Page 156 - SHB 2020 Issue 1

P. 156

JSE – HOS Profile’s Stock Exchange Handbook: 2020 – Issue 1

Hosken Passenger Logistics and Rail Hospitality Property Fund Ltd.

Ltd. ISIN: ZAE000214656 SHORT: HOSP-B CODE: HPB

HOS

HOS REG NO: 2005/014211/06 FOUNDED: 2005 LISTED: 2006

ISIN: ZAE000255907 SHORT: HPLR CODE: HPR NATURE OF BUSINESS: The Company is a Real Estate Investment Trust

REG NO: 2015/250356/06 FOUNDED: 2015 LISTED: 2018 (‘REIT’) listed on the JSE Ltd. (‘JSE’). The Company is the only specialised

NATURE OF BUSINESS: HPLR is an investment entity tailored to REIT in South Africa investing in the hotel and leisure sector, providing

consolidate and expand opportunities in the mobility and logistics sectors. investors with exposure to both the property and hospitality industries.

The current portfolio is rooted in the commuter bus and luxury coach SECTOR: Fins—Rest—Inv—Spec

segments. Through its principal subsidiary Golden Arrow Bus Services,

with over 157 years of proven operational expertise, the Company aims to NUMBER OF EMPLOYEES: 19

harness the combined institutional knowledge and skills sets to pursue DIRECTORS: Ahmed M H (ind ne), September C C (ind ne),

further prospects in bus and coach operations and potential entrées into von Aulock M N (ne), Copelyn J A (Chair, ne), de Lima M (FD),

freight, rail and logistics operations. McDonald L (ne), Nicolella J R (CEO)

SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Travel&Tourism MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019

NUMBER OF EMPLOYEES: 0 Southern Sun Hotels (Pty) Ltd. 59.15%

11.08%

Coronation Fund Managers

DIRECTORS: Govender L (ld ind ne), Jappie N (ind ne), HCI Foundation 7.41%

Watson R D (ind ne), Shaik Y (Chair, ne), Govender T G (

(Dep Chair, ne), Meyer F E (CEO), Wilkin M L (CFO) POSTAL ADDRESS: PO Box X200, Bryanston, 2021

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2019 MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=HPB

HCI 75.07% COMPANY SECRETARY: L R van Onselen

POSTAL ADDRESS: PO Box 115, Cape Town, 8000 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/v2/Scripts/Summary.aspx?c=HPR SPONSOR: Java Capital

COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd. AUDITORS: PwC Inc.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Investec Bank Ltd. HPB Ords no par value 2 000 000 000 578 154 207

AUDITORS: BDO Cape Incorporated

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED Ords no par value Ldt Pay Amt

HPR Ords no par val 1 000 000 000 290 000 000 Final No 21 13 Sep 16 19 Sep 16 78.62

DISTRIBUTIONS [ZARc] Interim No 20 11 Mar 16 22 Mar 16 77.00

Ords no par val Ldt Pay Amt LIQUIDITY: Jan20 Ave 739 180 shares p.w., R7.3m(6.6% p.a.)

Interim No 3 10 Dec 19 17 Dec 19 14.00

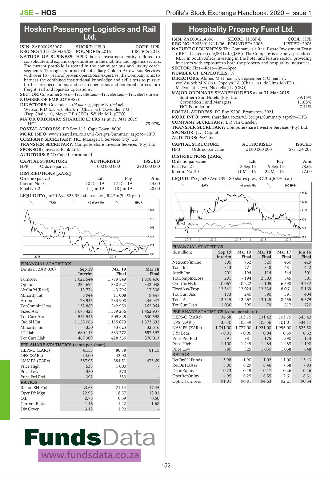

SAPY 40 Week MA HOSP-B

Final No 2 11 Jun 19 18 Jun 19 28.00

1462

LIQUIDITY: Jan20 Ave 526 364 shares p.w., R2.2m(9.4% p.a.)

TRAV 40 Week MA HPLR 1283

685 1105

619 926

553 748

487 569

2015 | 2016 | 2017 | 2018 | 2019

421

FINANCIAL STATISTICS

(R million) Sep 19 Mar 19 Mar 18 Mar 17 Jun 16

355

2018 | 2019 Interim Final Final Final Final

NetRent/InvInc 305 752 820 460 429

FINANCIAL STATISTICS

(Amts in ZAR’000) Sep 19 Mar 19 Mar 18 Total Inc 313 771 848 481 442

Interim Final Final Attrib Inc 201 - 194 114 544 501

Turnover 1 022 544 1 779 849 1 808 406 TotCompIncLoss 201 - 194 2 503 545 501

Op Inc 234 694 330 527 342 038 Ord UntHs Int 10 067 10 222 11 105 6 598 3 732

NetIntPd(Rcvd) 13 774 - 3 796 17 308 FixedAss/Prop 12 341 12 024 12 534 8 061 5 169

Minority Int 3 944 11 008 9 447 Tot Curr Ass 173 240 590 391 404

Att Inc 128 945 233 908 235 947 Total Ass 12 515 12 267 13 125 8 455 5 579

TotCompIncLoss 132 889 242 950 262 064 Tot Curr Liab 1 036 395 79 217 720

Fixed Ass 1 673 427 1 579 256 1 462 937 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 541 546 609 825 630 598 HEPS-C (ZARc) 34.68 103.15 131.42 103.75 345.42

Ord SH Int 1 125 066 1 115 079 1 373 692 DPS (ZARc) 35.40 105.39 105.56 101.01 534.17

Minority Int - 350 43 623 32 616 NAV PS (ZARc) 1 741.00 1 777.00 1 921.00 1 996.00 4 525.50

LT Liab 680 113 633 272 557 397 3 Yr Beta - 0.01 - 0.05 0.04 0.39 0.52

Tot Curr Liab 467 309 428 356 376 013 Price Prd End 791 981 1 175 1 390 1 113

PER SHARE STATISTICS (cents per share) Price High 1 100 1 249 1 484 1 485 1 190

HEPS-C (ZARc) 41.53 80.78 81.15 Price Low 780 825 1 050 1 068 648

DPS (ZARc) 14.00 42.00 - RATIOS

NAV PS (ZARc) 387.95 384.51 473.69 RetOnSH Funds 3.98 - 1.90 1.02 11.00 13.43

Price High 535 1 000 - RetOnTotAss 5.00 6.29 6.46 7.58 7.93

Price Low 350 370 - Debt:Equity 0.23 0.19 0.17 0.26 0.46

Price Prd End 391 380 - OperRetOnInv 4.95 6.25 6.55 7.61 8.31

RATIOS OpInc:Turnover 91.01 90.81 94.63 92.21 90.54

Ret on SH Fnd 23.63 21.14 17.45

Oper Pft Mgn 22.95 18.57 18.91

D:E 0.76 0.69 0.50

Current Ratio 1.16 1.42 1.68

Div Cover 3.18 1.92 -

152