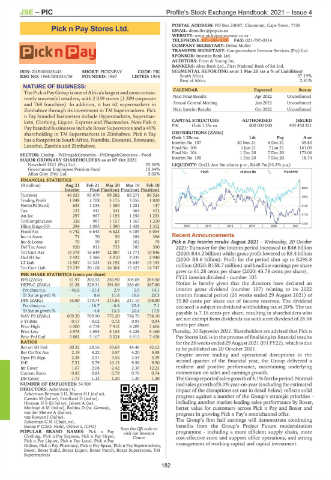

ISIN: ZAE000005443 SHORT: PICKNPAY CODE: PIK SEGMENTAL REPORTING as at 1 Mar 20 (asa%of Liabilities)

REG NO: 1968/008034/06 FOUNDED: 1967 LISTED: 1968 South Africa 97.19%

Rest of Africa 2.81%

NATURE OF BUSINESS:

ThePicknPayGroup isoneofAfrica'slargestandmostconsis- CALENDAR Expected Status

Next Final Results Apr 2022 Unconfirmed

tently successful retailers, with 2 039 stores (1 209 corporate

and 768 franchise). In addition, it has 62 supermarkets in Annual General Meeting Jun 2022 Unconfirmed

Zimbabwe through its investment in TM Supermarkets. Pick Next Interim Results Oct 2022 Unconfirmed

n Pay branded businesses include Hypermarkets, Supermar-

kets, Clothing, Liquor, Express and Pharmacies. Non-Pick n CAPITAL STRUCTURE AUTHORISED ISSUED

PIK Ords 1.25c ea 800 000 000 493 450 321

Pay branded businesses include Boxer Superstores and a 49%

shareholding in TM Supermarkets in Zimbabwe. Pick n Pay DISTRIBUTIONS [ZARc]

Pay

Amt

Ldt

has a footprint in South Africa, Namibia, Eswatini, Botswana, Ords 1.25c ea 30 Nov 21 6 Dec 21 35.80

Interim No 107

Lesotho, Zambia and Zimbabwe. Final No 106 1 Jun 21 7 Jun 21 161.00

Final No 104 1 Dec 20 7 Dec 20 173.06

SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

MAJOR ORDINARY SHAREHOLDERS as at 07 Oct 2021 Interim No 105 1 Dec 20 7 Dec 20 18.74

Newshelf 1321 (Pty) Ltd. 25.30% LIQUIDITY: Oct21 Ave 9m shares p.w., R449.7m(93.2% p.a.)

Government Employees Pension Fund 15.34%

Allan Gray (Pty) Ltd. 5.02% FOOR 40 Week MA PICKNPAY

FINANCIAL STATISTICS

(R million) Aug 21 Feb 21 Mar 20 Mar 19 Feb 18

Interim Final Final(rst) Final(rst) Final(rst) 8005

Turnover 46 021 93 079 89 282 86 271 80 524 7063

Trading Profit 1 048 2 708 3 175 3 055 1 820

NetIntPd(Rcvd) 623 1 234 1 300 1 281 147 6120

Tax 131 441 541 464 472

Att Inc 297 967 1 195 1 350 1 253 5178

TotCompIncLoss 326 987 1 157 1 167 1 250

4236

Hline Erngs-CO 294 1 095 1 390 1 428 1 312 2016 | 2017 | 2018 | 2019 | 2020 | 2021

Fixed Ass 6 742 6 643 6 622 6 189 6 054

Inv in Assoc 71 70 50 184 366 Recent Announcements

Inv & Loans 79 59 87 102 79 Pick n Pay interim results August 2021 - Wednesday, 20 October

Def Tax Asset 920 913 753 785 590 2021: Turnover for the interim period increased to R46 billion

Tot Curr Ass 19 379 16 649 12 887 11 771 10 846 (2020: R44.2 billion) whilst gross profit lowered to R8.4 billion

Ord SH Int 2 922 3 386 3 010 3 035 2 940 (2020: R8.6 billion). Profit for the period shot up to R296.8

LT Liab 14 587 14 323 14 192 13 649 13 193

Tot Curr Liab 23 239 20 108 16 304 15 423 14 747 million (2020: R158.7 million) and headline earnings per share

grew to 61.28 cents per share (2020: 43.78 cents per share).

PER SHARE STATISTICS (cents per share) FY21 interim dividend - number 105

EPS (ZARc) 61.97 202.52 250.90 304.04 264.50

HEPS-C (ZARc) 61.28 229.31 291.90 283.60 267.80 Notice is hereby given that the directors have declared an

Pct chng p.a. - 46.6 - 21.4 2.9 5.9 14.1 interim gross dividend (number 107) relating to its 2022

Tr 5yr av grwth % - 8.6 11.6 16.6 20.3 interim financial period (26 weeks ended 29 August 2021) of

DPS (ZARc) 35.80 179.74 215.86 231.10 188.80 35.80 cents per share out of income reserves. The dividend

Pct chng p.a. - - 16.7 - 6.6 22.4 7.1 declared is subject to dividend withholding tax at 20%. The tax

Tr 5yr av grwth % - 4.8 13.5 20.4 17.9 payable is 7.16 cents per share, resulting in shareholders who

NAV PS (ZARc) 669.20 769.90 776.20 786.70 738.10 are not exempt from dividends tax with a net dividend of 28.64

3 Yr Beta - 0.17 - 0.02 0.72 0.93 0.94

Price High 6 000 6 778 7 412 8 209 7 606 cents per share.

Price Low 4 975 4 095 5 155 6 228 5 460 Thursday, 30 September 2021: Shareholders are advised that Pick n

Price Prd End 5 881 5 167 5 524 6 913 7 428 Pay Stores Ltd. is in the process of finalising its financial results

RATIOS for the 26 weeks ended 29 August 2021 (H1 FY22), which is due

Ret on SH Fnd 20.32 28.56 39.69 44.48 42.62 to be published on 20 October 2021.

Ret On Tot Ass 2.19 4.22 3.57 4.20 5.98 Despite severe trading and operational disruptions in the

Oper Pft Mgn 2.28 2.91 3.56 3.54 3.39

D:E 7.21 5.79 10.13 9.58 9.50 second quarter of the financial year, the Group delivered a

Int Cover 1.67 2.08 2.42 2.30 12.23 resilient and positive performance, maintaining underlying

Current Ratio 0.83 0.83 0.79 0.76 0.74 momentum on sales and earnings growth.

Div Cover 1.73 1.13 1.30 1.30 1.30 The Group reported salesgrowth of4.1% forthe period. Normal-

NUMBER OF EMPLOYEES: 54 900 ised sales growth of8.0% year-on-year (excluding the estimated

DIRECTORS: Ackerman J G, impact of the disruptions set out in detail below) reflects solid

Ackerman-Berman S D, BhoratHI(ind ne), progress against a number of the Group’s strategic priorities -

Cassim M (ind ne), Friedland D (ind ne),

HermanHS(ld ind ne), Jakoet A (ne), including another market-leading sales performance by Boxer,

MothupiAM(ind ne), Robins D (ne, German), better value for customers across Pick n Pay and Boxer and

van der Merwe A (ind ne), progress in growing Pick n Pay’s omnichannel offer.

van Rooyen J (ind ne),

Ackerman G M (Chair, ne), The Group’s first half earnings will demonstrate continuing

Boone P (CEO, Neth), Olivier L (CFO) Scan the QR code to benefits from the Group’s Project Future modernisation

POPULAR BRAND NAMES: Pick n Pay visit our Investor programme - including a more efficient supply chain, more

Clothing, Pick n Pay Express, Pick n Pay Hyper, Centre cost-effective store and support office operations, and strong

Pick n Pay Liquor, Pick n Pay Local, Pick n Pay

Online, Pick n Pay Pharmacy, Pick n Pay Spaza, Pick n Pay Supermarkets, management of working capital and capital investment.

Boxer, Boxer Build, Boxer Liquor, Boxer Punch, Boxer Superstores, TM

Supermarkets

182