Page 200 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 200

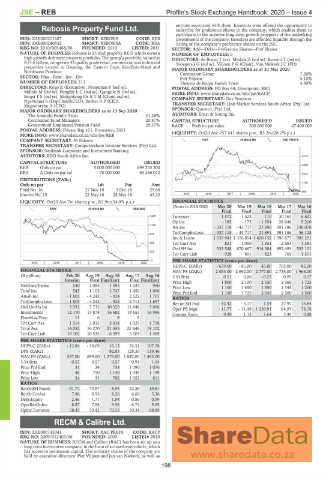

JSE – REB Profile’s Stock Exchange Handbook: 2020 – Issue 4

entities associated with them. Investors were offered the opportunity to

Rebosis Property Fund Ltd. subscribe for preference shares in the company, which enables them to

participate in the superior long-term growth prospects of the underlying

REB

ISIN: ZAE000201687 SHORT: REBOSIS CODE: REB investments of the company. Investors are afforded liquidity through the

ISIN: ZAE000240552 SHORT: REBOSISA CODE: REA listing of the company’s preference shares on the JSE.

REG NO: 2010/003468/06 FOUNDED: 2010 LISTED: 2011 SECTOR: Add—Debt—Preference Shares—Pref Shares

NATURE OF BUSINESS: Rebosis is a listed property REIT which owns a NUMBER OF EMPLOYEES: 0

high growth defensive property portfolio. The group’s portfolio, valued at DIRECTORS: de Bruyn T (ne), Matlala Z (ind ne), Rossini T (ind ne),

R15.6 billion, comprises 43 quality grade retail, commercial and industrial SwiegersJG(ind ne), Viljoen P G (Chair), Van Niekerk J C (FD)

properties located in Gauteng, the Eastern Cape, KwaZulu-Natal and MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Northwest Province. Coronation Group 7.20%

SECTOR: Fins—Rest—Inv—Div Piet Viljoen 5.10%

NUMBER OF EMPLOYEES: 211 Theunis de Bruyn Family Trust 4.80%

DIRECTORS: Kogo Z (Executive), Froneman F (ind ne), POSTAL ADDRESS: PO Box 44, Greenpoint, 8001

Mdlolo M (ind ne), PengillyLC(ind ne), Qangule N (ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/RACP

SeopaTS(ind ne), Mokgokong DrATM (Chair, ind ne), COMPANY SECRETARY: Guy Simpson

Ngebulana S (DepChair&CEO), Becker R P (CIO),

Magwentshu A (CFO) TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 11 Sep 2020 SPONSOR: Questco (Pty) Ltd.

The Amatolo Family Trust 31.26% AUDITORS: Ernst & Young Inc.

Coronation Fund Managers 20.87% CAPITAL STRUCTURE AUTHORISED ISSUED

Government Employees Pension Fund 20.37% RACP Prefs no par value 200 000 000 47 400 000

POSTAL ADDRESS: Private Bag x21, Bryanston, 2021

MORE INFO: www.sharedata.co.za/sdo/jse/REB LIQUIDITY: Oct20 Ave 257 441 shares p.w., R3.2m(28.2% p.a.)

COMPANY SECRETARY: M Ndema FINA 40 Week MA RAC PREFS

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: BDO South Africa Inc. 2234

CAPITAL STRUCTURE AUTHORISED ISSUED

1868

REB Ords no par 5 000 000 000 699 253 200

REA A Ords no par val 70 000 000 63 266 012 1502

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 1136

Final No 16 27 Nov 18 3 Dec 18 29.60 769

Interim No 15 22 May 18 28 May 18 63.23 2015 | 2016 | 2017 | 2018 | 2019 | 2020

LIQUIDITY: Oct20 Ave 7m shares p.w., R2.9m(54.0% p.a.) FINANCIAL STATISTICS

(Amts in ZAR’000) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

SAPY 40 Week MA REBOSIS

Final Final Final Final Final

1445 Turnover 1 572 1 523 110 30 163 6 601

Op Inc - 185 - 175 - 1 354 28 646 5 200

1160

Att Inc - 337 118 - 43 717 21 890 391 186 136 078

TotCompIncLoss - 337 118 - 43 717 21 891 391 186 56 128

874

Inv & Loans 1 039 941 1 376 854 1 420 152 1 396 877 983 291

588 Tot Curr Ass 831 1 000 1 351 2 681 1 381

Ord SH Int 533 548 870 667 914 384 892 493 533 101

303

Tot Curr Liab 928 891 823 769 1 571

17 PER SHARE STATISTICS (cents per share)

2015 | 2016 | 2017 | 2018 | 2019 | 2020

HEPS-C (ZARc) - 659.00 - 85.00 43.00 765.00 86.00

FINANCIAL STATISTICS NAV PS (ZARc) 2 033.00 2 692.00 2 777.00 2 735.00 1 966.00

(R million) Feb 20 Aug 19 Aug 18 Aug 17 Aug 16 3 Yr Beta 0.51 0.06 - 0.23 0.09 0.17

Interim Final Final(rst) Final Final(rst) Price High 1 800 2 100 2 550 2 660 1 725

NetRent/InvInc 540 1 095 1 595 1 325 960 Price Low 1 150 1 650 1 850 1 544 1 260

Total Inc 545 1 103 1 747 1 450 1 006 Price Prd End 1 150 1 725 2 045 2 500 1 560

Attrib Inc - 1 803 - 4 242 - 924 2 522 1 707 RATIOS

TotCompIncLoss - 1 803 - 4 242 - 924 2 711 1 657

Ret on SH Fnd - 32.42 - 3.17 1.54 27.97 13.84

Ord UntHs Int 3 931 5 735 10 329 11 848 7 696 Oper Pft Mgn - 11.77 - 11.49 - 1 230.91 94.97 78.78

Investments 12 170 13 878 16 682 19 653 16 996 Current Ratio 0.90 1.12 1.64 3.49 0.88

FixedAss/Prop 11 6 9 6 -

Tot Curr Ass 1 514 2 015 2 034 1 029 1 718

Total Ass 14 052 16 270 21 655 22 646 19 102

Tot Curr Liab 10 102 10 535 6 399 5 504 1 469

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 12.84 - 14.69 16.13 74.51 107.78

DPS (ZARc) - - 92.83 128.35 119.46

NAV PS (ZARc) 557.00 699.00 1 276.00 1 842.00 1 452.00

3 Yr Beta 0.57 0.57 0.57 0.91 1.04

Price Prd End 31 34 738 1 090 1 076

Price High 48 750 1 140 1 348 1 199

Price Low 24 33 702 1 052 811

RATIOS

RetOnSH Funds - 91.74 - 73.97 - 8.95 22.26 19.81

RetOnTotAss 7.96 6.93 8.26 6.60 5.36

Debt:Equity 2.46 1.77 1.04 0.86 0.99

OperRetOnInv 8.87 7.88 9.56 6.74 5.65

OpInc:Turnover 58.45 59.42 70.53 70.34 68.89

RECM & Calibre Ltd.

REC

ISIN: ZAE000145041 SHORT: RAC PREFS CODE: RACP

REG NO: 2009/012403/06 FOUNDED: 2009 LISTED: 2010

NATURE OF BUSINESS: RECM and Calibre (RAC) has been set up as a

long term investment company, in the form of a closed-end vehicle, which

has access to permanent capital. The ordinary shares of the company are

held by executive directors: Piet Viljoen and Jan van Niekerk, as well as

198