Page 51 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 51

Profile’s Stock Exchange Handbook: 2020 – Issue 4 ZARX – ZXSWB

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance

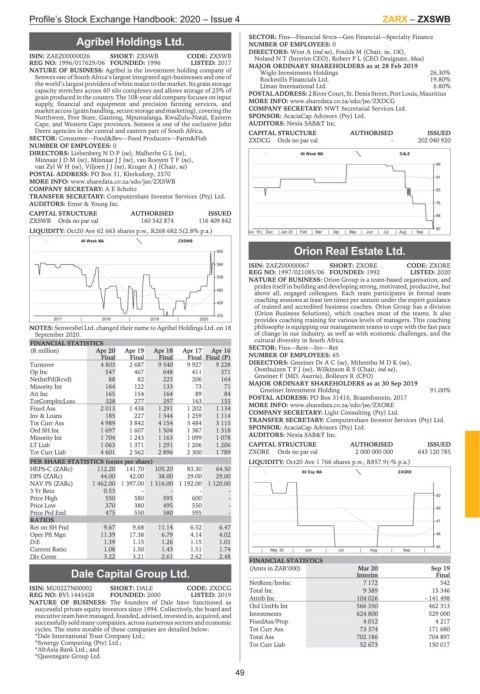

Agribel Holdings Ltd. NUMBER OF EMPLOYEES: 0

ZXSWB DIRECTORS: West A (ind ne), Foulds M (Chair, ne, UK),

ISIN: ZAEZ00000026 SHORT: ZXSWB CODE: ZXSWB Noland N T (Interim CEO), Robert F L (CEO Designate, Mau)

REG NO: 1996/017629/06 FOUNDED: 1996 LISTED: 2017 MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2019

NATURE OF BUSINESS: Agribel is the investment holding company of Wiglo Investments Holdings 26.30%

Senwes one of South Africa’s largest integrated agri-businesses and one of Rockmills Financials Ltd. 19.80%

the world’s largest providers of white maize to the market. Its grain storage Liman International Ltd. 6.80%

capacity stretches across 60 silo complexes and allows storage of 25% of POSTAL ADDRESS:2RiverCourt,St.DenisStreet,PortLouis,Mauritius

grain produced in the country. The 108-year old company focuses on input

supply, financial and equipment and precision farming services, and MORE INFO: www.sharedata.co.za/sdo/jse/ZXDCG

marketaccess(grainhandling,securestorageandmarketing),coveringthe COMPANY SECRETARY: NWT Secretarial Services Ltd.

Northwest, Free State, Gauteng, Mpumalanga, KwaZulu-Natal, Eastern SPONSOR: AcaciaCap Advisors (Pty) Ltd.

Cape, and Western Cape provinces. Senwes is one of the exclusive John AUDITORS: Nexia SAB&T Inc.

Deere agencies in the central and eastern part of South Africa. CAPITAL STRUCTURE AUTHORISED ISSUED

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish ZXDCG Ords no par val. - 202 040 920

NUMBER OF EMPLOYEES: 0

DIRECTORS: LiebenbergNDP(ne), MalherbeGL(ne), 40 Week MA DALE

MinnaarJDM(ne), MinnaarJJ(ne), van RooyenTF(ne),

99

van ZylWH(ne), ViljoenJJ(ne), Kruger A J (Chair, ne)

POSTAL ADDRESS: PO Box 31, Klerksdorp, 2570

91

MORE INFO: www.sharedata.co.za/sdo/jse/ZXSWB

COMPANY SECRETARY: A E Scholtz 83

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc. 76

CAPITAL STRUCTURE AUTHORISED ISSUED

68

ZXSWB Ords no par val 160 542 874 116 409 842

LIQUIDITY: Oct20 Ave 62 663 shares p.w., R268 682.5(2.8% p.a.) Nov 19 | Dec | Jan 20 | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | 60

40 Week MA ZXSWB

Orion Real Estate Ltd.

650

ZXORE

594 ISIN: ZAEZ00000067 SHORT: ZXORE CODE: ZXORE

REG NO: 1997/021085/06 FOUNDED: 1992 LISTED: 2020

538

NATURE OF BUSINESS: Orion Group is a team-based organisation, and

prides itself in building and developing strong, motivated, productive, but

482

above all, engaged colleagues. Each team participates in formal team

coaching sessions at least ten times per annum under the expert guidance

426

of trained and accredited business coaches. Orion Group has a division

(Orion Business Solutions), which coaches most of the teams. It also

370

2017 | 2018 | 2019 | 2020 provides coaching training for various levels of managers. This coaching

NOTES: Senwesbel Ltd. changed their name to Agribel Holdings Ltd. on 18 philosophy is equipping our management teams to cope with the fast pace

September 2020. of change in our industry, as well as with economic challenges, and the

cultural diversity in South Africa.

FINANCIAL STATISTICS

(R million) Apr 20 Apr 19 Apr 18 Apr 17 Apr 16 SECTOR: Fins—Rest—Inv—Ret

Final Final Final Final Final (P) NUMBER OF EMPLOYEES: 65

Turnover 4 803 2 687 9 540 9 927 9 228 DIRECTORS: Gmeiner DrAC(ne), MthembuMDK(ne),

Op Inc 547 467 648 411 371 OosthuizenTFJ(ne), Wilkinson R S (Chair, ind ne),

NetIntPd(Rcvd) 88 82 225 206 164 Gmeiner F (MD, Austria), Bolleurs R (CFO)

Minority Int 164 122 133 73 71 MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019 91.00%

Gmeiner Investment Holding

Att Inc 165 154 164 89 84 POSTAL ADDRESS: PO Box 31416, Braamfontein, 2017

TotCompIncLoss 328 277 297 163 155

Fixed Ass 2 013 1 438 1 291 1 202 1 134 MORE INFO: www.sharedata.co.za/sdo/jse/ZXORE

Inv & Loans 185 227 1 344 1 259 1 114 COMPANY SECRETARY: Light Consulting (Pty) Ltd.

Tot Curr Ass 4 989 3 842 4 154 3 484 3 115 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Ord SH Int 1 697 1 607 1 504 1 387 1 318 SPONSOR: AcaciaCap Advisors (Pty) Ltd.

Minority Int 1 704 1 243 1 163 1 099 1 078 AUDITORS: Nexia SAB&T Inc.

LT Liab 1 063 1 371 1 291 1 206 1 206 CAPITAL STRUCTURE AUTHORISED ISSUED

Tot Curr Liab 4 601 2 562 2 896 2 300 1 789 ZXORE Ords no par val 2 000 000 000 643 120 785

PER SHARE STATISTICS (cents per share) LIQUIDITY: Oct20 Ave 1 766 shares p.w., R857.9(-% p.a.)

HEPS-C (ZARc) 112.20 141.70 105.20 83.30 64.50

DPS (ZARc) 44.00 42.00 38.00 29.00 29.00 80 Day MA ZXORE

NAV PS (ZARc) 1 462.00 1 397.00 1 316.00 1 192.00 1 120.00

3 Yr Beta 0.53 - - - -

50

Price High 550 580 595 600 -

Price Low 370 380 495 550 -

Price Prd End 475 550 580 595 - 49

RATIOS 47

Ret on SH Fnd 9.67 9.68 11.14 6.52 6.47

Oper Pft Mgn 11.39 17.38 6.79 4.14 4.02 46

D:E 1.39 1.15 1.26 1.15 1.01

Current Ratio 1.08 1.50 1.43 1.51 1.74 | May 20 | Jun | Jul | Aug | Sep | 45

Div Cover 3.22 3.21 2.61 2.62 2.48

FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 20 Sep 19

Dale Capital Group Ltd. Interim Final

ZXDCG NetRent/InvInc 7 172 542

ISIN: MU0227N00002 SHORT: DALE CODE: ZXDCG Total Inc 9 389 15 346

REG NO: BVI.1443428 FOUNDED: 2000 LISTED: 2019 Attrib Inc 104 026 - 141 498

NATURE OF BUSINESS: The founders of Dale have functioned as

successful private equity investors since 1994. Collectively, the board and Ord UntHs Int 566 350 462 313

executive teamhave managed,founded,advised,investedin,acquired, and Investments 624 800 529 000

successfully sold many companies, across numerous sectors and economic FixedAss/Prop 4 012 4 217

cycles. The more notable of these companies are detailed below: Tot Curr Ass 73 374 171 680

*Dale International Trust Company Ltd.; Total Ass 702 186 704 897

*Synergy Computing (Pty) Ltd.; Tot Curr Liab 52 673 150 017

*AfrAsia Bank Ltd.; and

*Queensgate Group Ltd.

49