Page 150 - Stock Exchange Handbook 2020 - Issue 3

P. 150

JSE – IND Profile’s Stock Exchange Handbook: 2020 – Issue 3

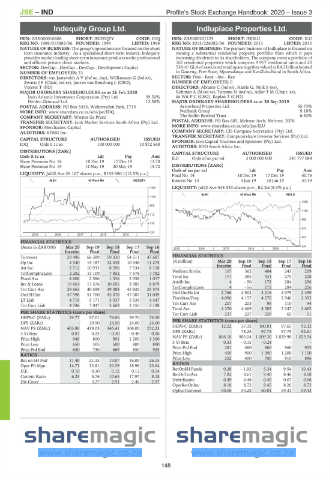

Indequity Group Ltd. Indluplace Properties Ltd.

IND IND

ISIN: ZAE000016606 SHORT: INDEQTY CODE: IDQ ISIN: ZAE000201125 SHORT: INDLU CODE: ILU

REG NO: 1998/015883/06 FOUNDED: 1995 LISTED: 1998 REG NO: 2013/226082/06 FOUNDED: 2013 LISTED: 2015

NATURE OF BUSINESS: The group’s operations are focused on the short NATURE OF BUSINESS: The primary business of Indluplace is focused on

term insurance industry. As a specialised short-term insurer, Indequity owning a substantial residential property portfolio from which it pays

provides market leading short-term insurance products to the professional increasing dividends to its shareholders. The company owns a portfolio of

and affluent private client markets. 167 residential properties which comprise 9 917 residential units and 20

SECTOR: DevCap—DevCap—DevCap—Development Capital 538 m 2 GLAofassociatedretailspace togethervaluedatR4.2 billionlocated

NUMBER OF EMPLOYEES: 23 in Gauteng, Free State, Mpumalanga and KwaZulu-Natal in South Africa.

DIRECTORS: van JaarsveldtAV(ind ne, Aus), Williamson G (ind ne), SECTOR: Fins—Rest—Inv—Res

Zwarts J F (Chair, ind ne), Jansen van Rensburg L (CEO), NUMBER OF EMPLOYEES: 0

Vorster T (FD) DIRECTORS: Abrams C (ind ne), Harris G, Noik S (ne),

Rehman A (ld ind ne), Tetyana N (ind ne), Adler T M (Chair, ne),

MAJOR ORDINARY SHAREHOLDERS as at 26 Feb 2020

Indo Atlantic Investment Corporation (Pty) Ltd. 39.50% de Wit P C (CEO), Kaplan T (CFO)

Heiden Grimaud Ltd. 12.58% MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2019

POSTAL ADDRESS: PO Box 5433, Weltevreden Park, 1715 Arrowhead Properties Ltd. 55.73%

MORE INFO: www.sharedata.co.za/sdo/jse/IDQ Nedbank Group 9.18%

COMPANY SECRETARY: Werner du Preez The Buffet Bewind Trust 6.53%

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. POSTAL ADDRESS: PO Box 685, Melrose Arch, Melrose, 2076

SPONSOR: Merchantec Capital MORE INFO: www.sharedata.co.za/sdo/jse/ILU

AUDITORS: KPMG Inc. COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

IDQ Ords 0.1c ea 100 000 000 10 872 568

AUDITORS: BDO South Africa Inc.

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

Ords 0.1c ea Ldt Pay Amt ILU Ords of no par val 3 000 000 000 341 797 084

Share Premium No 16 10 Dec 19 17 Dec 19 13.78

Share Premium No 15 14 May 19 20 May 19 15.72 DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul20 Ave 26 167 shares p.w., R195 980.1(12.5% p.a.) Ords of no par val Ldt Pay Amt

Final No 14 10 Dec 19 17 Dec 19 40.76

ALSH 40 Week MA INDEQTY Interim No 13 4 Jun 19 10 Jun 19 37.49

1300 LIQUIDITY: Jul20 Ave 548 533 shares p.w., R2.2m(8.3% p.a.)

ALSH 40 Week MA INDLU

1104

1326

908

1109

712

892

516

674

320

2015 | 2016 | 2017 | 2018 | 2019 |

457

FINANCIAL STATISTICS

(Amts in ZAR’000) 240

2015 | 2016 | 2017 | 2018 | 2019 |

Sep 19

Mar 20

Sep 18

Sep 16

Sep 17

Interim Final Final Final Final

Turnover 29 496 66 589 59 330 54 511 47 687 FINANCIAL STATISTICS

Op Inc 4 340 15 187 12 038 10 346 11 275 (R million) Mar 20 Sep 19 Sep 18 Sep 17 Sep 16

Att Inc 2 712 10 933 8 596 7 534 8 118 Interim Final Final Final Final

TotCompIncLoss 2 282 13 109 7 852 7 578 7 782 NetRent/InvInc 167 362 404 243 209

Fixed Ass 4 606 2 586 1 336 2 058 1 017 Total Inc 171 385 431 275 228

Inv & Loans 19 664 17 576 10 695 3 985 8 879 Attrib Inc 4 - 56 172 284 256

Tot Curr Ass 29 663 40 559 39 088 45 926 25 575 TotCompIncLoss 4 - 56 172 284 256

Ord SH Int 47 598 51 700 45 078 47 087 31 049 Ord UntHs Int 2 766 2 902 3 216 2 979 2 459

LT Liab 4 719 5 171 5 537 5 539 4 447 FixedAss/Prop 4 096 4 157 4 270 2 946 2 392

Tot Curr Liab 4 746 7 047 3 669 2 555 3 128 Tot Curr Ass 207 203 98 110 94

Total Ass 4 370 4 469 4 582 3 247 2 662

Tot Curr Liab 237 227 229 65 51

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 24.77 97.01 74.06 59.70 74.50

DPS (ZARc) - 29.50 24.50 24.00 24.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 403.80 419.05 345.41 368.00 272.23 HEPS-C (ZARc) 12.22 37.32 100.81 97.65 92.32

3 Yr Beta 0.87 0.23 - 0.30 - 0.48 0.06 DPS (ZARc) - 78.25 97.75 97.75 92.61

Price High 949 800 901 1 200 1 300 NAV PS (ZARc) 866.18 903.04 1 009.30 1 029.98 1 023.54

Price Low 650 305 500 800 890 3 Yr Beta 0.33 - 0.15 - 0.24 - -

Price Prd End 650 730 669 850 925 Price Prd End 281 460 860 960 925

Price High 459 900 1 090 1 200 1 150

RATIOS Price Low 262 400 700 910 896

Ret on SH Fnd 11.40 21.15 19.07 16.00 26.15

Oper Pft Mgn 14.71 22.81 20.29 18.98 23.64 RATIOS

D:E 0.10 0.10 0.12 0.12 0.14 RetOnSH Funds 0.28 - 1.92 5.34 9.54 10.43

Current Ratio 6.25 5.76 10.65 17.97 8.18 RetOnTotAss 7.82 8.61 9.40 8.46 8.58

Div Cover - 3.27 2.91 2.46 2.97 Debt:Equity 0.49 0.46 0.40 0.07 0.06

OperRetOnInv 8.18 8.72 9.45 8.26 8.72

OpInc:Turnover 50.06 55.28 60.01 59.33 59.43

148