Page 172 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 172

JSE – MPA Profile’s Stock Exchange Handbook: 2020 – Issue 4

Mpact Ltd. Mr Price Group Ltd.

MPA MRP

ISIN: ZAE000156501 SHORT: MPACT CODE: MPT ISIN: ZAE000200457 SHORT: MRPRICE CODE: MRP

REG NO: 2004/025229/06 FOUNDED: 2004 LISTED: 2011 REG NO: 1933/004418/06 FOUNDED: 1885 LISTED: 1952

NATURE OF BUSINESS: Mpact is the largest paper and plastics packaging NATURE OF BUSINESS: Mr Price Group Ltd. is a cash-based, omni-channel,

and recycling business in Southern Africa. Mpact’s integrated business fashion-value retailer targeting younger customers in the mid to upper LSM

model is uniquely focused on closing the loop in plastic and paper categories retailing predominantly own-branded merchandise.

packaging through recycling and beneficiation of recyclables. Innovation SECTOR: Consumer Srvcs—Retail—Gen Retailers—Apparels

lies at the heart of Mpact’s strategy and the company uses its close NUMBER OF EMPLOYEES: 18 605

relationships with customers and its understanding of their industries to DIRECTORS: Blair M M (CEO & FD), Abrams N (alt),

anticipate their needs and create structural and graphic solutions, as well Bowman M (ind ne), Chauke M (ind ne), Ellis S (alt), Getz K (ne),

as value-added services. Motanyane-WelchRM(ind ne), Naidoo D (ind ne), Niehaus B (ind ne),

SECTOR: Ind—Ind Goods&Srvcs—Gen Ind—Containers&Packaging Swartz L (ind ne), Payne N G (Chair, ind ne),

NUMBER OF EMPLOYEES: 5 142 Cohen S B (Honorary Chair, ne), Stirton M (Group CFO)

DIRECTORS: DongwanaNP(ind ne), Langa-RoydsNB(ind ne), MAJOR ORDINARY SHAREHOLDERS as at 27 Dec 2019

LuthuliPCS(ind ne), Makanjee M (ind ne),RossTDA(ind ne), Public Investment Corporation Group 12.58%

ThompsonAM(ind ne), Phillips A J (Chair, ind ne), Strong B W (CEO), JP Morgan Chase and Co 9.42%

ClarkBDV (CFO) BlackRock Inc. 5.21%

MAJOR ORDINARY SHAREHOLDERS as at 15 May 2020 POSTAL ADDRESS: PO Box 912, Durban, 4000

Allan Gray 19.19% MORE INFO: www.sharedata.co.za/sdo/jse/MRP

Prudential Investment Managers 13.62% COMPANY SECRETARY: Janis Peta Cheadle

Public Investment Corporation Group 10.09% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: Postnet Suite #179, Private Bag X1, Melrose Arch, SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Johannesburg, 2076 AUDITORS: Ernst & Young Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/MPT

COMPANY SECRETARY: Donna Dickson CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MRP Ords 0.025c ea 323 300 000 256 370 858

SPONSOR: The Standard Bank of South Africa Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: Deloitte & Touche Ords 0.025c ea Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Interim No 59 10 Dec 19 17 Dec 19 311.40

MPT Ords no par value 217 500 000 173 304 517 Final No 58 18 Jun 19 24 Jun 19 424.80

DISTRIBUTIONS [ZARc] LIQUIDITY: Oct20 Ave 8m shares p.w., R1 207.3m(155.5% p.a.)

Ords no par value Ldt Pay Amt

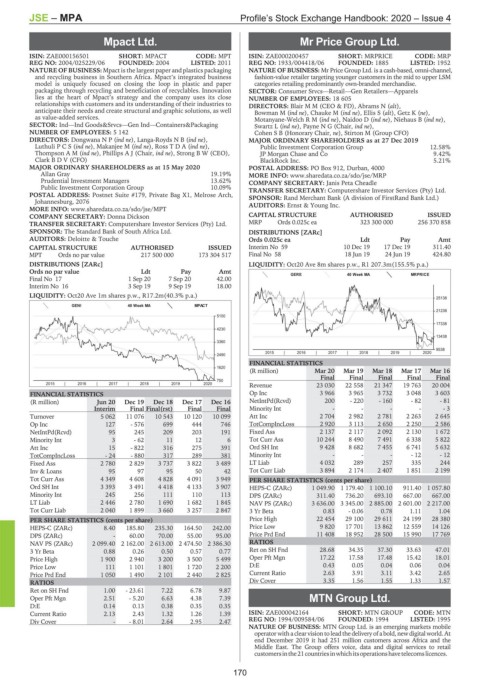

GERE 40 Week MA MRPRICE

Final No 17 1 Sep 20 7 Sep 20 42.00

Interim No 16 3 Sep 19 9 Sep 19 18.00

LIQUIDITY: Oct20 Ave 1m shares p.w., R17.2m(40.3% p.a.) 25138

GENI 40 Week MA MPACT

21238

5100

17338

4230

13438

3360

9538

2015 | 2016 | 2017 | 2018 | 2019 | 2020

2490

FINANCIAL STATISTICS

1620

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

Final Final Final Final Final

750

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Revenue 23 030 22 558 21 347 19 763 20 004

FINANCIAL STATISTICS Op Inc 3 966 3 965 3 732 3 048 3 603

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 NetIntPd(Rcvd) 200 - 220 - 160 - 82 - 81

Interim Final Final(rst) Final Final Minority Int - - - - - 3

Turnover 5 062 11 076 10 543 10 120 10 099 Att Inc 2 704 2 982 2 781 2 263 2 645

Op Inc 127 - 576 699 444 746 TotCompIncLoss 2 920 3 113 2 650 2 250 2 586

NetIntPd(Rcvd) 95 245 209 203 191 Fixed Ass 2 137 2 117 2 092 2 130 1 672

Minority Int 3 - 62 11 12 6 Tot Curr Ass 10 244 8 490 7 491 6 338 5 822

Att Inc 15 - 822 316 275 391 Ord SH Int 9 428 8 682 7 455 6 741 5 632

TotCompIncLoss - 24 - 880 317 289 381 Minority Int - - - - 12 - 12

Fixed Ass 2 780 2 829 3 737 3 822 3 489 LT Liab 4 032 289 257 335 244

Inv & Loans 95 97 95 50 42 Tot Curr Liab 3 894 2 174 2 407 1 851 2 199

Tot Curr Ass 4 349 4 608 4 828 4 091 3 949 PER SHARE STATISTICS (cents per share)

Ord SH Int 3 393 3 491 4 418 4 133 3 907 HEPS-C (ZARc) 1 049.90 1 179.40 1 100.10 911.40 1 057.80

Minority Int 245 256 111 110 113 DPS (ZARc) 311.40 736.20 693.10 667.00 667.00

LT Liab 2 446 2 780 1 690 1 682 1 845 NAV PS (ZARc) 3 636.00 3 345.00 2 885.00 2 601.00 2 217.00

Tot Curr Liab 2 040 1 899 3 660 3 257 2 847 3 Yr Beta 0.83 - 0.06 0.78 1.11 1.04

PER SHARE STATISTICS (cents per share) Price High 22 454 29 100 29 611 24 199 28 380

HEPS-C (ZARc) 8.40 185.80 235.30 164.50 242.00 Price Low 9 820 17 701 13 862 12 559 14 126

DPS (ZARc) - 60.00 70.00 55.00 95.00 Price Prd End 11 408 18 952 28 500 15 990 17 769

NAV PS (ZARc) 2 099.40 2 162.00 2 613.00 2 474.50 2 386.30 RATIOS

3 Yr Beta 0.88 0.26 0.50 0.57 0.77 Ret on SH Fnd 28.68 34.35 37.30 33.63 47.01

Price High 1 900 2 940 3 200 3 500 5 499 Oper Pft Mgn 17.22 17.58 17.48 15.42 18.01

Price Low 111 1 101 1 801 1 720 2 200 D:E 0.43 0.05 0.04 0.06 0.04

Price Prd End 1 050 1 490 2 101 2 440 2 825 Current Ratio 2.63 3.91 3.11 3.42 2.65

RATIOS Div Cover 3.35 1.56 1.55 1.33 1.57

Ret on SH Fnd 1.00 - 23.61 7.22 6.78 9.87

Oper Pft Mgn 2.51 - 5.20 6.63 4.38 7.39 MTN Group Ltd.

D:E 0.14 0.13 0.38 0.35 0.35 MTN

Current Ratio 2.13 2.43 1.32 1.26 1.39 ISIN: ZAE000042164 SHORT: MTN GROUP CODE: MTN

Div Cover - - 8.01 2.64 2.95 2.47 REG NO: 1994/009584/06 FOUNDED: 1994 LISTED: 1995

NATURE OF BUSINESS: MTN Group Ltd. is an emerging markets mobile

operator with a clear visionto lead the delivery of a bold, newdigital world. At

end December 2019 it had 251 million customers across Africa and the

Middle East. The Group offers voice, data and digital services to retail

customersinthe21countriesinwhichitsoperationshavetelecomslicences.

170