Page 52 - SHB 2020 Issue 1

P. 52

4AX – 4ANWK Profile’s Stock Exchange Handbook: 2020 – Issue 1

NWK Ltd.

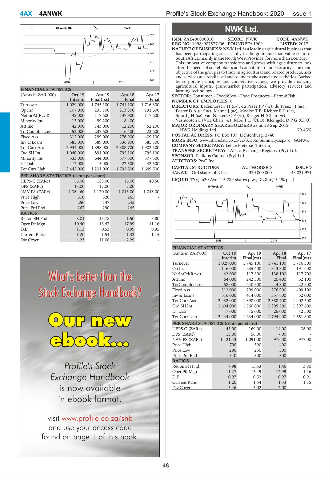

40 Week MA NWKH

320 4ANWK

ISIN: ZAE400000010 SHORT: NWK CODE: 4ANWK

283 REG NO: 1998/007577/06 FOUNDED: 1909 LISTED: 2017

NATURE OF BUSINESS: NWK Ltd. is a leading agricultural business that

247 has been participating successfully in the grain and food value chain of

South Africa, mainly in the North West Province, for more than a century.

210 This innovative company transforms and grows with agriculture to look

after the needs of stakeholders and contribute to food security. The main

174 objective of the group is to trade in agricultural and related products, aids

and services at a retail level and to undertake associated activities. Backed

137 by corporate principles and cooperative values, we provide financing,

2018 | 2019

agricultural inputs, grain-market participation, advisory services and

FINANCIAL STATISTICS farming technology.

(Amts in ZAR’000) Oct 19 Apr 19 Apr 18 Apr 17 SECTOR: Consumer—Food&Bev—Food Producers—Farm&Fish

Interim Final(rst) Final Final NUMBER OF EMPLOYEES: 0

Turnover 1 029 000 1 745 100 1 741 100 1 716 300

DIRECTORS: Badenhorst F H (ne), du Preez J P (ne), du Preez J J (ne),

Op Inc 107 000 235 100 313 300 191 600 Foster D A (ind ne), Mahne J (ne), Modise T B, Richter R P (ne),

NetIntPd(Rcvd) 42 000 117 600 137 900 117 600 Suurd J H (ne), van Niekerk C F (ne), Kruger H (Chair, ne),

Minority Int 13 000 99 200 8 400 - Vermooten L (Vice Chair, ne), Rabe T E (CEO), Kleingeld D P G (CFO)

Att Inc 42 000 143 000 12 200 52 200 MAJOR ORDINARY SHAREHOLDERS as at 18 Sep 2019

TotCompIncLoss 52 000 237 600 6 400 23 600 NWK Holdings Ltd. 79.45%

Fixed Ass 312 000 299 000 276 900 409 100 POSTAL ADDRESS: PO Box 107, Lichtenburg, 2740

Inv & Loans 385 000 389 000 336 900 385 300 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=4ANWK

Tot Curr Ass 2 934 000 1 898 000 2 388 700 1 902 500 COMPANY SECRETARY: Lehae Pieterse (Interim)

Ord SH Int 1 040 000 891 000 795 100 795 100 TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd.

SPONSOR: Pallidus Capital (Pty) Ltd.

Minority Int 333 000 644 000 577 500 577 500

LT Liab 17 000 15 000 27 500 42 500 AUDITORS: PwC Inc.

Tot Curr Liab 2 442 000 1 231 000 1 792 500 1 649 500 CAPITAL STRUCTURE AUTHORISED ISSUED

4ANWK Ord shares of R1 ea 320 000 000 143 031 971

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 55.00 188.00 16.00 40.50 LIQUIDITY: Jan20 Ave 415 789 shares p.w., R2.8m(15.1% p.a.)

DPS (ZARc) 13.00 17.00 7.00 - 40 Week MA NWK

NAV PS (ZARc) 1 364.60 1 170.00 1 043.00 1 043.00

390

Price High 310 320 265 -

Price Low 250 137 245 - 362

Price Prd End 267 290 245 -

334

RATIOS

Ret on SH Fnd 8.01 15.78 1.50 3.80

306

Oper Pft Mgn 10.40 13.47 17.99 11.16

D:E 1.13 0.53 0.99 0.95 278

Current Ratio 1.20 1.54 1.33 1.15

Div Cover 4.23 11.06 2.29 - 2018 | 2019 250

FINANCIAL STATISTICS

(Amts in ZAR’000) Oct 19 Apr 19 Apr 18 Apr 17

Interim Final(rst) Final Final(rst)

Turnover 1 029 000 1 745 100 1 741 100 1 716 300

Op Inc 116 000 235 400 313 300 191 600

NetIntPd(Rcvd) 42 000 117 800 138 100 117 700

Att Inc 64 000 242 300 20 400 52 100

TotCompIncLoss 58 000 240 600 4 300 22 600

Fixed Ass 312 000 299 000 276 900 409 100

Inv & Loans 616 000 414 000 357 600 32 000

Tot Curr Ass 2 932 000 1 898 000 2 388 700 1 902 500

Ord SH Int 1 604 000 1 560 000 1 395 500 1 397 600

LT Liab 17 000 15 000 26 000 42 500

Tot Curr Liab 2 444 000 1 234 000 1 794 900 1 651 800

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 45.00 169.00 14.00 36.00

DPS (ZARc) 13.00 56.00 7.00 -

NAV PS (ZARc) 1 121.43 1 091.00 976.00 977.00

Price High 700 390 400 -

Price Low 290 250 300 -

Price Prd End 340 300 300 -

RATIOS

Profile's Stock Ret on SH Fnd 7.98 15.53 1.46 3.80

Oper Pft Mgn 11.27 13.49 17.99 11.16

Exchange Handbook D:E 0.97 0.52 0.97 0.91

Current Ratio 1.20 1.54 1.33 1.15

is now available Div Cover 3.46 3.02 2.00 -

in ebook format.

visit www.profile.co.za/shb

and use your access code

found on page 1 of this book.

48