Page 8 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 8

About the Stock Exchange Handbook Profile’s Stock Exchange Handbook: 2021 – Issue 1

HEPS-C: Headline Earnings per Share from (P): Pro-forma financials

continuedoperations–Earnings(profits)pershare P/E: Ratio of Price to Earnings (12-month rolling

excluding the effects of exceptional items and HEPS-C)

discontinued operations.

PEG: Price/Earnings Growth ratio

Hline Erngs-CO: Headline earnings from continuing

operations. (rst): Restated result

Scr/100: The number of shares a shareholder can

Ldt: Last day to trade (to qualify for dividends or

other corporate action) elect to receive per one hundred ordinary share

held instead of a cash dividend.

Ldr: Last day to register (to qualify for dividends or

other corporate action) Tr 5yr av grwth %: Trailing five year average

growth (ie, average of five years to that point)

Liquidity: The three figures shown are (i) the

average number of shares traded per week, (ii) the TRI: Total Return Index (ie, price performance

average value of shares traded per week, and (iii) includingreinvestmentofdividends/distributions)

the percentage of issued shares traded over the last Volatility: Standard deviation of month-on-month

year. (ii) is based on the latest share price available percentage price change over 36 months

before going to print. (iii) is annualised where full ZAR: South African rands

year data is not available.

ZARc: South African cents

Market Cap: Market Capitalisation (calculated as Note: All financial statements are presented in

total number of outstanding shares multiplied by accordance with International Financial Reporting

share price)

Standards (IFRS) unless otherwise stated.

NAV: Net Asset Value

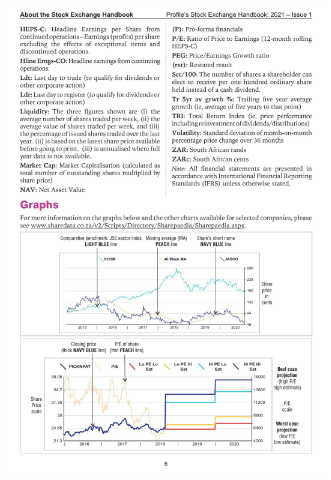

Graphs

For more information on the graphs below and the other charts available for selected companies, please

see www.sharedata.co.za/v2/Scripts/Directory/Sharepaedia/Sharepaedia.aspx.

Comparative benchmark: JSE sector index Moving average (MA) Share’s short name

LIGHT BLUE line PEACH line NAVY BLUE line

SCOM 40 Week MA JASCO

286

238

Share

190 price

in

142 cents

94

46

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Closing price P/E of share

(thick NAVY BLUE line) (thin PEACH line)

Lo PE Lo Lo PE Hi Hi PE Lo Hi PE Hi

PICKNPAY P/E

Est Est Est Est Best case

projection

38.05 16000

(high P/E

high estimate)

34.7 13600

Share

Price 31.35 11200 P/E

scale scale

28 8800

Worst case

24.65 6400

projection

(low P/E

21.3 4000 low estimate)

| 2016 | 2017 | 2018 | 2019 | 2020 |

6