Page 130 - Stock Exchange Handbook 2020 - Issue 3

P. 130

JSE – FIR Profile’s Stock Exchange Handbook: 2020 – Issue 3

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 CAPITAL STRUCTURE AUTHORISED ISSUED

Pershing LLC 39.20% FSR Ords 1c ea 6 001 688 450 5 609 488 001

Net 1 Finance Holdings 28.10% FSRP Prefs 1c ea 100 000 000 45 000 000

Kings Reign Investments (Pty) Ltd. 19.50%

POSTAL ADDRESS: PO Box 2127, Brooklyn Square, 0075 DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/FGL Ords 1c ea Ldt Pay Amt

COMPANY SECRETARY: B C Bredenkamp Interim No 44 31 Mar 20 6 Apr 20 146.00

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. Final No 43 23 Sep 19 30 Sep 19 152.00

SPONSOR: Grindrod Bank Ltd. LIQUIDITY: Jul20 Ave 65m shares p.w., R3 550.9m(60.0% p.a.)

AUDITORS: BDO South Africa Inc.

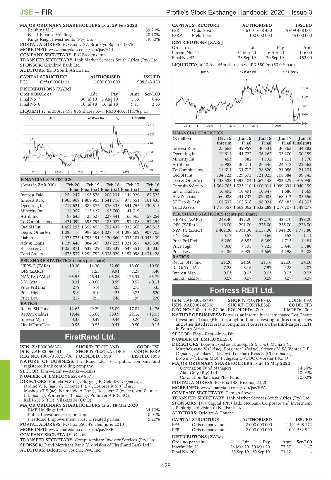

BANK 40 Week MA FIRSTRAND

CAPITAL STRUCTURE AUTHORISED ISSUED

FGL Ords 0.0001c ea 1 000 000 000 908 243 450

6703

DISTRIBUTIONS [ZARc]

5799

Ords 0.0001c ea Ldt Pay Amt Scr/100

FinalNo 7 30 Jul19 5 Aug 19 1.55 0.43

Final No 6 10 Jul 18 16 Jul 18 9.91 2.53 4894

LIQUIDITY: Jul20 Ave 197 866 shares p.w., R630 405.8(1.1% p.a.)

3990

ALSH 40 Week MA FINBOND

3086

610 2015 | 2016 | 2017 | 2018 | 2019 |

528 FINANCIAL STATISTICS

(R million) Dec 19 Jun 19 Jun 18 Jun 17 Jun 16

445

Interim Final Final Final Final(rst)

Interest Rcvd 25 668 49 957 40 531 36 863 34 882

363

Operating Inc 19 614 41 722 36 262 33 200 30 159

Minority Int 453 882 1 132 1 211 1 170

280

Attrib Inc 13 982 30 211 26 546 24 572 22 563

198 TotCompIncLoss 14 611 31 717 28 820 24 086 24 204

2015 | 2016 | 2017 | 2018 | 2019 |

Ord SH Int 134 723 129 673 121 025 108 884 99 745

Dep & OtherAcc 1 438 588 1 393 104 1 267 448 983 529 919 930

FINANCIAL STATISTICS

(Amts in ZAR’000) Feb 20 Feb 19 Feb 18 Feb 17 Feb 16 Deposits&Accep 1 564 763 1 523 110 1 400 014 1 099 691 1 040 159

Inv & Trad Sec 10 493 10 491 10 847 1 686 1 569

Final Final(rst) Final(rst) Final(rst) Final

Interest Paid 254 247 193 876 208 231 144 929 87 525 Adv & Loans 260 088 241 732 209 085 168 012 185 556

Interest Rcvd 1 903 969 1 809 953 1 541 716 978 551 161 435 ST Dep & Cash 106 537 102 518 96 024 68 483 64 303

Operating Inc 717 621 882 873 878 335 541 755 - 230 515 Total Assets 1 716 357 1 669 062 1 532 289 1 217 707 1 149 277

Minority Int 116 957 113 427 93 760 41 719 -

Attrib Inc 97 643 26 528 227 441 165 565 57 254 PER SHARE STATISTICS (cents per share) 472.70 423.70 399.20

HEPS-C (ZARc)

497.20

249.40

TotCompIncLoss 421 099 395 792 185 027 97 108 57 254

Ord SH Int 1 452 293 1 352 455 792 437 935 668 388 813 DPS (ZARc) 146.00 291.00 275.00 255.00 226.00

Dep & OtherAcc 1 095 116 998 604 1 027 114 1 098 609 907 705 NAV PS (ZARc) 2 402.20 2 331.30 2 157.90 1 941.20 1 778.80

Liabilities 2 973 773 1 793 191 2 120 660 2 035 181 1 043 439 3 Yr Beta 0.77 0.57 0.66 0.52 1.11

Adv & Loans 1 139 446 984 369 937 223 1 021 557 438 530 Price Prd End 6 280 6 855 6 389 4 715 4 484

Price High 7 000 7 195 7 725 5 446 5 780

ST Dep & Cash 1 055 871 532 429 422 339 547 351 136 035

Total Assets 4 673 537 3 299 792 3 036 029 3 197 098 1 431 428 Price Low 5 486 5 900 4 669 4 198 3 408

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fund 21.20 21.50 21.16 22.00 24.00

HEPS-C (ZARc) 10.30 14.20 32.80 18.60 10.50 RetOnTotalAss 7.28 8.16 7.97 9.28 2.07

DPS (ZARc) - 1.55 9.91 7.28 3.40 Interest Mgn 0.03 0.03 0.03 0.03 0.03

NAV PS (ZARc) 165.55 146.41 105.86 125.31 65.79 LiquidFnds:Dep 0.07 0.07 0.08 0.07 0.07

3 Yr Beta 0.31 - 0.66 0.99 0.57 - 0.11

Price Prd End 279 514 325 275 335

Price High 519 610 425 375 520 Fortress REIT Ltd.

Price Low 217 255 246 199 270 FOR

ISIN: ZAE000248498 SHORT: FORTRESSA CODE: FFA

RATIOS ISIN: ZAE000248506 SHORT: FORTRESSB CODE: FFB

Ret on SH Fund 12.63 9.29 35.09 17.84 14.76 REG NO: 2009/016487/06 FOUNDED: 2009 LISTED: 2009

RetOnTotalAss 19.44 36.66 38.69 22.16 - 18.03 NATURE OF BUSINESS:Fortress,aninternallyassetmanaged RealEstate

Interest Mgn 0.35 0.49 0.44 0.26 0.05 Investment Trust (REIT) is a hybrid fund, investing in direct properties

LiquidFnds:Dep 0.96 0.53 0.41 0.50 0.15 and other listed real estate companies. Fortress are the third-largest REIT

in South Africa.

FirstRand Ltd. SECTOR: Fins—Rest—Inv—Div

NUMBER OF EMPLOYEES: 0

FIR DIRECTORS: Lopion I (ind ne), Ludolph S (ind ne), Majija S V,

ISIN: ZAE000066304 SHORT: FIRSTRAND CODE: FSR Mutshekwane V (ind ne), Potgieter J (ind ne), Stevens M W, Venter D P

ISIN: ZAE000060141 SHORT: FIRSTRANDB-P CODE: FSRP C(ind ne), Vilakazi T (ind ne), Lockhart-Ross R (Chair, ind ne),

REG NO: 1966/010753/06 FOUNDED: 1998 LISTED: 1998 Brown S (CEO & MD), Pydigadu D (COO), Vorster I (CFO)

NATURE OF BUSINESS: FirstRand Ltd. is a public company and

registered bank controlling company. MAJOR ORDINARY SHAREHOLDERS as at 15 May 2020 14.66%

Coronation Fund Managers

SECTOR: Fins—Banks—Banks—Banks Alan Gray (Pty) Ltd. 10.04%

NUMBER OF EMPLOYEES: 49 867 Coronation Balanced Plus Fund 10.00%

DIRECTORS: BomelaMS(ne), Burger J P, GelinkGG(ind ne), POSTAL ADDRESS: PO Box 138, Rivonia, 2128

JardineWR(ind ne), Knoetze F (ne), LoubserRM(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/FFA

MashegoTS(ne), NzimandeAT(ne), Roscherr Z (ind ne), von Zeuner COMPANY SECRETARY: Tamlyn Stevens

LL(ind ne), Winterboer T (ind ne), Pullinger A P (CEO),

Kellan H S (FD), Vilakazi M (COO) TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

SPONSORS: Java Capital (Pty) Ltd., Nedbank Corporate and Investment

MAJOR ORDINARY SHAREHOLDERS as at 18 Mar 2020 Banking, a division of Nedbank Ltd.

RMB Holdings Ltd. 34.10%

Public Investment Corporation 10.01% AUDITORS: Deloitte & Touche

FirstRand Empowerment Trust & related parties 5.20%

CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 650149, Benmore, 2010 FFA Ords no par value 2 000 000 000 1 191 595 172

MORE INFO: www.sharedata.co.za/sdo/jse/FSR FFB Ords no par value 2 000 000 000 1 091 532 994

COMPANY SECRETARY: C Low

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. DISTRIBUTIONS [ZARc]

Amt

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) Ords no par value 24 Mar 20 30 Mar 20 77.67 Scr/100

Pay

Ldt

1.47

Interim No 21

AUDITORS: Deloitte & Touche, PwC Inc.

Final No 20 23 Sep 19 30 Sep 19 73.62 -

128