Page 50 - Stock Exchange Handbook 2020 - Issue 3

P. 50

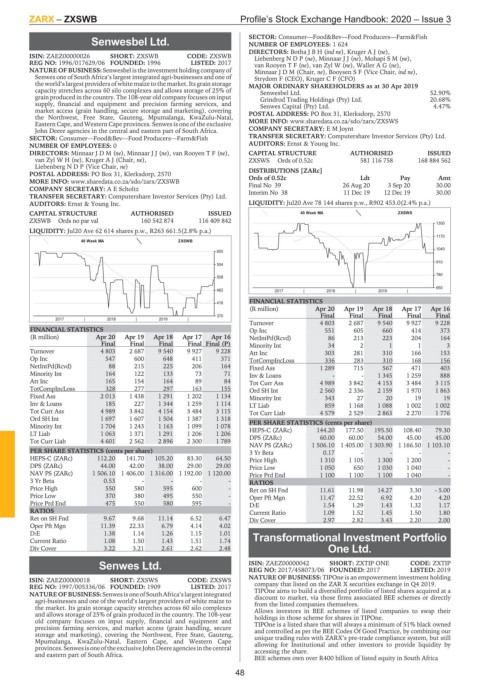

ZARX – ZXSWB Profile’s Stock Exchange Handbook: 2020 – Issue 3

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

Senwesbel Ltd. NUMBER OF EMPLOYEES: 1 624

ZXSWB DIRECTORS: BothaJBH(ind ne), KrugerAJ(ne),

ISIN: ZAEZ00000026 SHORT: ZXSWB CODE: ZXSWB LiebenbergNDP(ne), MinnaarJJ(ne), MohapiSM(ne),

REG NO: 1996/017629/06 FOUNDED: 1996 LISTED: 2017 van RooyenTF(ne), van Zyl W (ne), WallerAG(ne),

NATURE OF BUSINESS: Senwesbel is the investment holding company of MinnaarJDM (Chair, ne), Booysen S F (Vice Chair, ind ne),

Senwes one of South Africa’s largest integrated agri-businesses and one of Strydom F (CEO), Kruger C F (CFO)

the world’s largest providers of white maize to the market. Its grain storage MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2019

capacity stretches across 60 silo complexes and allows storage of 25% of Senwesbel Ltd. 52.90%

grain produced in the country. The 108-year old company focuses on input Grindrod Trading Holdings (Pty) Ltd. 20.68%

supply, financial and equipment and precision farming services, and Senwes Capital (Pty) Ltd. 4.47%

market access (grain handling, secure storage and marketing), covering POSTAL ADDRESS: PO Box 31, Klerksdorp, 2570

the Northwest, Free State, Gauteng, Mpumalanga, KwaZulu-Natal,

Eastern Cape, and Western Cape provinces. Senwes is one of the exclusive MORE INFO: www.sharedata.co.za/sdo/zarx/ZXSWS

John Deere agencies in the central and eastern part of South Africa. COMPANY SECRETARY: E M Joynt

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 AUDITORS: Ernst & Young Inc.

DIRECTORS: MinnaarJDM(ne), MinnaarJJ(ne), van RooyenTF(ne), CAPITAL STRUCTURE AUTHORISED ISSUED

van ZylWH(ne), Kruger A J (Chair, ne), ZXSWS Ords of 0.52c 581 116 758 168 884 562

LiebenbergNDP (Vice Chair, ne)

POSTAL ADDRESS: PO Box 31, Klerksdorp, 2570 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/zarx/ZXSWB Ords of 0.52c Ldt Pay Amt

3 Sep 20

COMPANY SECRETARY: A E Scholtz Final No 39 26 Aug 20 12 Dec 19 30.00

Interim No 38

30.00

11 Dec 19

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc. LIQUIDITY: Jul20 Ave 78 144 shares p.w., R902 453.0(2.4% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED 40 Week MA ZXSWS

ZXSWB Ords no par val 160 542 874 116 409 842

1300

LIQUIDITY: Jul20 Ave 62 614 shares p.w., R263 661.5(2.8% p.a.)

1170

40 Week MA ZXSWB

1040

600

910

554

780

508

650

462 2017 | 2018 | 2019 |

416 FINANCIAL STATISTICS

(R million) Apr 20 Apr 19 Apr 18 Apr 17 Apr 16

370 Final Final Final Final Final

2017 | 2018 | 2019 |

Turnover 4 803 2 687 9 540 9 927 9 228

FINANCIAL STATISTICS Op Inc 551 605 660 414 373

(R million) Apr 20 Apr 19 Apr 18 Apr 17 Apr 16 NetIntPd(Rcvd) 86 213 223 204 164

Final Final Final Final Final (P) Minority Int 34 2 1 1 3

Turnover 4 803 2 687 9 540 9 927 9 228 Att Inc 303 281 310 166 153

Op Inc 547 600 648 411 371 TotCompIncLoss 336 283 310 168 156

NetIntPd(Rcvd) 88 215 225 206 164 Fixed Ass 1 289 715 567 471 403

Minority Int 164 122 133 73 71 Inv & Loans - - 1 345 1 259 888

Att Inc 165 154 164 89 84 Tot Curr Ass 4 989 3 842 4 153 3 484 3 115

TotCompIncLoss 328 277 297 163 155 Ord SH Int 2 560 2 336 2 159 1 970 1 863

Fixed Ass 2 013 1 438 1 291 1 202 1 134 Minority Int 343 27 20 19 19

Inv & Loans 185 227 1 344 1 259 1 114 LT Liab 859 1 168 1 088 1 002 1 002

Tot Curr Ass 4 989 3 842 4 154 3 484 3 115 Tot Curr Liab 4 579 2 529 2 863 2 270 1 776

Ord SH Int 1 697 1 607 1 504 1 387 1 318

Minority Int 1 704 1 243 1 163 1 099 1 078 PER SHARE STATISTICS (cents per share) 195.50 108.40 79.30

177.50

144.20

HEPS-C (ZARc)

LT Liab 1 063 1 371 1 291 1 206 1 206

Tot Curr Liab 4 601 2 562 2 896 2 300 1 789 DPS (ZARc) 60.00 60.00 54.00 45.00 45.00

NAV PS (ZARc) 1 506.10 1 405.00 1 303.90 1 166.50 1 103.10

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.17 - - - -

HEPS-C (ZARc) 112.20 141.70 105.20 83.30 64.50 Price High 1 310 1 105 1 300 1 200 -

DPS (ZARc) 44.00 42.00 38.00 29.00 29.00 Price Low 1 050 650 1 030 1 040 -

NAV PS (ZARc) 1 506.10 1 406.00 1 316.00 1 192.00 1 120.00 Price Prd End 1 100 1 100 1 100 1 040 -

3 Yr Beta 0.53 - - - - RATIOS

Price High 550 580 595 600 - Ret on SH Fnd 11.61 11.98 14.27 3.30 - 5.00

Price Low 370 380 495 550 - Oper Pft Mgn 11.47 22.52 6.92 4.20 4.20

Price Prd End 475 550 580 595 - D:E 1.54 1.29 1.43 1.32 1.17

RATIOS Current Ratio 1.09 1.52 1.45 1.50 1.80

Ret on SH Fnd 9.67 9.68 11.14 6.52 6.47 Div Cover 2.97 2.82 3.43 2.20 2.00

Oper Pft Mgn 11.39 22.33 6.79 4.14 4.02

D:E 1.38 1.14 1.26 1.15 1.01

Current Ratio 1.08 1.50 1.43 1.51 1.74 Transformational Investment Portfolio

Div Cover 3.22 3.21 2.61 2.62 2.48 One Ltd.

ZXTIP

CODE: ZXTIP

Senwes Ltd. ISIN: ZAEZ00000042 SHORT: ZXTIP ONE LISTED: 2019

REG NO: 2017/458073/06 FOUNDED: 2017

ZXSWS

ISIN: ZAEZ00000018 SHORT: ZXSWS CODE: ZXSWS NATURE OF BUSINESS: TIPOne is an empowerment investment holding

REG NO: 1997/005336/06 FOUNDED: 1909 LISTED: 2017 company that listed on the ZAR X securities exchange in Q4 2019.

NATUREOF BUSINESS:SenwesisoneofSouth Africa’slargestintegrated TIPOne aims to build a diversified portfolio of listed shares acquired at a

discount to market, via those firms associated BEE schemes or directly

agri-businesses and one of the world’s largest providers of white maize to from the listed companies themselves.

the market. Its grain storage capacity stretches across 60 silo complexes Allows investors in BEE schemes of listed companies to swap their

and allows storage of 25% of grain produced in the country. The 108-year holdings in those scheme for shares in TIPOne.

old company focuses on input supply, financial and equipment and TIPOne is a listed share that will always a minimum of 51% black owned

precision farming services, and market access (grain handling, secure and controlled as per the BEE Codes Of Good Practice, by combining our

storage and marketing), covering the Northwest, Free State, Gauteng, unique trading rules with ZARX’s pre-trade compliance system, but still

Mpumalanga, KwaZulu-Natal, Eastern Cape, and Western Cape allowing for Institutional and other investors to provide liquidity by

provinces.Senwesisoneofthe exclusive JohnDeere agencies inthe central accessing the share.

and eastern part of South Africa.

BEE schemes own over R400 billion of listed equity in South Africa

48