Page 37 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 37

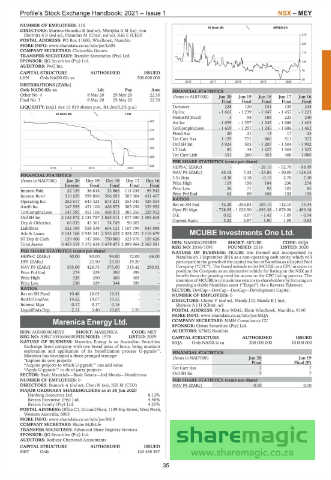

Profile’s Stock Exchange Handbook: 2021 – Issue 1 NSX – MEY

NUMBER OF EMPLOYEES: 116

40 Week MA MARENICA

DIRECTORS: Martins-Hausiku R (ind ne), MbetjihaRM(ne), von

BlottnitzSB(ind ne), Palanduz M (Chair, ind ne), Kali E (CEO) 275

POSTAL ADDRESS: PO Box 11600, Windhoek, Namibia

MORE INFO: www.sharedata.co.za/sdo/jse/LHN 225

COMPANY SECRETARY: Chriszelda Gontes

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. 175

SPONSOR: IJG Securities (Pty) Ltd. 126

AUDITORS: PwC Inc.

76

CAPITAL STRUCTURE AUTHORISED ISSUED

LHN Ords NAD0.02c ea - 500 000 000 26

2016 | 2017 | 2018 | 2019 | 2020 |

DISTRIBUTIONS [ZARc]

Ords NAD0.02c ea Ldt Pay Amt FINANCIAL STATISTICS

Other No 4 8 May 20 29 May 20 22.50 (Amts in AUD’000) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final No 3 8 May 20 29 May 20 22.50 Final Final Final Final Final

LIQUIDITY: Jan21 Ave 15 019 shares p.w., R4.2m(0.2% p.a.) Turnover 228 120 151 135 245

Op Inc - 1 662 - 1 239 - 1 047 - 1 457 - 1 223

40 Week MA LHN

NetIntPd(Rcvd) - 3 58 189 223 240

405

Att Inc - 1 659 - 1 297 - 1 245 - 1 686 - 1 463

TotCompIncLoss - 1 659 - 1 297 - 1 245 - 1 686 - 1 462

370

Fixed Ass 20 21 13 17 23

335 Tot Curr Ass 1 129 771 860 511 572

Ord SH Int 3 924 505 - 1 207 - 1 504 - 1 992

300

LT Liab 82 34 1 627 1 564 1 502

Tot Curr Liab 351 260 453 468 1 085

265

PER SHARE STATISTICS (cents per share)

230 HEPS-C (ZARc) - - - 26.10 - 52.70 - 88.49

2018 | 2019 | 2020 |

NAV PS (ZARc) 45.18 7.32 - 25.86 - 50.00 - 124.03

FINANCIAL STATISTICS

3 Yr Beta - 0.38 0.18 - 0.15 2.70 2.30

(Amts in NAD’000) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 Price High 119 156 164 236 278

Interim Final Final Final Final

Interest Paid 22 135 36 618 32 866 114 038 99 943 Price Low 26 71 92 103 85

Interest Rcvd 310 629 599 896 596 693 585 304 431 407 Price Prd End 63 89 106 155 155

Operating Inc 252 617 643 323 673 231 553 045 429 554 RATIOS

Attrib Inc 147 595 451 106 468 873 385 256 329 952 Ret on SH Fnd - 42.28 - 256.83 103.15 112.10 73.44

TotCompIncLoss 147 595 451 106 468 873 385 256 329 952 Oper Pft Mgn - 728.95 - 1 032.50 - 693.38 - 1 079.26 - 499.18

D:E

- 1.09

- 0.94

- 1.42

0.02

0.07

Ord SH Int 2 142 872 2 133 757 1 865 011 1 577 080 1 304 618

Dep & OtherAcc 66 033 43 361 74 749 90 205 - Current Ratio 3.22 2.97 1.90 1.09 0.53

Liabilities 632 104 558 538 604 121 1 107 799 843 888

Adv & Loans 3 141 168 2 935 341 2 555 622 2 424 222 2 118 679 MCUBE Investments One Ltd.

ST Dep & Cash 139 406 147 586 750 860 323 676 159 626 MQA

Total Assets 3 455 319 3 372 638 3 479 475 2 899 964 2 363 591 ISIN: NA000A2P8HD9 SHORT: MCUBE CODE: MQA

REG NO: 2016/1091 FOUNDED: 2016 LISTED: 2020

PER SHARE STATISTICS (cents per share) NATURE OF BUSINESS: MCUBE was formed and incorporated in

HEPS-C (ZARc) 30.00 90.00 94.00 72.00 66.00 Namibia on 1 September 2016 as a non-operating cash entity, which will

DPS (ZARc) - 22.50 23.50 19.20 - participate in the growth of the capital market of Namibia as a Capital Pool

NAV PS (ZARc) 565.00 426.75 373.00 315.42 260.92 Company (“CPC”). The Board intends to list MCUBE as a CPC in order to

Price Prd End 274 329 390 399 - position the Company as an alternative vehicle for listing on the NSX and

Price High 329 390 400 405 - benefit from the growing need for access to the CPC listing process. The

intention of MCUBE is to maximise returns to shareholders by focusing on

Price Low 230 329 344 399 - pursuing a viable Namibian asset (“Target”) via a Reverse Takeover.

RATIOS SECTOR: DevCap—DevCap—DevCap—Development Capital

Ret on SH Fund 10.46 16.03 16.31 - - NUMBER OF EMPLOYEES: 0

RetOnTotalAss 14.62 19.07 19.35 - - DIRECTORS: Cloete V (ind ne), Mandy J D, MandyBJ(ne),

Interest Mgn 0.17 0.17 0.16 - - ShiyukaAJH (Chair, ne)

LiquidFnds:Dep 2.11 3.40 10.05 3.59 - POSTAL ADDRESS: PO Box 90242, Klein Windhoek, Namibia, 9190

MORE INFO: www.sharedata.co.za/sdo/jse/MQA

Marenica Energy Ltd. COMPANY SECRETARY: MMM Consultancy CC

SPONSOR: Cirrus Securities (Pty) Ltd.

MEY

ISIN: AU000000MEY0 SHORT: MARENICA CODE: MEY AUDITORS: KPMG Namibia

REG NO: ABN71001666600 FOUNDED: 1978 LISTED: 2009 CAPITAL STRUCTURE AUTHORISED ISSUED

NATURE OF BUSINESS: Marenica Energy is an Australian Securities MQA Ords NAD0.1c ea 200 000 000 10 000 000

Exchange listed company with two broad areas of focus, being uranium

exploration and application of its beneficiation process U-pgrade™. FINANCIAL STATISTICS

Marenica has developed a three-pronged strategy: (Amts in NAD’000) Jun 20 Jun 19

*Explore its own projects Final Final (P)

*Acquire projects to which U-pgrade™ can add value

*Apply U-pgrade™ to third party projects Tot Curr Ass 7 7

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Nonferrous Ord SH Int 7 7

NUMBER OF EMPLOYEES: 0 PER SHARE STATISTICS (cents per share)

DIRECTORS: Bantock A (ind ne), Chen N (ne), Hill M (CEO) NAV PS (ZARc) 0.10 0.10

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Hanlong Resources Ltd. 8.12%

Retzos Executive (Pty) Ltd. 4.46%

Retzos Family (Pty) Ltd. 4.25%

POSTAL ADDRESS: Office C1, Ground Floor, 1139 Hay Street, West Perth,

Western Australia, 6005

MORE INFO: www.sharedata.co.za/sdo/jse/MEY

COMPANY SECRETARY: Shane McBride

TRANSFER SECRETARY: Advanced Share Registry Services

SPONSOR: IJG Securities (Pty) Ltd.

AUDITORS: Rothsay Chartered Accountants

CAPITAL STRUCTURE AUTHORISED ISSUED

MEY Ords - 143 365 397

35