Page 42 - Stock Exchange Handbook 2020 - Issue 3

P. 42

4AX – 4AIHG Profile’s Stock Exchange Handbook: 2020 – Issue 3

POSTAL ADDRESS: PO Box 107, Lichtenburg, 2740

iHealthcare Group Ltd. MORE INFO: www.sharedata.co.za/sdo/4ax/4ANWKH

4AIHG COMPANY SECRETARY: Lehae Pieterse (interim)

ISIN: ZAE400000085 SHORT: IHEALTH GROUP CODE: 4AIHG TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

REG NO: 2011/009651/06 FOUNDED: 2011 LISTED: 2020 SPONSOR: Pallidus Capital (Pty) Ltd.

NATURE OF BUSINESS: iHealthcare Group was established during 2011

with the primary focus of investing in the healthcare industry. Through its AUDITORS: PwC Inc.

operating subsidiaries, iHealthcare holds the distributing rights in South CAPITAL STRUCTURE AUTHORISED ISSUED

Africa to import a range of medical and surgical equipment, devices and 4ANWKH Ord shares of R1 ea 120 000 000 84 680 920

pharmaceuticals, to its customers mainly in the ophthalmology market,

but other markets in healthcare too. The iHealthcare group also owns a DISTRIBUTIONS [ZARc]

registered pharmaceutical wholesaler business, which procures Ord shares of R1 ea Ldt Pay Amt

pharmaceuticals in bulk from manufacturers and importers. As part of the Interim No 4 3 Jan 20 6 Jan 20 13.00

iHealthcare Group strategy, the group will also invest in operational Final No 3 23 Aug 19 26 Aug 19 5.00

entities managing hospitals and properties. LIQUIDITY: Jul20 Ave 50 293 shares p.w., R180 767.3(3.1% p.a.)

SECTOR: Health—Health—Health Equip&Srvcs—Health Providers

NUMBER OF EMPLOYEES: 0 40 Week MA NWKH

DIRECTORS: CoetzeeAP(ind ne), Hoffman DrHD(ind ne), 550

MojaKJM(ind ne), Fleischhauer K (Chair, ind ne),

Jacobsz Dr A (Joint CEO), Odendaal DrPJL (Joint CEO) 467

MAJOR ORDINARY SHAREHOLDERS as at 13 Dec 2019

iHealthcare Group Holdings Ltd. 66.09% 385

Dr PJL Odendaal 1.29%

Olia Investments (Pty) Ltd. 1.29% 302

POSTAL ADDRESS: PO Box 36290, Menlo Park, Pretoria, 0102

220

MORE INFO: www.sharedata.co.za/sdo/4ax/4AIHG

COMPANY SECRETARY: FluidRock Co Sec 137

2018 | 2019 |

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

AUDITORS: SNG Grant Thornton Inc. FINANCIAL STATISTICS

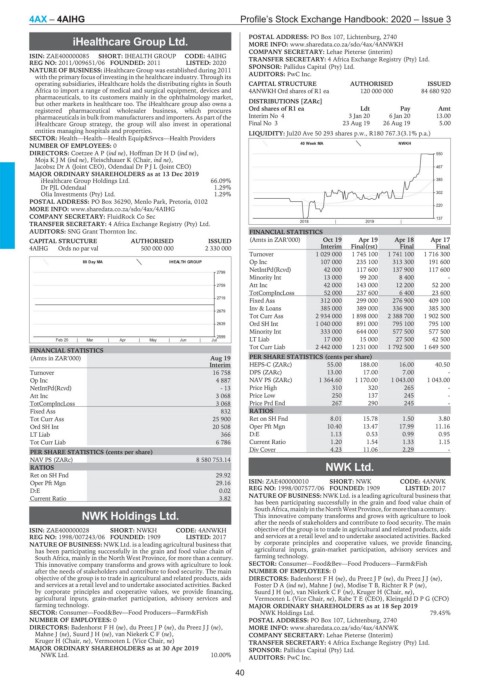

CAPITAL STRUCTURE AUTHORISED ISSUED (Amts in ZAR’000) Oct 19 Apr 19 Apr 18 Apr 17

4AIHG Ords no par val 500 000 000 2 330 000 Interim Final(rst) Final Final

Turnover 1 029 000 1 745 100 1 741 100 1 716 300

80 Day MA IHEALTH GROUP Op Inc 107 000 235 100 313 300 191 600

NetIntPd(Rcvd) 42 000 117 600 137 900 117 600

2799

Minority Int 13 000 99 200 8 400 -

2759 Att Inc 42 000 143 000 12 200 52 200

TotCompIncLoss 52 000 237 600 6 400 23 600

2719

Fixed Ass 312 000 299 000 276 900 409 100

Inv & Loans 385 000 389 000 336 900 385 300

2679

Tot Curr Ass 2 934 000 1 898 000 2 388 700 1 902 500

2639 Ord SH Int 1 040 000 891 000 795 100 795 100

Minority Int 333 000 644 000 577 500 577 500

2599

Feb 20 | Mar | Apr | May | Jun | Jul LT Liab 17 000 15 000 27 500 42 500

Tot Curr Liab 2 442 000 1 231 000 1 792 500 1 649 500

FINANCIAL STATISTICS

(Amts in ZAR’000) Aug 19 PER SHARE STATISTICS (cents per share)

Interim HEPS-C (ZARc) 55.00 188.00 16.00 40.50

Turnover 16 758 DPS (ZARc) 13.00 17.00 7.00 -

Op Inc 4 887 NAV PS (ZARc) 1 364.60 1 170.00 1 043.00 1 043.00

NetIntPd(Rcvd) - 13 Price High 310 320 265 -

Att Inc 3 068 Price Low 250 137 245 -

TotCompIncLoss 3 068 Price Prd End 267 290 245 -

Fixed Ass 832 RATIOS

Tot Curr Ass 25 900 Ret on SH Fnd 8.01 15.78 1.50 3.80

Ord SH Int 20 508 Oper Pft Mgn 10.40 13.47 17.99 11.16

LT Liab 366 D:E 1.13 0.53 0.99 0.95

Tot Curr Liab 6 786 Current Ratio 1.20 1.54 1.33 1.15

Div Cover 4.23 11.06 2.29 -

PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 8 580 753.14

RATIOS NWK Ltd.

Ret on SH Fnd 29.92 4ANWK

Oper Pft Mgn 29.16 ISIN: ZAE400000010 SHORT: NWK CODE: 4ANWK

D:E 0.02 REG NO: 1998/007577/06 FOUNDED: 1909 LISTED: 2017

Current Ratio 3.82 NATURE OF BUSINESS: NWK Ltd. is a leading agricultural business that

has been participating successfully in the grain and food value chain of

SouthAfrica,mainlyintheNorthWestProvince,formorethanacentury.

NWK Holdings Ltd. This innovative company transforms and grows with agriculture to look

after the needs of stakeholders and contribute to food security. The main

4ANWKH

ISIN: ZAE400000028 SHORT: NWKH CODE: 4ANWKH objective of the group is to trade in agricultural and related products, aids

REG NO: 1998/007243/06 FOUNDED: 1909 LISTED: 2017 and services at a retail level and to undertake associated activities. Backed

NATURE OF BUSINESS: NWK Ltd. is a leading agricultural business that by corporate principles and cooperative values, we provide financing,

has been participating successfully in the grain and food value chain of agricultural inputs, grain-market participation, advisory services and

South Africa, mainly in the North West Province, for more than a century. farming technology.

This innovative company transforms and grows with agriculture to look SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

after the needs of stakeholders and contribute to food security. The main NUMBER OF EMPLOYEES: 0

objective of the group is to trade in agricultural and related products, aids DIRECTORS: BadenhorstFH(ne), du PreezJP(ne), du PreezJJ(ne),

and services at a retail level and to undertake associated activities. Backed FosterDA(ind ne), Mahne J (ne), Modise T B, RichterRP(ne),

by corporate principles and cooperative values, we provide financing, SuurdJH(ne), van NiekerkCF(ne), Kruger H (Chair, ne),

agricultural inputs, grain-market participation, advisory services and Vermooten L (Vice Chair, ne), Rabe T E (CEO), KleingeldDPG (CFO)

farming technology. MAJOR ORDINARY SHAREHOLDERS as at 18 Sep 2019

SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish NWK Holdings Ltd. 79.45%

NUMBER OF EMPLOYEES: 0 POSTAL ADDRESS: PO Box 107, Lichtenburg, 2740

DIRECTORS: BadenhorstFH(ne), du PreezJP(ne), du PreezJJ(ne), MORE INFO: www.sharedata.co.za/sdo/4ax/4ANWK

Mahne J (ne), SuurdJH(ne), van NiekerkCF(ne), COMPANY SECRETARY: Lehae Pieterse (Interim)

Kruger H (Chair, ne), Vermooten L (Vice Chair, ne) TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2019 SPONSOR: Pallidus Capital (Pty) Ltd.

NWK Ltd. 10.00%

AUDITORS: PwC Inc.

40