Page 250 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 250

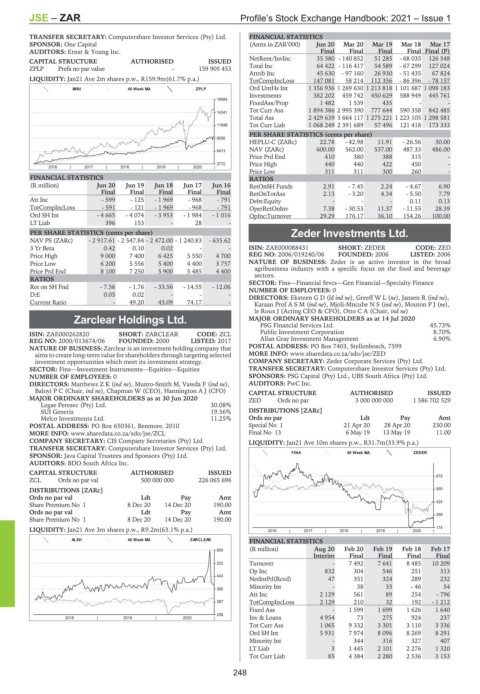

JSE – ZAR Profile’s Stock Exchange Handbook: 2021 – Issue 1

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. FINANCIAL STATISTICS

SPONSOR: One Capital (Amts in ZAR’000) Jun 20 Mar 20 Mar 19 Mar 18 Mar 17

AUDITORS: Ernst & Young Inc. Final Final Final Final Final (P)

NetRent/InvInc 35 380 - 140 852 51 285 - 68 035 126 548

CAPITAL STRUCTURE AUTHORISED ISSUED

ZPLP Prefs no par value - 159 905 453 Total Inc 64 422 - 116 417 54 589 - 67 299 127 024

Attrib Inc 45 630 - 97 160 26 930 - 51 435 67 824

LIQUIDITY: Jan21 Ave 2m shares p.w., R159.9m(61.7% p.a.) TotCompIncLoss 147 081 58 214 112 356 - 86 396 - 78 157

MINI 40 Week MA ZPLP Ord UntHs Int 1 356 936 1 269 630 1 213 818 1 101 687 1 098 183

Investments 382 202 459 742 450 629 588 949 445 761

16984

FixedAss/Prop 1 482 1 539 435 - -

Tot Curr Ass 1 894 386 2 995 390 777 644 590 358 842 485

14341

Total Ass 2 429 639 3 664 117 1 275 221 1 223 105 1 298 581

11698 Tot Curr Liab 1 068 249 2 391 689 57 496 121 418 173 333

PER SHARE STATISTICS (cents per share)

9056

HEPLU-C (ZARc) 22.78 - 42.98 11.91 - 26.56 30.00

6413 NAV (ZARc) 600.00 562.00 537.00 487.33 486.00

Price Prd End 410 380 388 315 -

3770 Price High 440 440 422 450 -

2016 | 2017 | 2018 | 2019 | 2020 |

Price Low 311 311 300 260 -

FINANCIAL STATISTICS RATIOS

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 RetOnSH Funds 2.91 - 7.45 2.24 - 4.67 6.90

Final Final Final Final Final RetOnTotAss 2.13 - 3.20 4.34 - 5.50 7.79

Att Inc - 599 - 125 - 1 969 - 968 - 791 Debt:Equity - - - 0.11 0.13

TotCompIncLoss - 591 - 121 - 1 969 - 968 - 791 OperRetOnInv 7.38 - 30.53 11.37 - 11.55 28.39

Ord SH Int - 4 665 - 4 074 - 3 953 - 1 984 - 1 016 OpInc:Turnover 29.29 176.17 36.10 154.26 100.00

LT Liab 396 153 - 28 -

PER SHARE STATISTICS (cents per share) Zeder Investments Ltd.

NAV PS (ZARc) - 2 917.61 - 2 547.84 - 2 472.00 - 1 240.83 - 635.62 ZED

3 Yr Beta 0.42 0.10 0.02 - - ISIN: ZAE000088431 SHORT: ZEDER CODE: ZED

Price High 9 000 7 400 6 425 5 550 4 700 REG NO: 2006/019240/06 FOUNDED: 2006 LISTED: 2006

Price Low 6 200 5 556 5 400 4 400 3 757 NATURE OF BUSINESS: Zeder is an active investor in the broad

Price Prd End 8 100 7 250 5 900 5 485 4 400 agribusiness industry with a specific focus on the food and beverage

sectors.

RATIOS SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

Ret on SH Fnd - 7.56 - 1.76 - 33.56 - 14.55 - 12.06 NUMBER OF EMPLOYEES: 0

D:E 0.05 0.02 - - - DIRECTORS: EksteenGD(ld ind ne), GreeffWL(ne), Jansen R (ind ne),

Current Ratio - 49.20 43.09 74.17 - Karaan ProfASM(ind ne), Mjoli-MncubeNS(ind ne), MoutonPJ(ne),

le Roux J (Acting CEO & CFO), Otto C A (Chair, ind ne)

Zarclear Holdings Ltd. MAJOR ORDINARY SHAREHOLDERS as at 14 Jul 2020

PSG Financial Services Ltd. 45.73%

ZAR

ISIN: ZAE000262820 SHORT: ZARCLEAR CODE: ZCL Public Investment Corporation 8.70%

REG NO: 2000/013674/06 FOUNDED: 2000 LISTED: 2017 Allan Gray Investment Management 6.90%

NATURE OF BUSINESS: Zarclear is an investment holding company that POSTAL ADDRESS: PO Box 7403, Stellenbosch, 7599

aims to create long-term value for shareholders through targeting selected MORE INFO: www.sharedata.co.za/sdo/jse/ZED

investment opportunities which meet its investment strategy. COMPANY SECRETARY: Zeder Corporate Services (Pty) Ltd.

SECTOR: Fins—Investment Instruments—Equities—Equities TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd.

DIRECTORS: MatthewsZK(ind ne), Munro-Smith M, Vawda F (ind ne), AUDITORS: PwC Inc.

Baloyi P C (Chair, ind ne), Chapman W (CEO), Hannington A J (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 ZED Ords no par 3 000 000 000 1 586 702 529

Legae Peresec (Pty) Ltd. 30.08%

SUI Generis 19.56% DISTRIBUTIONS [ZARc]

Melco Investments Ltd. 11.25% Ords no par Ldt Pay Amt

POSTAL ADDRESS: PO Box 650361, Benmore, 2010 Special No 1 21 Apr 20 28 Apr 20 230.00

MORE INFO: www.sharedata.co.za/sdo/jse/ZCL Final No 13 6 May 19 13 May 19 11.00

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. LIQUIDITY: Jan21 Ave 10m shares p.w., R31.7m(33.9% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. FINA 40 Week MA ZEDER

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

ZCL Ords no par val 500 000 000 226 065 696 675

DISTRIBUTIONS [ZARc] 550

Ords no par val Ldt Pay Amt

424

Share Premium No 1 8 Dec 20 14 Dec 20 190.00

Ords no par val Ldt Pay Amt

299

Share Premium No 1 8 Dec 20 14 Dec 20 190.00

LIQUIDITY: Jan21 Ave 3m shares p.w., R9.2m(63.1% p.a.) 2016 | 2017 | 2018 | 2019 | 2020 | 174

ALSH 40 Week MA ZARCLEAR FINANCIAL STATISTICS

600 (R million) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

Interim Final Final Final Final

522 Turnover - 7 492 7 641 8 485 10 209

Op Inc 832 304 546 251 313

443

NetIntPd(Rcvd) 47 351 324 289 232

Minority Int - 38 33 - 46 54

365

Att Inc 2 129 561 89 254 - 796

287 TotCompIncLoss 2 129 210 32 192 - 1 212

Fixed Ass - 1 599 1 699 1 626 1 640

208

2018 | 2019 | 2020 | Inv & Loans 4 954 73 275 924 237

Tot Curr Ass 1 065 9 332 3 301 3 110 3 336

Ord SH Int 5 931 7 974 8 096 8 269 8 291

Minority Int - 344 316 327 407

LT Liab 3 1 445 2 101 2 276 1 320

Tot Curr Liab 85 4 384 2 280 2 536 3 153

248