Page 188 - SHB 2020 Issue 1

P. 188

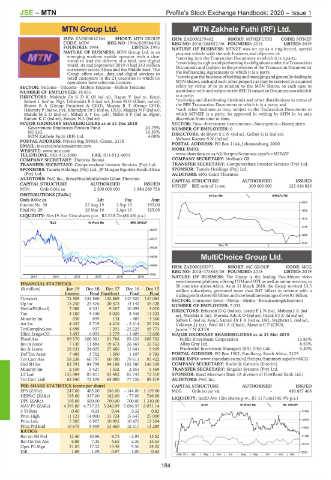

JSE – MTN Profile’s Stock Exchange Handbook: 2020 – Issue 1

MTN Group Ltd. MTN Zakhele Futhi (RF) Ltd.

MTN MTN

ISIN: ZAE000042164 SHORT: MTN GROUP ISIN: ZAE000279402 SHORT: MTNZFUTHI CODE: MTNZF

CODE: MTN REG NO: 1994/009584/06 REG NO: 2016/268837/06 FOUNDED: 2016 LISTED: 2019

FOUNDED: 1994 LISTED: 1995 NATURE OF BUSINESS: MTNZF was set up as a ring-fenced, special

NATURE OF BUSINESS: MTN Group Ltd. is an purpose vehicle with the sole business and objective of:

emerging markets mobile operator with a clear *entering into the Transaction Documents to which it is a party;

vision to lead the delivery of a bold, new digital *exercising its rights and performing its obligations under the Transaction

world. At end September 2019 it had 243 million Documents and (subject to the provisions of the Transaction Documents)

customers across Africa and the Middle East. The

Group offers voice, data and digital services to the Refinancing Agreements to which it is a party;

retail customers in the 21 countries in which its *carrying on the business of holding and managing and generally dealing in

operations have telecoms licences. MTN Shares, cash and such other property as may be received or acquired

SECTOR: Telcoms—Telcoms—Mobile Telcoms—Mobile Telcoms solely by virtue of or in relation to the MTN Shares, in each case in

NUMBER OF EMPLOYEES: 18 835 accordance with and subject to the BEE Transaction Documents to which it

DI REC TORS: Mokhele Dr K D K (ld ind ne), Rague V (ind ne, Keny), is a party;

Sanusi L (ind ne, Nig), Tshabalala B S (ind ne), Jonas M H (Chair, ind ne), *receiving and distributing dividends and other distributions in terms of

Shuter R A (Group President & CEO), Mupita R T (Group CFO), the BEE Transaction Documents to which it is a party; and

Hanratty P (ind ne, Ire), Kheradpir Dr S (ind ne, USA), Mageza N P (ind ne), *such other business as may, subject to the Transaction Documents to

Marole M L D (ind ne), Mikati A T (ne, Leb), Miller S P (ind ne, Blgm), which MTNZF is a party, be approved in writing by MTN in its sole

Ramon K C (ind ne), Sowazi N L (ind ne) discretion from time to time.

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2018 SECTOR: Fins—Investment Instruments—Nonequities—Nonequities

Government Employees Pension Fund 24.75% NUMBER OF EMPLOYEES: 0

M1 Ltd. 10.50% DIRECTORS: de Bruyn S E N (ind ne), Gelink G G (ind ne),

MTN Zakhele Futhi (RF) Ltd. 4.08% Mabaso-Koyana S N (ind ne)

POSTAL ADDRESS: Private Bag X9955, Cresta, 2118

EMAIL: investor.relations@mtn.com POSTAL ADDRESS: PO Box 1144, Johannesburg, 2000

WEBSITE: www.mtn.com MORE INFO:

TELE PHONE: 083-912-3000 FAX: 011-912-4093 www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MTNZF

COMPANY SECRETARY: Thobeka Bonoyi COMPANY SECRETARY: Nedbank GS

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: Tamela Holdings (Pty) Ltd., JP Morgan Equities South Africa SPONSOR: Tamela Holdings (Pty) Ltd.

(Pty) Ltd. AUDITORS: SNG Grant Thornton

AUDITORS: PwC Inc., SizweNtsalubaGobodo Grant Thornton CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED MTNZF BEE ords of 1c eac 300 000 000 123 416 826

MTN Ords 0.01c ea 2 500 000 000 1 884 269 758

DISTRIBUTIONS [ZARc] 40 Day MA MTNZFUTHI

Ords 0.01c ea Ldt Pay Amt

Interim No 30 27 Aug 19 2 Sep 19 195.00 2000

Final No 29 26 Mar 19 1 Apr 19 325.00 1805

LIQUIDITY: Nov19 Ave 31m shares p.w., R3 018.7m(86.4% p.a.)

1610

TELE 40 Week MA MTN GROUP

1415

26007

1220

22217

1025

Dec 19 |

18428

14638 MultiChoice Group Ltd.

MUL

10849

ISIN: ZAE000265971 SHORT: MC GROUP CODE: MCG

REG NO: 2018/473845/06 FOUNDED: 2018 LISTED: 2019

7059

2014 | 2015 | 2016 | 2017 | 2018 | 2019 NATURE OF BUSINESS: The Group is the leading Pan-African video

entertainment platform, offering DTH and DTT as well as online services, in

FINANCIAL STATISTICS 50 countries across Africa. As at 31 March 2018, the Group serviced 13.5

(R million) Jun 19 Dec 18 Dec 17 Dec 16 Dec 15 million subscribers, generated more than R47 billion in revenue with a

Interim Final Final(rst) Final Final trading profit of over R6 billion and core headline earnings of over R1 billion.

Turnover 72 505 134 560 132 869 147 920 147 063 SECTOR: Consumer Srvcs—Media—Media—Broadcasting&Entment

Op Inc 15 250 23 576 20 573 14 142 35 328 NUMBER OF EMPLOYEES: 7 053

NetIntPd(Rcvd) 7 088 8 331 9 267 10 495 3 010 DIRECTORS: Eriksson D G (ind ne), Letele F L N (ne), Mabuza J A (ind

Tax 3 180 5 430 5 020 8 346 11 322 ne), Masilela E (ne), Moroka Adv K D (ind ne), Pacak S J Z (ld ind ne),

Minority Int 858 859 134 - 489 3 366 Sabwa C (ind ne, Keny), Sanusi Dr F A (ind ne, UK), Stephens L (ind ne),

Att Inc 4 433 8 719 4 416 - 2 614 20 204 Volkwyn J J (ne), Patel M I A (Chair), Mawela C P (CEO),

TotCompIncLoss 4 698 937 1 291 - 25 225 45 773 Jacobs T N (CFO)

Hline Erngs-CO 3 497 6 055 3 279 - 1 409 13 600 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

Fixed Ass 99 570 100 581 91 786 95 633 106 702 Public Investment Corporation 13.81%

Inv in Assoc 7 149 11 884 19 673 26 669 35 552 Allan Gray Ltd. 8.53%

Inv & Loans 28 631 24 025 27 686 11 841 9 969 Prudential Investment Managers (SA) (Pty) Ltd. 5.30%

Def Tax Asset 7 489 3 702 1 590 1 107 9 783 POSTAL ADDRESS: PO Box 1502, Randburg, South Africa, 2125

Tot Curr Ass 58 238 60 797 60 780 79 611 95 422 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=MCG

Ord SH Int 82 791 84 799 94 188 102 380 146 369 COMPANY SECRETARY: Rochelle Gabriels (Interim)

Minority Int 2 159 3 427 1 532 2 851 5 469 TRANSFER SECRETARY: Singular Systems (Pty) Ltd.

LT Liab 135 984 83 811 83 482 85 743 72 510 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Tot Curr Liab 62 840 72 570 65 080 77 726 89 519 AUDITORS: PwC Inc.

PER SHARE STATISTICS (cents per share) CAPITAL STRUCTURE AUTHORISED ISSUED

EPS (ZARc) 247.00 485.00 246.00 - 144.00 1 109.00 MCG Ords no par val - 438 837 468

HEPS-C (ZARc) 195.00 337.00 182.00 - 77.00 746.00 LIQUIDITY: Jan20 Ave 12m shares p.w., R1 517.6m(145.9% p.a.)

DPS (ZARc) 195.00 500.00 700.00 700.00 1 310.00

NAV PS (ZARc) 4 393.80 4 717.23 5 240.09 5 696.55 8 031.14 ALSH 40 Week MA MC GROUP

3 Yr Beta 0.60 0.23 0.44 0.32 0.82 13765

Price High 11 123 14 000 13 724 15 647 25 000

Price Low 7 505 6 907 10 905 10 476 12 304 12879

Price Prd End 10 675 8 900 13 660 12 617 13 289 11992

RATIOS

Ret on SH Fnd 12.46 10.86 4.75 - 2.95 15.52 11106

Ret On Tot Ass 6.88 7.35 4.65 2.36 13.53

10219

Oper Pft Mgn 21.03 17.52 15.48 9.56 24.02

D:E 1.69 1.09 0.97 1.00 0.63 9333

| Mar 19 | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

184