Page 52 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 52

ZARX – ZXTWI Profile’s Stock Exchange Handbook: 2021 – Issue 3

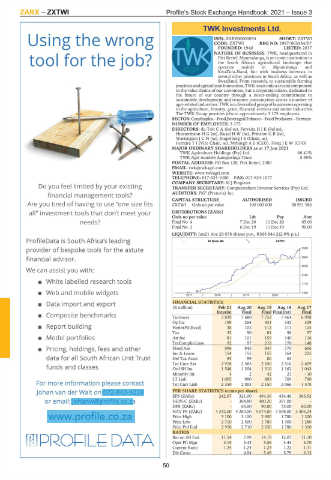

TWK Investments Ltd.

Using the wrong ZXTWI ISIN: ZAEZ00000034 REG NO: 1997/003334/07

SHORT: ZXTWI

CODE: ZXTWI

FOUNDED: 1940 LISTED: 2017

NATURE OF BUSINESS: TWK, headquartered in

tool for the job? Piet Retief, Mpumalanga, is an iconic institution in

the South African agricultural landscape that

operates mainly in Mpumalanga and

KwaZulu-Natal, but with business interests in

several other provinces in South Africa, as well as

Swaziland. From research, to sustainable farming

practices andagricultural innovation,TWKisnotonlyacrucial component

in the value chains of our customers, but a corporate citizen, dedicated to

the future of our country through a never-ending commitment to

sustainable development and resource consumption across a number of

agri-related industries. TWK is a diversified group of businesses operating

in the agriculture, forestry, grain, financial services and motor industries.

The TWK Group provides jobs to approximately 3 175 employees.

SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers

NUMBER OF EMPLOYEES: 3 175

DIRECTORS: du ToitCA(ind ne), FerreiraHJK(ind ne),

HiestermannHG(ne), KuselHW(ne), PrinslooGB(ne),

WartingtonJCN(ne), Stapelberg J S (Chair, ne),

Ferreira T I (Vice Chair, ne), Myburgh A S (CEO), FivazJEW (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 17 Jun 2021

TWK Agriculture Holdings (Pty) Ltd. 66.41%

TWK Agri Aandele Aansporings Trust 5.95%

POSTAL ADDRESS: PO Box 128, Piet Retief, 2380

EMAIL: twk@twkagri.com

WEBSITE: www.twkagri.com

TELEPHONE: 017-824-1000 FAX: 017-824-1077

COMPANY SECRETARY: M J Potgieter

Do you feel limited by your existing TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

financial management tools? AUDITORS: PKF (Pretoria) Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

Are you tired of having to use “one size fits ZXTWI Ords no par value 100 000 000 38 951 986

all” investment tools that don’t meet your DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

needs? Final No 4 7 Dec 20 11 Dec 20 65.00

Final No 3 6 Dec 19 11 Dec 19 90.00

LIQUIDITY: Jun21 Ave 20 078 shares p.w., R566 844.2(2.9% p.a.)

ProfileData is South Africa’s leading 40 Week MA ZXTWI

provider of bespoke tools for the astute 3350

financial advisor. 2940

2530

We can assist you with:

2120

White labelled research tools

1710

Web and mobile widgets 1300

2017 | 2018 | 2019 | 2020 |

Data import and export FINANCIAL STATISTICS

(R million) Feb 21 Aug 20 Aug 19 Aug 18 Aug 17

Interim Final Final Final(rst) Final

Composite benchmarks Turnover 3 839 7 680 7 753 7 464 6 998

Op Inc 159 264 431 332 329

Report building NetIntPd(Rcvd) 38 105 112 111 125

Tax 32 50 81 58 57

Model portfolios Att Inc 81 101 159 140 116

TotCompIncLoss 92 97 218 170 148

Pricing, holdings, fees and other Fixed Ass 996 845 847 770 666

Inv & Loans 154 155 155 164 225

data for all South African Unit Trust Def Tax Asset 93 99 80 63 -

Tot Curr Ass 2 918 2 585 2 650 2 516 2 609

funds and classes Ord SH Int 1 548 1 354 1 310 1 162 1 043

Minority Int 4 2 42 21 - 10

LT Liab 1 005 990 803 769 790

For more information please contact Tot Curr Liab 2 350 2 093 2 150 2 066 1 578

Johan van der Walt on 072-843-9239 PER SHARE STATISTICS (cents per share)

EPS (ZARc) 242.67 321.00 494.30 434.46 366.92

or email: johanw@profile.co.za HEPS-C (ZARc) - 384.80 480.20 391.00 -

DPS (ZARc) - 65.00 90.00 75.00 60.00

NAV PS (ZARc) 4 242.00 4 283.00 4 074.00 3 598.00 3 306.24

Price High 3 100 3 100 2 650 1 780 1 320

Price Low 2 710 2 500 1 780 1 300 1 280

Price Prd End 2 950 2 710 2 650 1 780 1 300

RATIOS

Ret on SH Fnd 11.54 7.99 14.19 12.07 11.10

Oper Pft Mgn 4.15 3.43 5.56 4.44 4.70

Current Ratio 1.24 1.24 1.23 1.22 1.31

Div Cover - 4.94 5.49 5.79 6.12

50