Sunday Times - BUSINESS TIMES: MONEY

25 November 2001

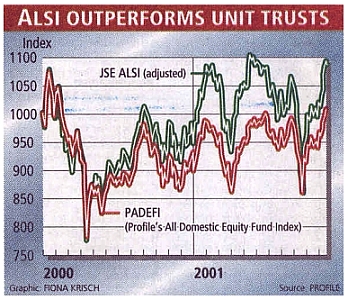

Domestic equity unit trusts this week got back to where they were in February last year, according to Profile’s Nic Oldert. His calculation is based on the performance of Padefi (Profile’s All Domestic Equity Fund Index), which has broken through 1000 barrier for the first time in 20 months.

Padefi closed at 1003.8 on Monday, having been below 1000 since February 16 2000. The index reached a low point of 786.6 on April 17 2000.

Padefi was created as a benchmark for the PSC Growth Fund. Its starting value was 1000 as at January 3 2000. The index is a weighted average of all domestic equity funds. It includes asset allocation funds, which usually have large holdings. It excludes the effects of dividends, but also excludes entry costs, making it a fairly pure measure of fund performance. As a weighted index, it is more influenced by larger funds, and is an indicator of the "average" experience of the South African investor in domestic equity funds.

"There was some controversy around the inclusion of asset allocation funds when we created Padefi," says Oldert, "but we say equities represent the single biggest asset class of these funds, with at least 60% in equities on average, hence they should be included."

The index moved down in sync with the JSE All Share Index from its start date in January 2000. It mirrored the movements of the JSE All Share very closely until April 2000, when it hit a low of 6633, Since then, says Oldert Padefi has increasingly diverged from the All Share, with the market index gradually outstripping the unit trusts. In the August JSE rally, Padefi was lagging the All Share by more than 6%.

So far, Padefi confirms the argument for tracker funds – managers of domestic equity funds do not, on average, outperform the market. In bull runs, the All Share seems to outpace the domestic equity funds, as if the upside performance of the unit trusts is capped in some way, according to Oldert. "This is very clear on a graph of Padefi against All Share Index." He says Padefi overstates returns because entry costs are not deducted. "Dividends would not compensate for this over a period as short as two years."

Oldert has been surprised at how closely Padefi matches a simple arithmetic average of unit trust price changes. "If you average the price change across the same universe of domestic equity unit trusts, from January 3 2000 to November 22 2001, you get a figure very close to Padefi.

"I would have expected the weighting to skew the index negatively, but the large funds have not dragged the index down."

Of the 167 funds in Padefi at January 3 2000, only 68 have given a positive return without dividends, and 20 have beaten inflation.

For more information please contact:

Nic Oldert

njo@profile.co.za

Managing Director

Anton du

Plooy

anton@profile.co.za

Research - Unit Trusts

(011) 728-5510