Page 43 - SHB 2020 Issue 1

P. 43

Profile’s Stock Exchange Handbook: 2020 – Issue 1 NSX – FNB

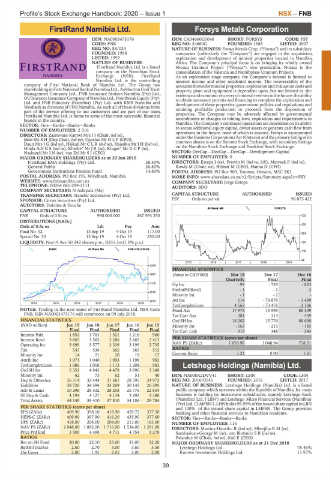

FirstRand Namibia Ltd. Forsys Metals Corporation

FNB FSY

ISIN: NA0003475176 ISIN: CA34660G1046 SHORT: FORSYS CODE: FSY

CODE: FNB REG NO: 34660G FOUNDED: 1985 LISTED: 2007

REG NO: 88/024 NATURE OF BUSINESS: Forsys Metals Corp. (“Forsys”) and its subsidiary

FOUNDED: 1988 companies (collectively the “Company”) are engaged in the acquisition,

LISTED: 1997 exploration and development of mineral properties located in Namibia,

NATURE OF BUSINESS: Africa. The Company’s principal focus is on bringing its wholly owned

FirstRand Namibia Ltd. is a listed Norasa Uranium Project (“Norasa”) into production. Norasa is the

company on the Namibian Stock consolidation of the Valencia and Namibplaas Uranium Projects.

Exchange (NSX). FirstRand As an exploration stage company, the Company’s income is limited to

Namibia Ltd. is the controlling interest income and other incidental income. The recoverability of the

company of First National Bank of Namibia Ltd. The Group has amounts shown for mineral properties, exploration and evaluation costs and

shareholding in First National Bank of Namibia Ltd., Ashburton Unit Trust property, plant and equipment is dependent upon, but not limited to: the

Management Company Ltd., FNB Insurance Brokers Namibia (Pty) Ltd., existence and economic recovery of mineral reserves in the future; the ability

OUTsurance Insurance Company of Namibia Ltd., Pointbreak Equity (Pty) to obtain necessary permits and financing to complete the exploration and

Ltd. and FNB Fiduciary (Namibia) (Pty) Ltd. with RMB Namibia and development of these properties; government policies and regulations; and

WesBank as divisions of FNB Namibia. As such all of these divisions form attaining profitable production or proceeds from the disposition of

part of the service offering to our customers and are part of our team.

FirstRand Namibia Ltd. is home to some of the most successful financial properties. The Company may be adversely affected by governmental

brands in the country. amendments or changes to mining laws, regulations and requirements in

SECTOR: Fins—Banks—Banks—Banks Namibia. The Company’s continued operations are dependent on its ability

NUMBER OF EMPLOYEES: 2 316 to secure additional equity capital, divest assets or generate cash flow from

operations in the future, none of which is assured. Forsys is incorporated

DIRECTORS: Zaamwani-Kamwi Mrs I I (Chair, ind ne), under the Business Corporations Act (Ontario) and the primary listing of its

Moir Mr S H (Dep Chair, ind ne), Capelao Mr O L P (CFO),

Daun Mrs J G (ind ne), Haikali Mr C L R (ind ne), Hausiku Mr J H (ind ne), common shares is on the Toronto Stock Exchange, with secondary listings

on the Namibian Stock Exchange and Frankfurt Stock Exchange.

Hinda Adv G S (ind ne), Khethe* Mr J R (ne), Kruger* Mr G C P (ne),

Nashandi Mr I N (ne), van Zyl Mr S J (CEO) SECTOR: DevCap—DevCap—DevCap—Development Capital

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2019 NUMBER OF EMPLOYEES: 0

FirstRand EMA Holdings (Pty) Ltd. 58.40% DIRECTORS: Estepa J (ne), Frewin M (ind ne, UK), Matysek P (ind ne),

General Public 26.80% Rowly M (Chair, ne), Hilmer M (CEO), Hanna D (CFO)

Government Institutions Pension Fund 14.80% POSTAL ADDRESS: PO Box 909, Toronto, Ontario, M5C 2K3

POSTAL ADDRESS: PO Box 195, Windhoek, Namibia MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=FSY

WEBSITE: www.fnbnamibia.com.na COMPANY SECRETARY: Jorge Estepa

TELE PHONE: 00264 061-299-2111 AUDITORS: BDO

COMPANY SECRETARY: N Ashipala (Ms)

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Cirrus Securities (Pty) Ltd. FSY Ords no par val - 96 875 422

AUDITORS: Deloitte & Touche

40 Week MA FORSYS

CAPITAL STRUCTURE AUTHORISED ISSUED

FNB Ords of 0.5c ea 990 000 000 267 593 250 332

DISTRIBUTIONS [NADc]

278

Ords of 0.5c ea Ldt Pay Amt

Final No 52 13 Sep 19 4 Oct 19 117.00

224

Special No 53 13 Sep 19 4 Oct 19 250.00

LIQUIDITY: Nov19 Ave 50 242 shares p.w., R231.5m(1.0% p.a.) 170

BANK 40 Week MA FNB HOLDINGS

116

62

2015 | 2016 | 2017 | 2018 | 2019

4245

FINANCIAL STATISTICS

3687 (Amts in CAD’000) Mar 18 Dec 17 Dec 16

Quarterly Final Final

3130

Op Inc - 99 - 729 - 823

NetIntPd(Rcvd) - 1 - 1 - 3

2572

Minority Int - 1 - 2 -

Att Inc 114 - 74 879 - 1 499

2015

2014 | 2015 | 2016 | 2017 | 2018 | 2019

TotCompIncLoss 4 562 - 73 476 2 106

NOTES: Trading in the new name of FirstRand Namibia Ltd, NSX Code Fixed Ass 17 973 15 595 88 309

FNB, ISIN NA0003475176 will commence on 09 July 2018.

Tot Curr Ass 381 314 439

FINANCIAL STATISTICS Ord SH Int 18 202 15 776 88 690

(NAD million) Jun 19 Jun 18 Jun 17 Jun 16 Jun 15 Minority Int - 163 - 215 - 185

Final Final Final Final Final Tot Curr Liab 315 348 243

Interest Paid 1 852 1 763 1 521 1 216 960

Interest Rcvd 3 865 3 583 3 286 2 869 2 413 PER SHARE STATISTICS (cents per share)

Operating Inc 3 699 3 577 3 339 3 199 2 735 NAV PS (ZARc) 1 093.98 1 048.94 718.51

Tax 547 536 565 565 515 RATIOS

Minority Int 14 21 20 19 17 Current Ratio 1.21 0.90 1.81

Attrib Inc 1 071 1 040 1 093 1 198 982

TotCompIncLoss 1 086 1 058 1 113 1 204 983 Letshego Holdings (Namibia) Ltd.

Ord SH Int 5 353 4 943 4 479 3 990 3 349

LHN

Minority Int 62 73 62 51 40 ISIN: NA000A2DVV41 SHORT: LHN CODE: LHN

Dep & OtherAcc 36 314 32 444 31 681 28 595 24 972 REG NO: 2016/0145 FOUNDED: 2016 LISTED: 2017

Liabilities 38 726 34 394 33 269 30 145 26 395 NATURE OF BUSINESS: Letshego Holdings (Namibia) Ltd. is a listed

Adv & Loans 30 298 28 532 28 258 25 776 22 834 public company, which operates within the Republic of Namibia. Its main

ST Dep & Cash 4 194 4 127 4 134 3 892 2 380 business is holding its investment subsidiaries, namely Letshego Bank

Total Assets 44 140 39 410 37 810 34 186 29 784 (Namibia) Ltd. (‘LBN’) and Letshego Micro Financial Services (Namibia)

(Pty) Ltd. (‘LMFSN’). LHN holds 99.99% of the issued share capital in LBN

PER SHARE STATISTICS (cents per share) and 100% of the issued share capital in LMFSN. The Group provides

EPS (ZARc) 409.90 398.10 418.90 459.72 377.50 banking and other financial services to Namibian residents.

HEPS-C (ZARc) 409.90 397.90 416.20 435.90 377.60 SECTOR: Fins—Banks—Banks—Banks

DPS (ZARc) 458.00 204.00 204.00 213.00 183.00 NUMBER OF EMPLOYEES: 116

NAV PS (ZARc) 2 048.00 1 892.00 1 716.00 1 534.00 1 291.00 DIRECTORS: Martins-Hausiku R (ind ne), Mbetjiha R M (ne),

Price Prd End 3 500 4 498 4 711 4 754 3 278 Sambasivan-George M (ne), von Blottnitz S B (ind ne),

RATIOS Palanduz M (Chair, ind ne), Kali E (CEO)

Ret on SH Fund 20.80 22.10 25.60 31.00 32.20 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018

RetOnTotalAss 2.60 2.70 3.00 3.60 3.50 Letshego Holdings Ltd. 78.46%

Div Cover 2.00 1.95 2.05 2.00 2.00 Kumwe Investment Holdings Ltd. 11.97%

39